EUR/USD continues to struggle amid US inflation concerns

EUR/USD is on a downward trajectory on Friday, hovering around 1.0686 after a short-lived pause. The dollar experienced a temporary dip due to mixed American economic indicators and market anticipation ahead of the critical Core PCE inflation report, a significant factor in Federal Reserve decision-making.

Yesterday's data showed a larger-than-expected decrease in US unemployment claims and a modest rise in Durable Goods Orders for May, although Core PCE dipped. The final GDP figures for Q1 2024 were slightly adjusted upward, showing the US economy grew by 1.4% compared to the previously estimated 1.3%, in contrast to the 3.4% growth seen in Q4 2023.

US Treasury yields also saw a minor decline, contributing to the dollar's brief retreat. However, market dynamics are shifting as focus intensifies on today's economic releases, including the Core PCE data, personal income and expenditures, and the University of Michigan's May consumer sentiment index.

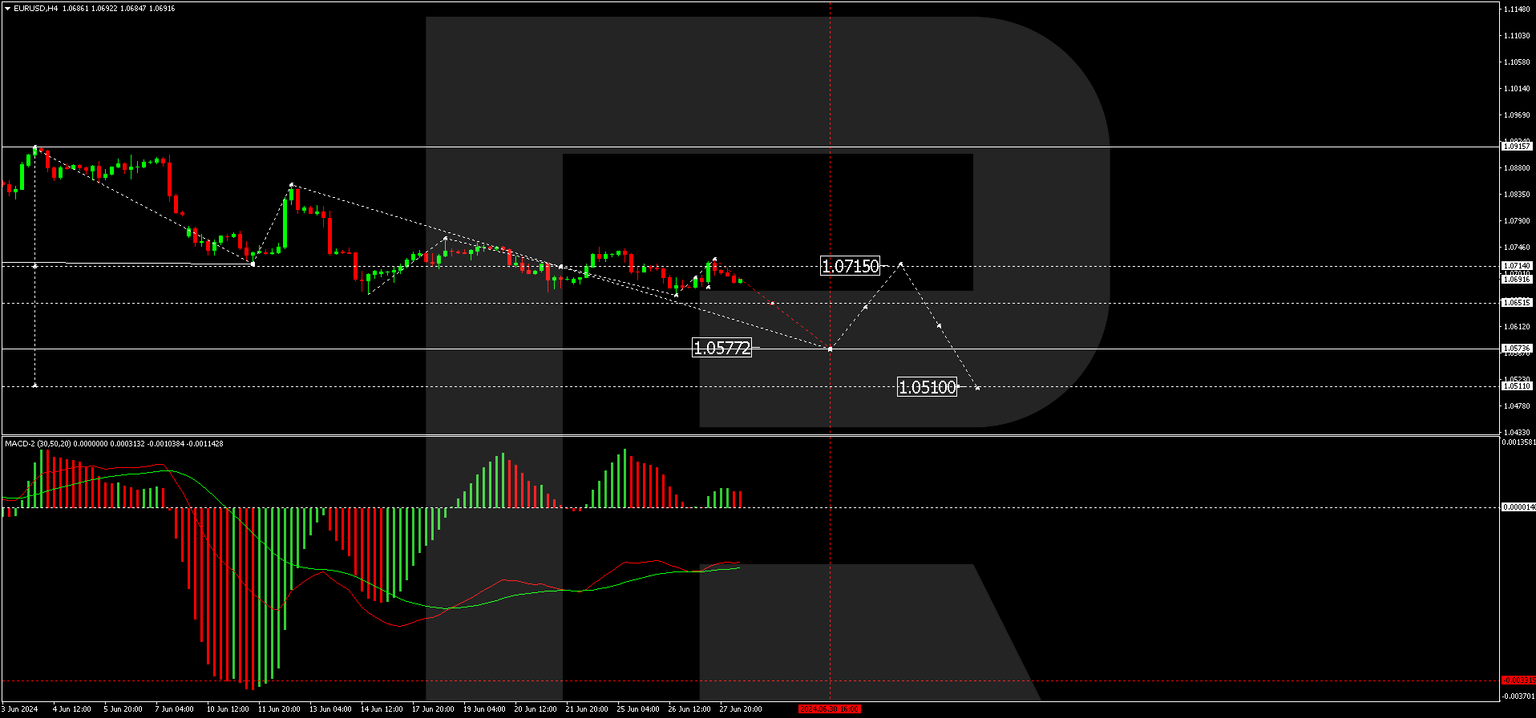

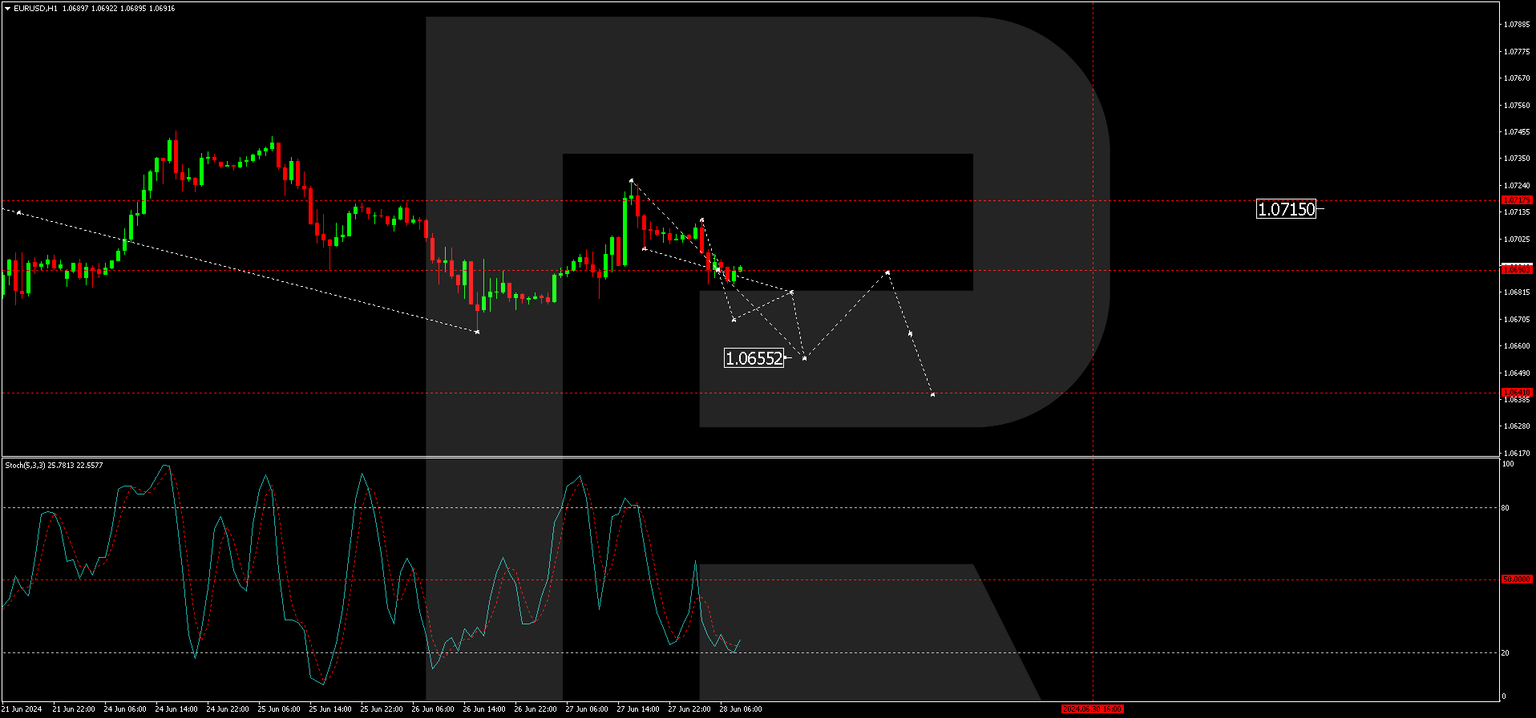

EUR/USD technical analysis

The EUR/USD has completed a downward movement to 1.0666 and corrected up to 1.0715. Currently, the market is forming another downward wave, targeting 1.0655. Should this level be reached, a rebound to 1.0690 is possible before continuing the downward trend towards at least 1.0577. This bearish outlook is supported by the MACD indicator, which remains below zero with a firm downward trajectory.

On the H1 chart, EUR/USD is consolidating around 1.0690. A downward breakout could lead to a continuation of the decline to 1.0655. Subsequently, a corrective move to 1.0690 may occur before a further drop to 1.0640. The Stochastic oscillator, hovering near 20, suggests potential for further declines before a rebound to 80 could happen, indicating volatile short-term movements.

Market outlook

Investors are advised to closely monitor the upcoming US economic data, which will likely influence Federal Reserve policy expectations and impact EUR/USD movements. The currency pair remains sensitive to shifts in US economic indicators and Federal Reserve signals regarding interest rates.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.