EUR/USD: Bulls losing interest amid fresh EU recession fears

EUR/USD Current price: 1.1122

- Discouraging European data fueled speculation of additional ECB interest rate cuts.

- Federal Reserve officials repeating their dovish messages after trimming the benchmark rate.

- EUR/USD bounces from sub-1.1100 but lacks positive momentum.

The EUR/USD pair fell during European trading hours to 1.1082, recovering the 1.1100 mark ahead of Wall Street’s opening. The Euro fell following the release of the September Hamburg Commercial Bank (HCOB) flash Purchasing Managers Indexes (PMIs) as pretty much every European figure missed expectations, signaling a continued setback in the region. The German economy sunk “deeper into contraction,” according to the official report, as the Composite PMI fell for a fourth consecutive month, printing at 47.2 from 48.4 in August. The manufacturing index shrank to 40.3, while services output barely held within expansion levels, still declining from 51.2 previously to 50.6.

The Eurozone Composite PMI declined to 48.9, missing the 50.6 expected, with the manufacturing sector performing the worst. “The fall in output was the first in seven months and was registered amid a sustained reduction in new orders. In fact, new business decreased at the sharpest pace since January,” according to HCOB.

The poor EU data spurred speculation the European Central Bank (ECB) will keep loosening the monetary policy with additional interest rate cuts, putting pressure on the Euro. At the same time, the recent United States (US) Federal Reserve’s (Fed) decision to trim the benchmark interest rate by 50 basis points (bps) weighs on the US Dollar.

Meanwhile, Fed speakers entertain market players. Their overall stance is dovish, aligning with the latest Fed announcement, and they are confident about economic progress. Also, S&P Global will release the preliminary estimates of the September PMIs for the US.

EUR/USD short-term technical outlook

From a technical point of view, the EUR/USD pair is at risk of extending its slide. The daily chart shows that technical indicators grind lower within positive levels while buyers are still trying to defend the downside around a now mildly bearish 20 Simple Moving Average (SMA) at around 1.1090. The 100 and 200 SMAs maintain their bullish slopes, although they are too far below the shorter one to be relevant in the upcoming sessions.

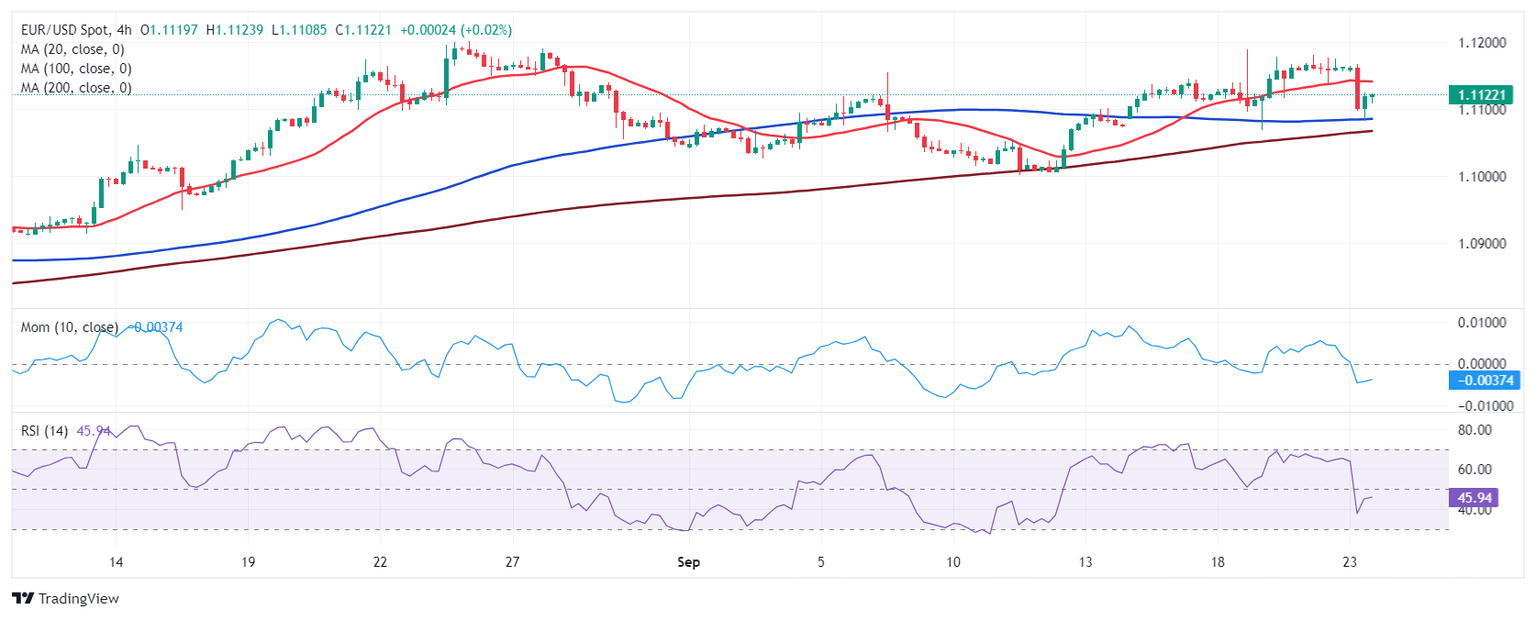

For the near term, the risk is also of another leg lower. In the 4-hour chart, the EUR/USD pair tested a flat 100 SMA before bouncing but holds ground below a directionless 20 SMA. At the same time, the Momentum indicator aims lower at around its 100 line, while the Relative Strength Index (RSI) indicator turned higher, but at around 47, far from supporting additional gains.

Support levels: 1.1090 1.1050 1.1010

Resistance levels: 1.1160 1.1200 1.1250

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.