EUR/USD encountered significant pressure, testing a low of 1.0331 before rebounding to 1.0476, as market concerns mount over the potential economic slowdown in Europe and aggressive rate cuts by the European Central Bank (ECB).

Recent business surveys indicating an accelerated economic contraction in Germany and France have starkly dampened the euro’s outlook. Additionally, under the newly elected President Donald Trump’s administration, potential new trade duties from the US threaten to exacerbate Germany’s already fragile economic state. Trump’s protectionist stance could notably impact German industries, intensifying existing internal challenges.

Investors are bracing for a scenario where the ECB might implement rate reductions more swiftly than anticipated. At the same time, the Federal Reserve may hold steady, expanding the interest rate differential unfavourably against the euro.

This backdrop has led to heightened investor nervousness about the euro’s future, with further potential declines in EUR/USD not ruled out amidst ongoing uncertainties regarding the full pricing-in of these expectations.

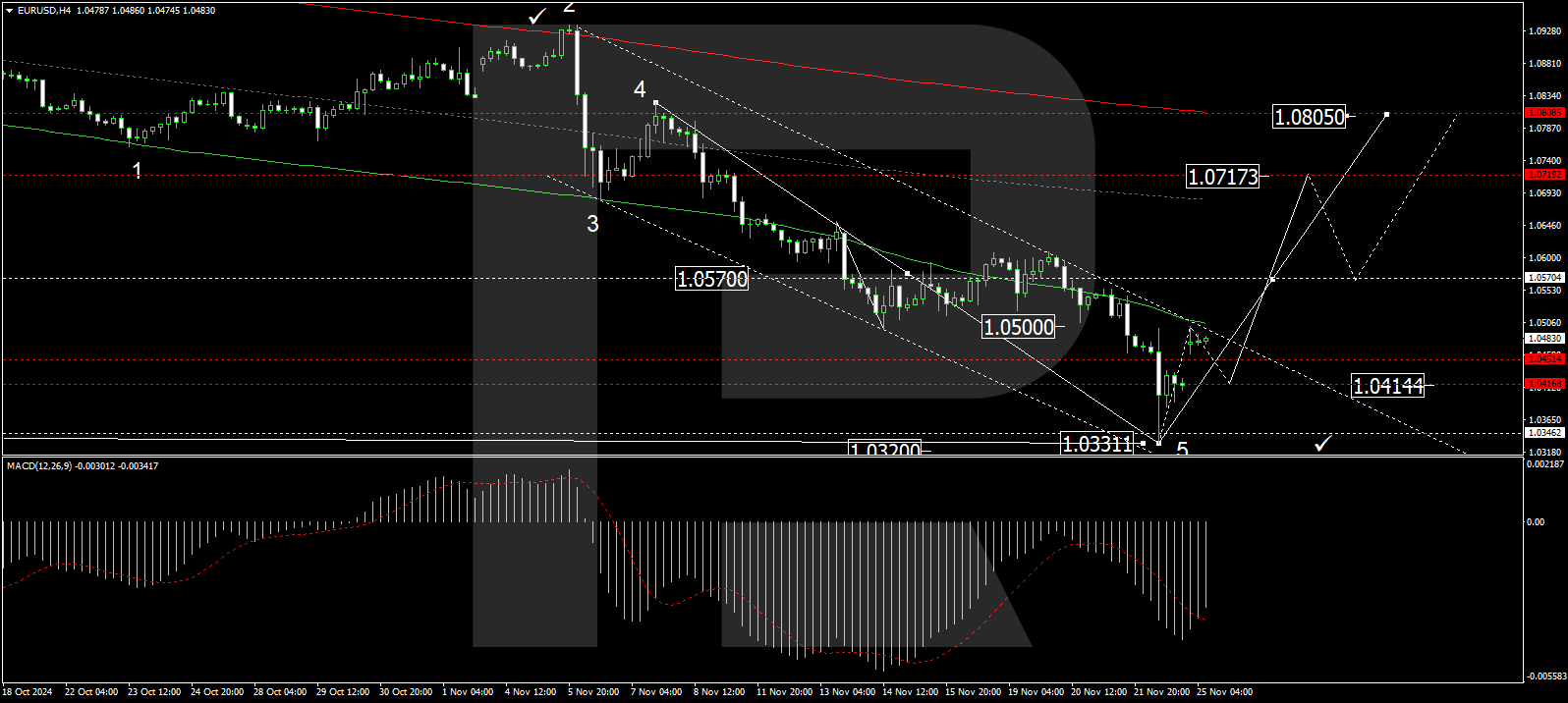

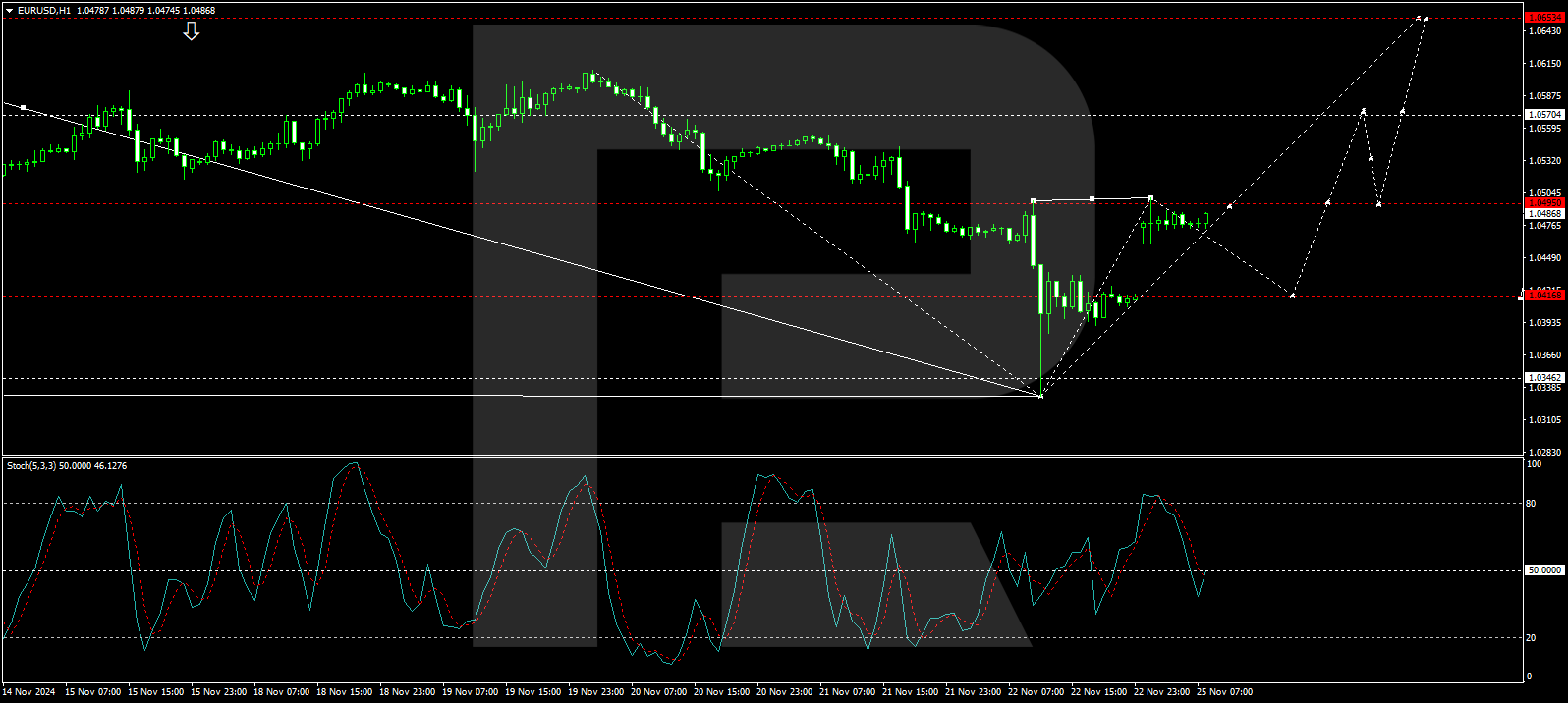

Technical analysis of EUR/USD

H4 chart: the EUR/USD has hit its projected low at 1.0331, subsequently initiating a rebound towards 1.0500. Upon reaching this level, a pullback to 1.0414 may occur. The market may form a consolidation range around 1.0414, with potential upward movements targeting 1.0570 and possibly extending to 1.0655. This EUR/USD outlook is supported by the MACD indicator, which suggests an impending rise from below the zero level.

H1 chart: the pair is forming a rise to 1.0500, which is anticipated as an initial target. After this level, a corrective phase towards 1.0414 is expected, suggesting a test from above. The stochastic oscillator corroborates this view, indicating a readiness to descend from a mid-range position towards lower thresholds.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.