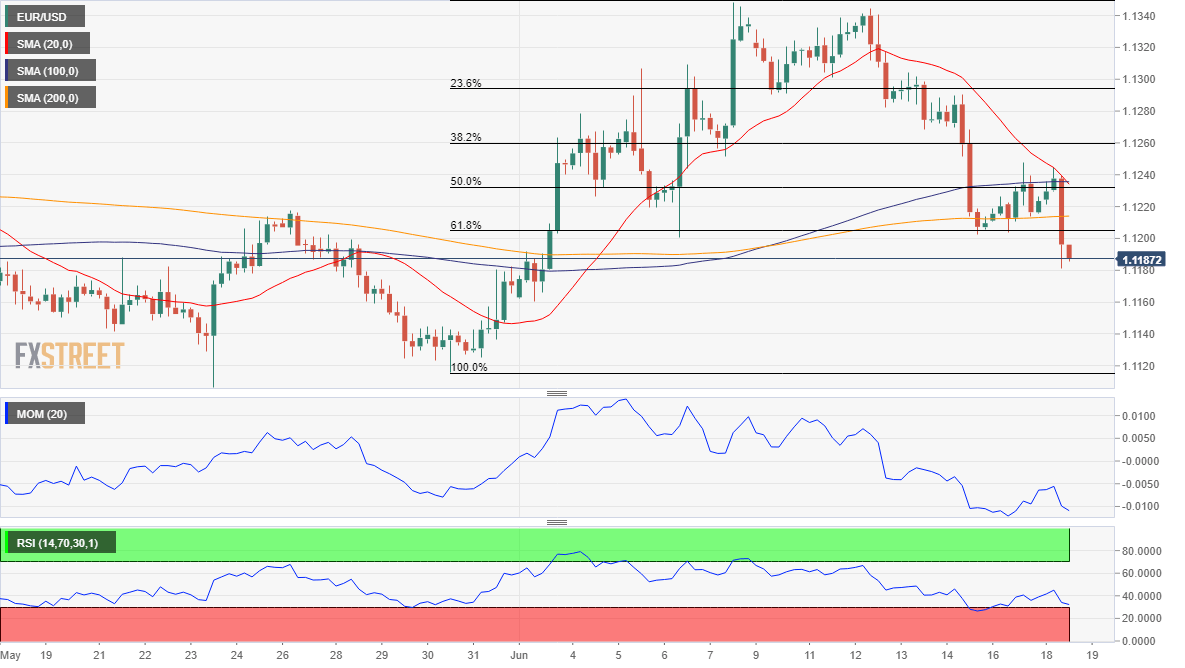

EUR/USD Current price: 1.1187

- ECB's head, Mario Draghi, suggested more stimulus coming particularly if inflation doesn't pick up.

- EUR/USD trading at its lowest in over two weeks, bearish case firming up, but the Fed in the way.

The EUR/USD pair broke lower and fell to a fresh one-week low sub-1.1200 during the London session, following comments from ECB's head, Mario Draghi. The central bank's leader spoke at the ECB Forum on Central Banking in Sintra and said that further interest rate cuts remain part of the central bank's tools, leaving doors opened for more stimulus if inflation doesn't give signs of picking up. Adding fuel to the fire, the German ZEW Survey showed that economic sentiment collapsed in June, with the index coming in at -21.1 for Germany and at -20.2 for the whole Union. The assessment of the current situation, however, came in at 7.8, worse than the previous 8.2 although better than the 6.0 expected. Finally, EU May's final inflation was confirmed at 1.2% YoY but downwardly revised to 0.1% MoM. The EUR/USD pair fell to 1.1181, its lowest since June 3, breaking through the 61.8% retracement of its latest bullish run, measured between 1.1115 and 1.1347 at around 1.1200, now the primary resistance.

Ahead of Wall Street's opening, the US released June Housing Starts and Building Permits, which came in mixed as the first decline by 0.9%, worse than anticipated, while the second increased by 0.3%, beating the market's estimate of -2.9%. There are no more relevant events scheduled for today. Equities are poised to open with gains, getting positive hints from European indexes, while US Treasury yields stand at fresh multi-month lows, with the benchmark yield on the 10-year note at 2.03%.

As for the technical picture, the 4 hours chart shows that the pair is currently developing below all of its moving averages, with the 20 SMA extending its decline but still above the larger ones, these last lacking directional strength. Technical indicators in the mentioned timeframe lack directional strength, holding flat around their daily lows well into negative ground. As long as the pair remains below the 1.1200 region, the risk will be skewed to the downside, with a break below 1.1150 exposing the yearly low at 1.1106.

Support levels: 1.1150 1.1105 1.1080

Resistance levels: 1.1200 1.1245 1.1280

View Live chart for the EUR/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range slightly below 1.0900

EUR/USD continues to move up and down in a narrow band slightly below 1.0900 in the second half of the day on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stay in range.

GBP/USD treads water above 1.2900 amid risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the American session on Monday. The positive shift seen in risk sentiment doesn't allow the US Dollar to gather strength and helps the pair hold its ground ahead of this week's key data releases.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.