EUR/USD faces major breakout resistance at 1.1075

Key highlights

-

EUR/USD is facing strong resistance near 1.1075.

-

A major bullish trend line is forming with support near 1.0990 on the 4-hour chart.

EUR/USD technical analysis

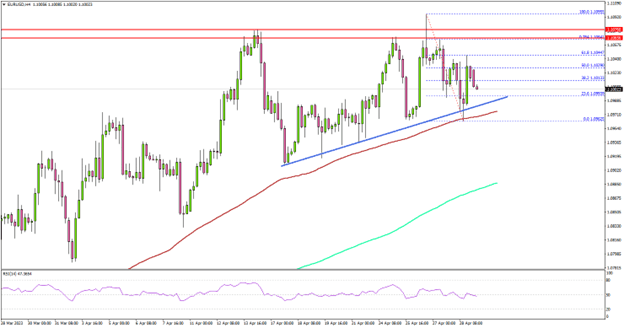

Looking at the 4-hour chart, the pair traded as high as 1.1095 before it corrected lower. There was a move below the 1.1020 support but the pair remained stable above the 100 simple moving average (red, 4 hours) and the 200 simple moving average (green, 4 hours).

The pair is now consolidating near the 1.1020 zone. Immediate resistance on the upside is near the 1.1050 level. The main breakout resistance is still near the 1.1075 level.

A clear upside break and close above the 1.1075 resistance might start a strong increase. The next key resistance is near the 1.1120 zone. Any more gains might send the pair toward 1.1200.

On the downside, there is major support near 1.1000 and the 100 simple moving average (red, 4 hours). There is also a major bullish trend line forming with support near 1.0990 on the same chart.

The next major support sits near the 1.0965 level, below which the pair might accelerate lower. In the stated case, EUR/USD could visit the 1.0920 support zone.

Author

Aayush Jindal

TitanFX

I have spent over six years as a financial markets contributor and observer, and possess strong technical analytical skills. I am a software engineer by profession, loves blogging and observing financial markets.