-

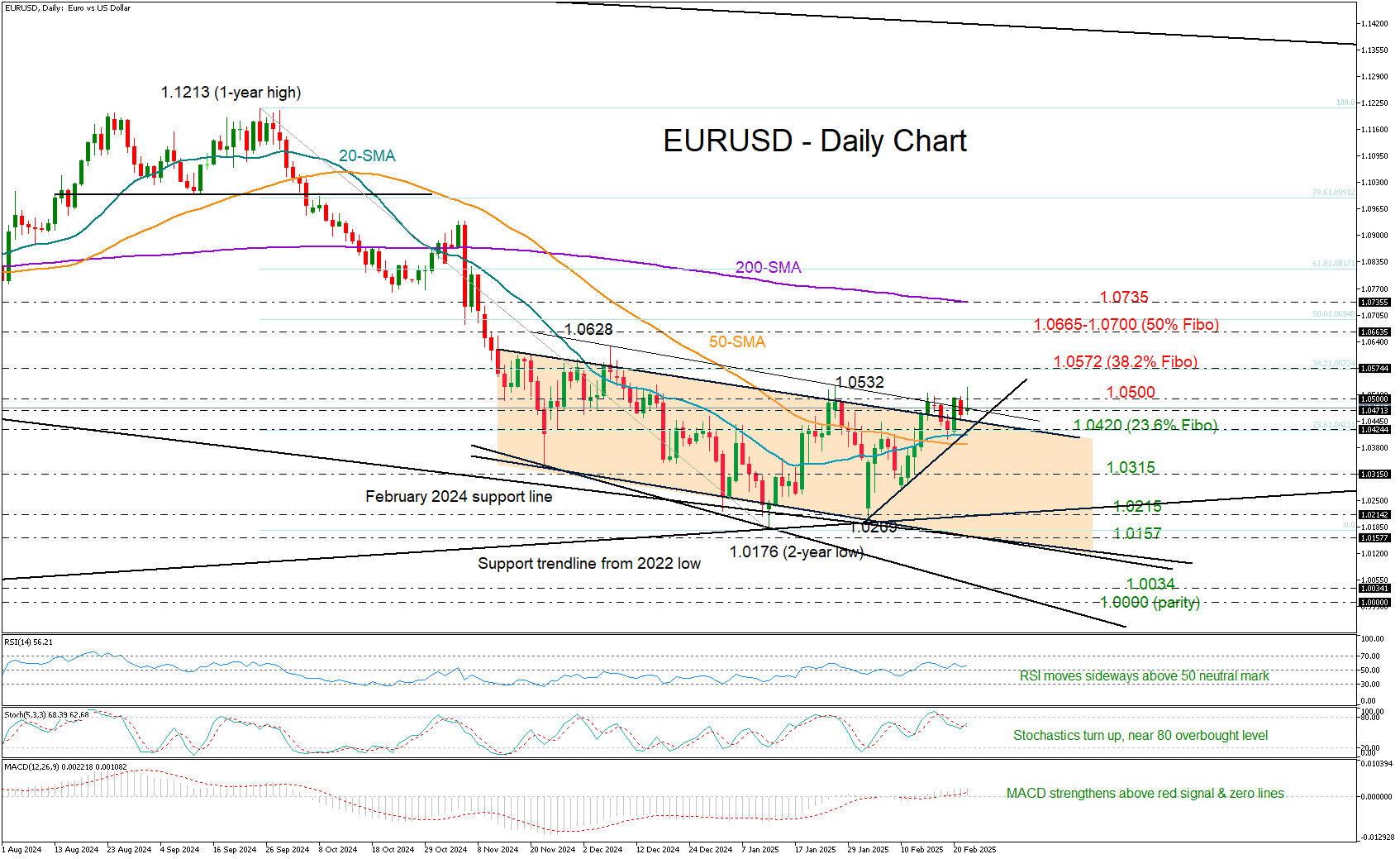

EURUSD stages a flash spike to 1.0527 in German election aftermath.

-

Technical signals favor the bulls, but traders await victory above 1.0500.

EURUSD is still struggling to secure a close above the 1.0500 ceiling, having briefly violated that threshold earlier today before losing steam marginally beneath January’s high of 1.0532 after the conservative CDU/CSU leader Friedrich Merz won Sunday’s election in Germany.

From a technical perspective, the short-term outlook remains bullish-to-neutral, with the RSI holding above its 50 mark and the stochastic oscillator pointing slightly higher but still below overbought levels. The MACD's momentum is positive, and a bullish crossover between the 20- and 50-day simple moving averages (SMAs) suggests buying interest is growing.

Given the support created within the trendline zone of 1.0450-1.0475, there is potential for an acceleration towards the 38.2% Fibonacci retracement of the September-January downleg at 1.0572 once the 1.0500 psychological level gives the green light. Further up, the bulls could speed up towards the 1.0665 barrier and the 50% Fibonacci mark of 1.7000, while the 200-day SMA could also come into play.

On the downside, the area around the 23.6% Fibonacci level of 1.0420, the 20-day SMA and the short-term support trendline could be critical for keeping buying appetite alive. If that floor collapses, the pair could forcefully drop towards 1.0315 and then straight down to the long-term ascending trendline drawn from the 2022 low at 1.0215. The lower boundary of the bearish channel at 1.0157, aligning with the falling trendline from February 2024, could serve as the next safety net.

In a nutshell, EURUSD has not exited the caution area, despite the improvement in technical signals. A sustainable rally above 1.0500 could be key for a bullish continuation.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

How will US Dollar react to February PCE inflation data – LIVE

February Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred gauge of inflation, from the US will be watched closely by market participants. Investors will scrutinize the data to reaffirm whether the Fed's cautious stance to policy-easing is warranted.

Gold: Record-setting rally remains intact ahead of US PCE data

Gold price refreshes a fresh all-time peak, closing on the $3,100 mark. The global risk sentiment continues to be undermined by worries over Donald Trump's auto tariffs announced earlier in the week, with traders rushing for safety in Gold price. US PCE inflation data awaited.

EUR/USD trades with mild losses below 1.0800, awaits US PCE

EUR/USD is on the back foot below 1.0800 early Friday, struggling to capitalize on the previous day's goodish bounce. Trump's tariff jitters keep investors on the edge, leaving the pair gyrating in a range ahead of the key US PCE inflation data.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.