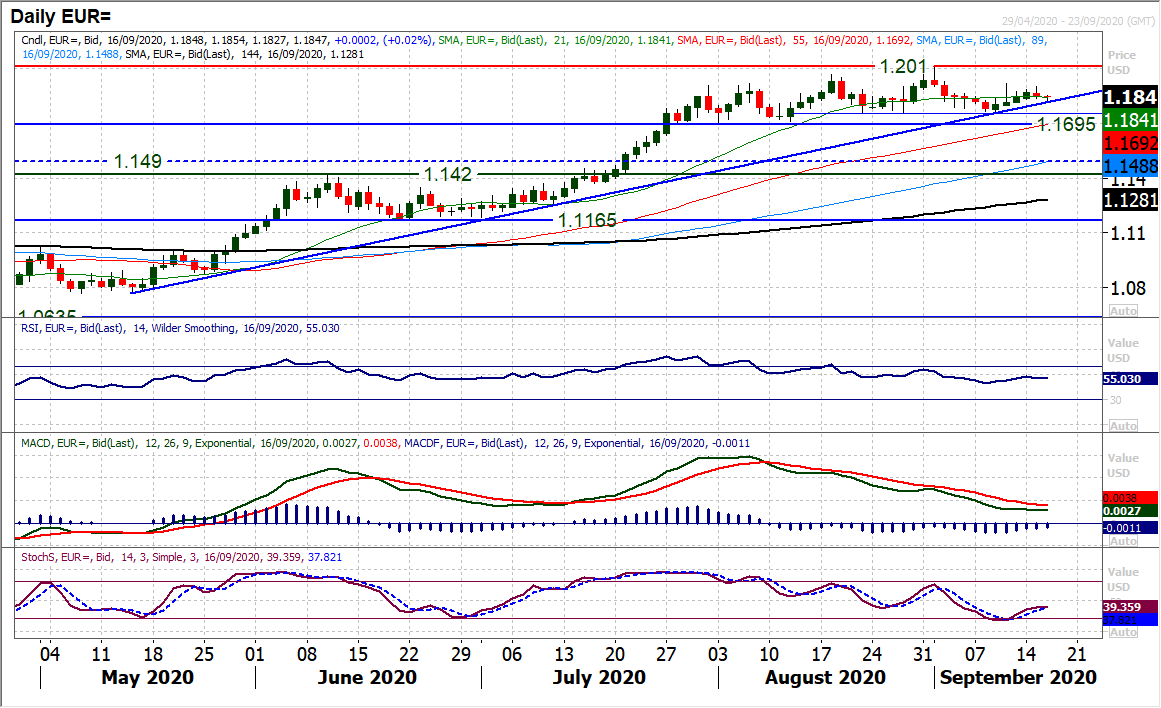

EUR/USD

Are the cracks starting to show in the euro bull run? Positive candles have formed in recent sessions, but they have been relatively muted, and now yesterday’s negative candlestick (with a close towards the session low) shows EUR/USD starting to roll over again. This time, the resistance at 1.1915 (from last week’s post ECB spike high) has held. The four month uptrend rises at 1.1815 today but is under pressure. An uptrend breach does not necessarily mean a big sell-off, more immediately that the bulls have lost control. The lack of drive through momentum indicators reflects this, as Stochastics and MACD lines tail off again. This is all coming ahead of the FOMC meeting today and it could just be that the market is ranging within 1.1695/1.2010. The hourly chart shows 1.1810 as the initial support to watch to the downside, whilst 1.1915 is a barrier to gains. Closing either side of these levels will drive the next move.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD edges lower below 0.6300 on global trade concerns

The AUD/USD pair trades in negative territory near 0.6280 during the early Asian session on Monday. The Australian Dollar weakens due to global trade concerns ahead of a planned announcement on Wednesday by US President Donald Trump on reciprocal tariffs.

USD/JPY weakens further below mid-149.00s; one-week low

USD/JPY retreats further from the vicinity of the monthly peak touched on Friday and attracts sellers at the start of a new week. Hawkish BoJ expectations and the risk-off mood amid rising trade tensions underpin the safe-haven JPY. Moreover, fears of stagflation in the US keep the USD bulls on the defensive and drag the pair to a one-week low.

Gold rises to near record high below $3,100 amid global uncertainty

Gold price gains momentum to around $3,090 during the early Asian session on Monday. The precious metal maintains its uptrend near a record high amid fears of a global trade war triggered by US President Donald Trump's latest tariffs.

Week ahead: US NFP and Eurozone CPI awaited as tariff war heats up, RBA meets

Trump’s reciprocal tariffs could spur more chaos. US jobs report might show DOGE impact on labour market. Eurozone inflation will be vital for ECB bets as April cut uncertain. RBA to likely hold rates; Canadian jobs, BoJ Tankan survey also on tap.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.