EUR/USD Forecast: Euro upside to remain capped ahead of key events

- EUR/USD edges higher to start the week.

- Technical outlook points to a buildup of bullish momentum.

- Investors could refrain from committing to a steady advance in the pair.

EUR/USD advances beyond 1.0750 during the European trading hours, starting the week on a bullish note. The pair's technical outlook suggests that additional gains could be witnessed in the near term, but investors are likely to move to the sidelines ahead of this week's key risk events.

The risk-positive market atmosphere makes it difficult for the US Dollar (USD) to find demand early Monday, providing a boost to EUR/USD. The Euro Stoxx 50 Index is up nearly 1% and US stock index futures cling to modest daily gains in the early European session.

May inflation data from the US will be released on Tuesday. The Consumer Price Index (CPI) is forecast to rise 4.1% on a yearly basis, significantly lower than the 4.9% increase recorded in April. The Federal Reserve and the European Central Bank's (ECB) policy announcements on Wednesday and Thursday, respectively, will ramp up the volatility in financial markets in the second half of the week.

In case Wall Street's main indexes gather bullish momentum after the opening bell, the USD could stay on the back foot, and vice versa, since there won't be any high-tier macroeconomic data releases that could impact the currency's valuation.

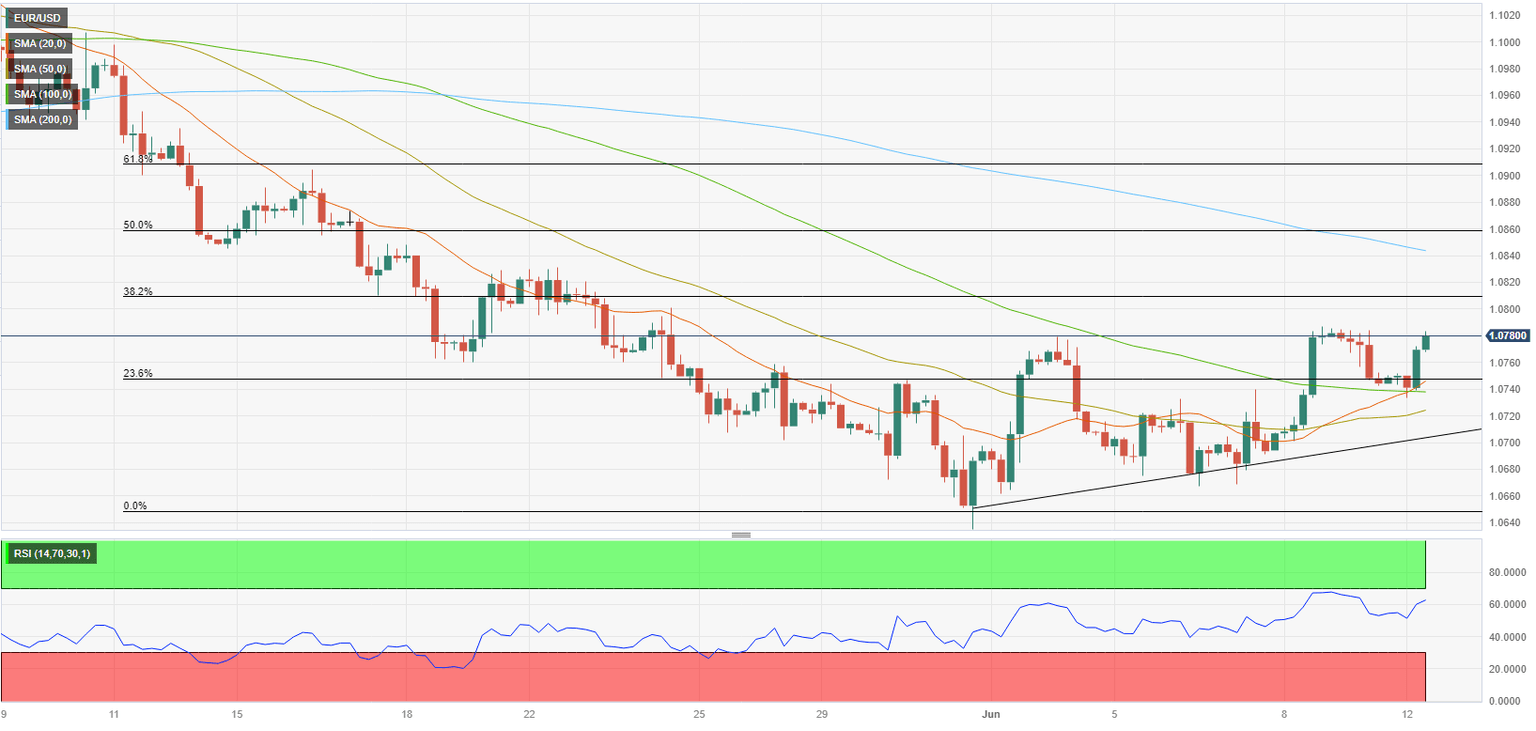

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the four-hour chart climbed above 60 and the 20-period Simple Moving Average (SMA) made a bullish cross with the 100-period SMA, highlighting the buildup of bullish momentum.

On the upside, 1.0800/1.0810 (psychological level, Fibonacci 38.2% retracement of the latest downtrend) aligns as first resistance area ahead of 1.0840 (200-period SMA) and 1.0860 (Fibonacci 50% retracement).

In case EUR/USD returns below 1.0750 (100-period SMA, Fibonacci 23.6% retracement), an extended slide toward 1.0720 (50-period SMA) and 1.0700 (psychological level, ascending trend line) could be witnessed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.