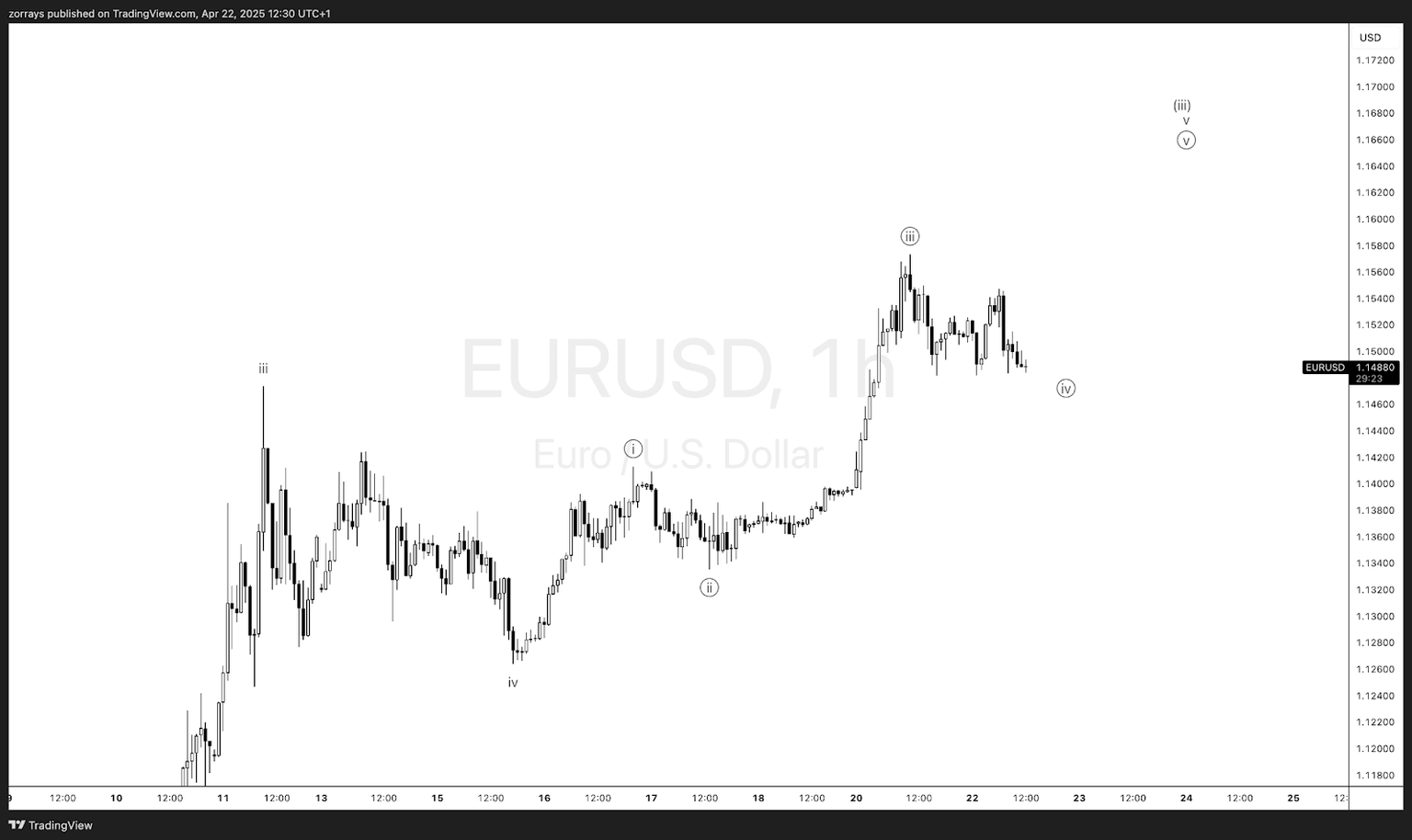

EUR/USD Elliott Wave update: Wave v extension still in play, but Dollar sentiment key

The EUR/USD has broken above the 1.1500 threshold, completing what appears to be an extended wave iii of a higher-degree impulse, with the pair now in a corrective wave iv consolidation. With wave iii registering a textbook extended leg, attention now shifts to whether wave v can materialise into a fifth-wave thrust toward the 1.1650–1.1700 region—or stall prematurely.

Current wave count (H1 chart)

We’re working under the assumption that EUR/USD is unfolding in a 5-wave impulse off the April 11 low, with the structure as follows:

-

Wave ((i)): Initiated on April 15, breaking through key local resistance.

-

Wave ((ii)): Pulled back modestly in a shallow flat/corrective structure.

-

Wave ((iii)): Clearly extended, accelerating through 1.1450–1.1500, showing strong directional momentum.

-

Wave ((iv)) (current): Unfolding sideways, likely as a running flat or triangle. No overlap with wave i suggests structure is still impulsive.

-

Wave ((v)): Projected to target 1.1650–1.1720 via Fib extensions from the wave i–iii move.

Alternate view

Should wave iv breach below the 1.1440 –1.1420 area impulsively, this would challenge the impulsive count. A deeper retracement toward 1.1380 would suggest either:

-

A larger-degree flat is unfolding, or

-

The advance off the April low was a C-wave, not wave iii.

Until then, the preferred count remains impulsive, with wave v extension in focus.

USD weakness driving the structure

Recent dollar weakness, driven largely by political pressure on the Fed and a growing confidence gap in USD assets, has added momentum to this wave count. The breach above 1.1500 wasn’t euro strength-led, but more a consequence of USD flight flows.

With Trump’s criticism of Fed independence escalating, and the market beginning to price in another rate cut, the USD remains on shaky footing. While the eurozone offers no compelling bullish narrative—given expectations for two more ECB cuts this year—the EUR is acting as a beneficiary of its reserve currency status in a risk-off rotation.

Importantly, euro upside here is likely not sustainable beyond 1.20, which we see as a cap driven by USD-specific factors, not eurozone fundamentals. Our baseline forecast remains that the EUR/USD will fade back to 1.13 by quarter-end, with upside risk skewed short-term only.

Conclusion

EUR/USD remains in a clear impulsive phase, with wave iv consolidation likely nearing completion. Provided 1.1450 holds, a final wave v push toward 1.1650–1.1720 remains probable. However, traders should remain cautious as this structure is largely USD-driven, and not underpinned by eurozone fundamentals.

A deeper wave iv or failed breakout above 1.1580 would warrant caution and reevaluation of the bullish count.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.