EUR/USD Elliott Wave technical analysis [Video]

![EUR/USD Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/EURUSD-bearish-object_XtraLarge.png)

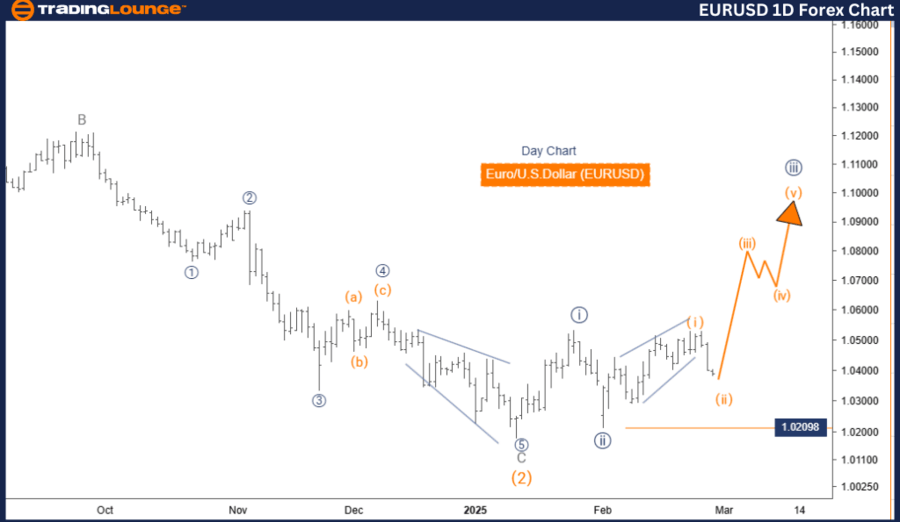

Euro/U.S. Dollar (EURUSD) Day Chart Analysis.

EUR/USD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Orange Wave 2.

-

Position: Navy Blue Wave 3.

-

Direction next higher degrees: Orange Wave 3.

-

Wave cancel invalid level: 1.02098.

Market overview

The EURUSD Elliott Wave Analysis for the day chart suggests a counter-trend correction, with the market currently in orange wave 2, forming part of a larger corrective structure within navy blue wave 3. This indicates an intermediate correction phase before the expected resumption of the broader trend.

Wave progression

-

Orange wave 1 appears completed, with orange wave 2 now unfolding.

-

This corrective phase may include sideways or downward movements before orange wave 3 begins.

-

The completion of orange wave 2 is a key moment for traders, as it may mark the start of orange wave 3, a potential impulsive move in the direction of the broader trend.

Key level to monitor

-

Wave cancellation invalid level: 1.02098.

-

If the price moves above 1.02098, it will invalidate the current wave count, requiring a reassessment of the market structure.

-

This level acts as key resistance, and a breakout above it may signal a trend shift.

Conclusion

The EURUSD is in a corrective phase within the Elliott Wave structure, with orange wave 2 in play after the completion of orange wave 1. This movement is part of navy blue wave 3, and the next major move is expected to be orange wave 3.

Traders should closely monitor the completion of orange wave 2, as it provides insight into the timing and direction of the upcoming wave. Understanding wave structures is crucial for predicting potential market movements and aligning trading strategies effectively.

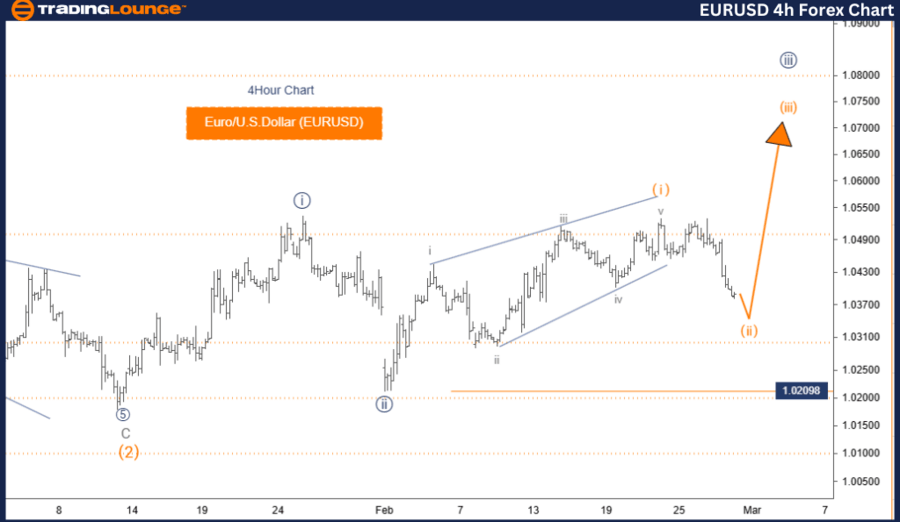

Euro/U.S. Dollar (EURUSD) 4-Hour Chart Analysis.

EUR/USD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Orange Wave 2.

-

Position: Navy Blue Wave 3.

-

Direction Next Higher Degrees: Orange Wave 3.

-

Wave cancel Invalid Level: 1.02098.

Market overview

The EURUSD Elliott Wave Analysis for the 4-hour chart indicates a counter-trend correction, with the market currently in orange wave 2, forming part of a larger corrective structure within navy blue wave 3. This suggests that the market is in an intermediate correction phase before continuing its broader trend.

Wave progression

-

Orange wave 1 appears completed, with orange wave 2 currently unfolding.

-

This corrective phase may involve sideways or downward movements before orange wave 3 begins.

-

The completion of orange wave 2 is crucial, as it may indicate the start of orange wave 3, a potential impulsive move in the direction of the broader trend.

Key level to monitor

-

Wave cancellation invalid level: 1.02098

-

If the price moves above 1.02098, it will invalidate the current wave count, requiring a reassessment of the market structure.

-

This level serves as key resistance, and a breakout above it may signal a trend shift.

Conclusion

The EURUSD is currently in a corrective phase within its Elliott Wave structure, with orange wave 2 in play following the completion of orange wave 1. This movement is part of navy blue wave 3, and the next significant move is anticipated to be orange wave 3.

Traders should closely monitor the completion of orange wave 2, as it will provide insight into the timing and direction of the upcoming wave. Understanding wave structures is essential for predicting market movements and aligning trading strategies effectively.

Technical analyst: Malik Awais.

EUR/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.