EUR/USD Forecast: Euro could find direction after ECB

- EUR/USD continues to move sideways below 1.0900 early Thursday.

- The ECB is widely expected to lower key rates by 25 bps.

- ECB President Lagarde's comments on policy outlook could drive the pair's action.

EUR/USD registered small losses on Wednesday but managed to hold comfortably above 1.0850. The pair fluctuates in a narrow channel below 1.0900 as investors await the European Central Bank's (ECB) monetary policy announcements.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.33% | -0.56% | 0.43% | 0.09% | -0.74% | -1.18% | |

| EUR | 0.25% | -0.06% | -0.31% | 0.68% | 0.22% | -0.49% | -0.94% | |

| GBP | 0.33% | 0.06% | -0.20% | 0.73% | 0.34% | -0.49% | -0.89% | |

| JPY | 0.56% | 0.31% | 0.20% | 0.96% | 0.71% | -0.03% | -0.45% | |

| CAD | -0.43% | -0.68% | -0.73% | -0.96% | -0.35% | -1.16% | -1.61% | |

| AUD | -0.09% | -0.22% | -0.34% | -0.71% | 0.35% | -0.72% | -1.18% | |

| NZD | 0.74% | 0.49% | 0.49% | 0.03% | 1.16% | 0.72% | -0.49% | |

| CHF | 1.18% | 0.94% | 0.89% | 0.45% | 1.61% | 1.18% | 0.49% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The ECB is widely expected to cut key interest rates by 25 bps following the June policy meeting. Since numerous ECB policymakers clearly communicated that they were intending to lower key rates in June, this decision by itself might not trigger a noticeable market reaction. Hence, investors will pay close attention to changes in the statement language and comments from President Christine Lagarde in the post-meeting press conference.

European Central Bank set to cut interest rates for first time since 2019.

In case Lagarde adopts an optimistic tone about the inflation outlook and leaves the door open to additional rate reductions in the upcoming meetings, the initial reaction could trigger a Euro selloff and cause EUR/USD to turn south.

On the other hand, the Euro could gather strength if Lagarde reiterates the data-dependent approach and refrains from committing to further policy easing later in the year.

The US economic docket will feature weekly Initial Jobless Claims data in the second half of the day. Ahead of Friday's May jobs report, investors are unlikely to react to this data.

EUR/USD Technical Analysis

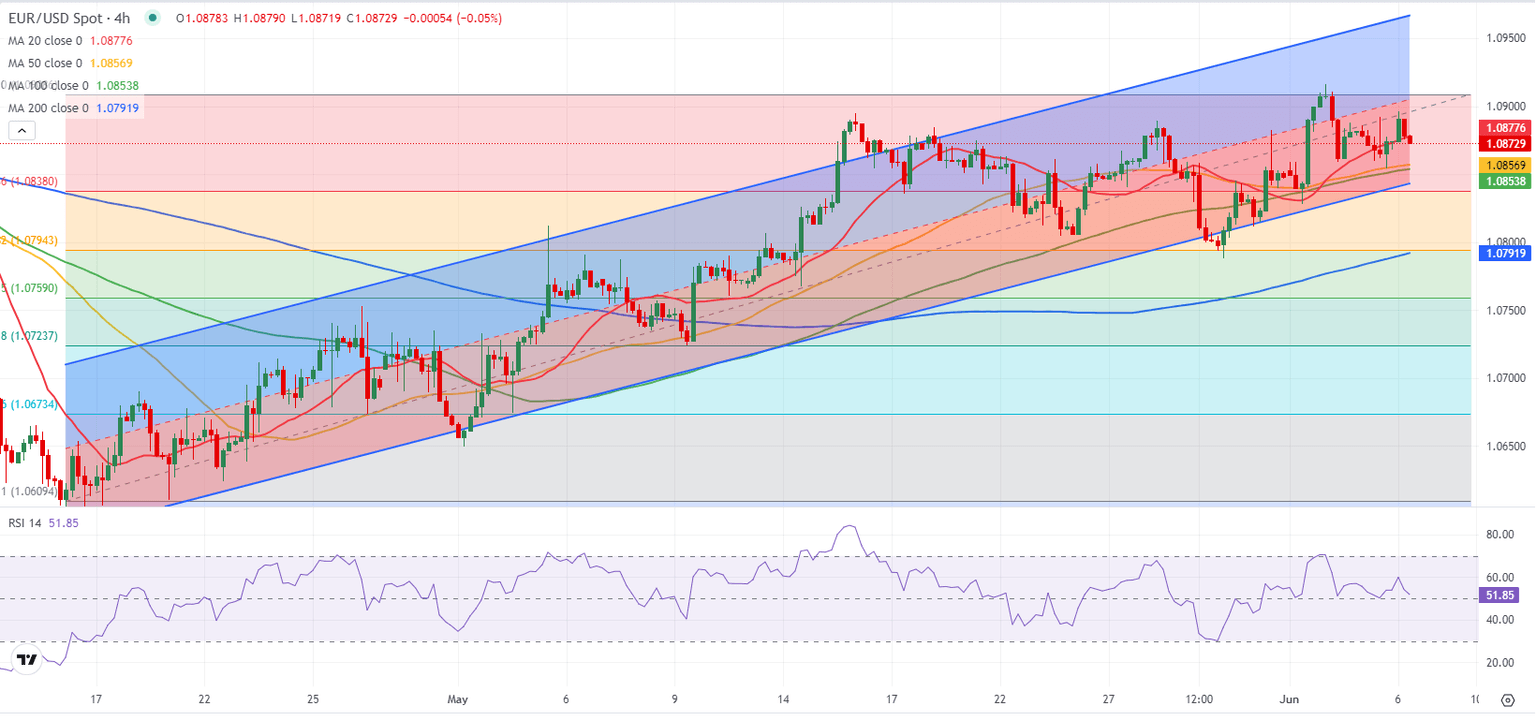

EUR/USD trades in the lower half of the ascending regression channel and the Relative Strength Index (RSI) indicator on the 4-hour chart stays near 50, reflecting the pair's indecisiveness.

1.0850-1.0840 (100-period Simple Moving Average (SMA), lower limit of the ascending channel) aligns as first support before 1.0800-1.0790 (psychological level, static level, 200-period SMA) and 1.0760 (static level). On the upside, resistances could be seen at 1.0900 (mid-point of the ascending channel, static level), 1.0950 (static level) and 1.0970 (upper limit of the ascending channel).

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

(This story was corrected on June 6 at 09:08 GMT so say that the 1.0950 is a static level, not the upper limit of the ascending channel).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.