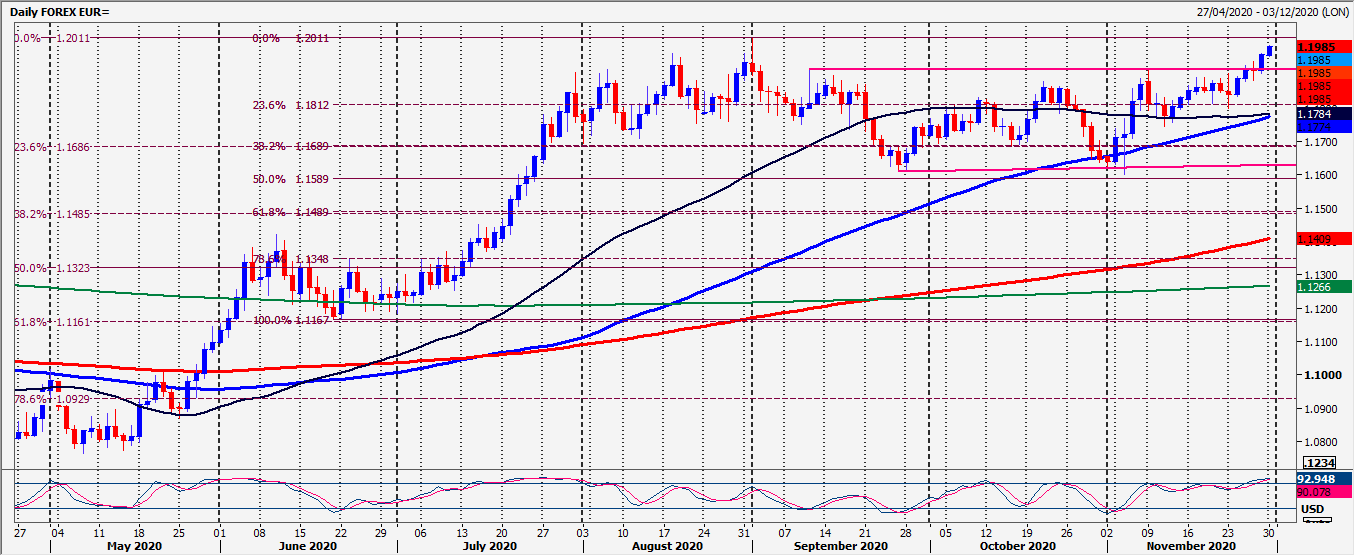

EUR/USD – USD/CAD

EURUSD beat 11 year trend line resistance 1.1915/25 & closed at the high of the week for a buy signal.

USDCAD up 1 day & down the next for at least 2 weeks. No clear direction or pattern to trade. We are holding first resistance at 1.3030/40.

Daily Analysis

EURUSD we have a buy signal targeting less important resistance at this year's high of 1.2000/10. A break above here is a very important longer term buy signal & should signal the start of a significant bulls trend in to 2021.

Bulls must hold the pair above first support at 1.1920/10. Longs need stops below 1.1890.

USDCAD first resistance at 1.3030/40 but above here targets minor resistance at 1.3080/90. Minor resistance again at 1.3115/25.

Holding 1.3030/40 re-targets 1.2990/80 then last week's low at 1.2978/68 before the November low at 1.2935/25.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD remains below 1.1000 on Powell's remarks

The US Dollar's recovery has gained momentum, pushing EUR/USD down to sub-1.1000 levels—the daily lows—following Fed Chair Jerome Powell's "Economic Outlook" speech.

GBP/USD loses the grip and approaches 1.2900

GBP/USD is shedding some of its weekly gains and retreating back to around the 1.2900 level, as the Greenback continues its recovery following Chair Powell's comments.

Gold remains offered, looks at $3,000

Gold prices are deepening their daily retreat, edging closer to the crucial $3,000 per troy ounce level as the US Dollar strengthens, all while investors digest Fed Chair Powell's speech.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.