EUR/USD: Dollar attention to the Fed?

The epic with the US debt limit bar was, as we expected, finally resolved. On Saturday, US President Biden signed the "Tax Liability Act of 2023", which suspends the government debt limit until January 1, 2025. At the same time, the limit itself will be increased from January 2, 2025. According to economists' forecasts, the US national debt may now grow from $31.4 trillion to $52.3 trillion within ten years.

And how did the American financial markets react to this? At least, the sale of these instruments began again in the US government bond market, and their profitability, accordingly, crept up, pushing up the dollar quotes as well. It seems that investors again prefer the dollar as a safe haven asset.

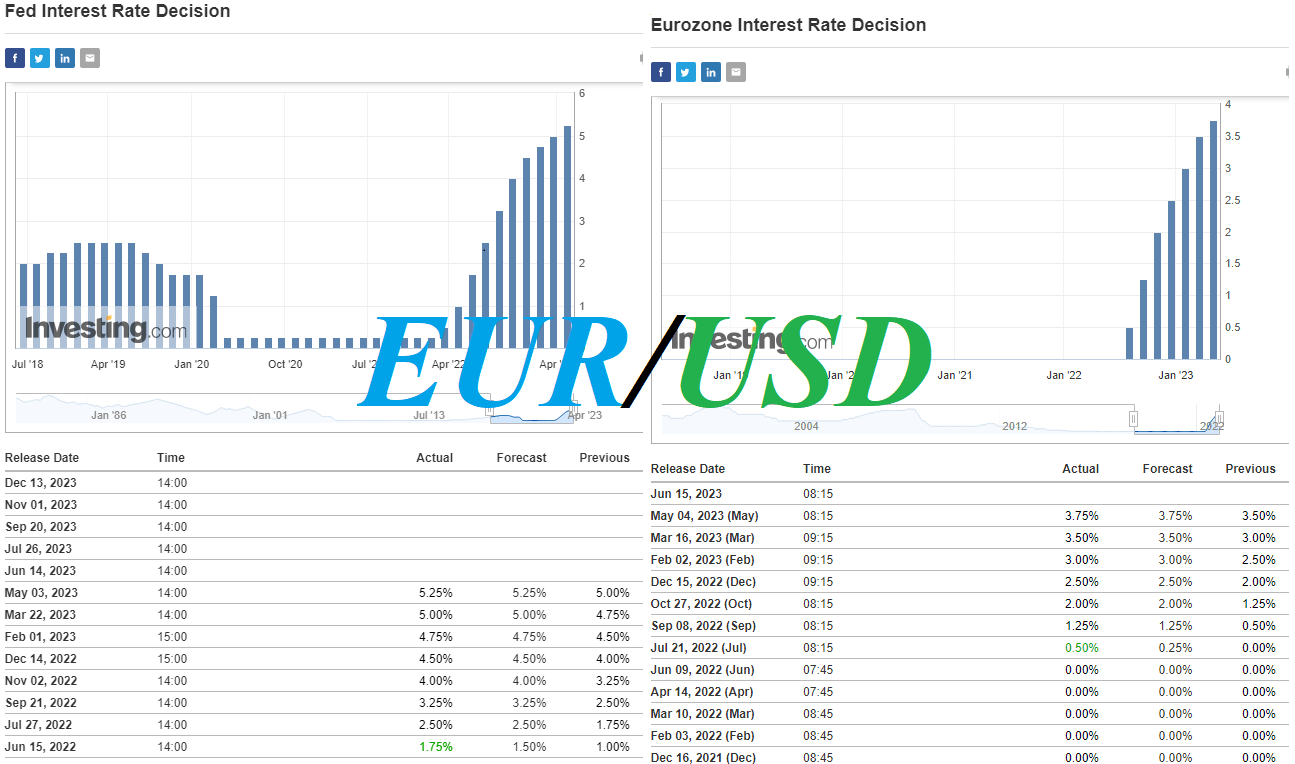

At the moment, economists predict that the interest rate will remain unchanged at 5.25% with a probability of about 66.0%, although there are also many forecasts about further tightening of the Fed's monetary policy. At least, the strong labor market in the United States allows this to be done. One way or another, inflation is still unacceptably (for the Fed, among other things) high, given the target level of 2%, and unemployment remains at minimum multi-year lows.

As for the dollar's main competitor in the euro currency market, it is strengthening today in the main cross-pairs, but declining against the dollar. So, at the time of publication of this article, the EUR/USD pair was trading near the 1.0685 mark, through which the key support level passes.

Economists believe that the transition of the main Eurozone economy to recession, as indicated by macro data, may negatively affect the stability of the entire Eurozone economy. This is also negative for the euro, although the main tone in the EUR/USD pair is now set by the dynamics of the dollar.

From a technical point of view, a breakdown of the support level of 1.0685 and a further decline will cause EUR/USD to return to the zone of medium- and long-term bear markets.

Support levels: 1.0685, 1.0600, 1.0520, 1.0500.

Resistance levels: 1.0720, 1.0734, 1.0775, 1.0800, 1.0825, 1.0900, 1.0950, 1.1000, 1.1070, 1.1100.

Author

Yuri Papshev

Independent Analyst

Independent trader and analyst at Forex market. Trade experience - more than 10 years. In trade Yuri Papshev uses a combination of fundamental and technical analysis.