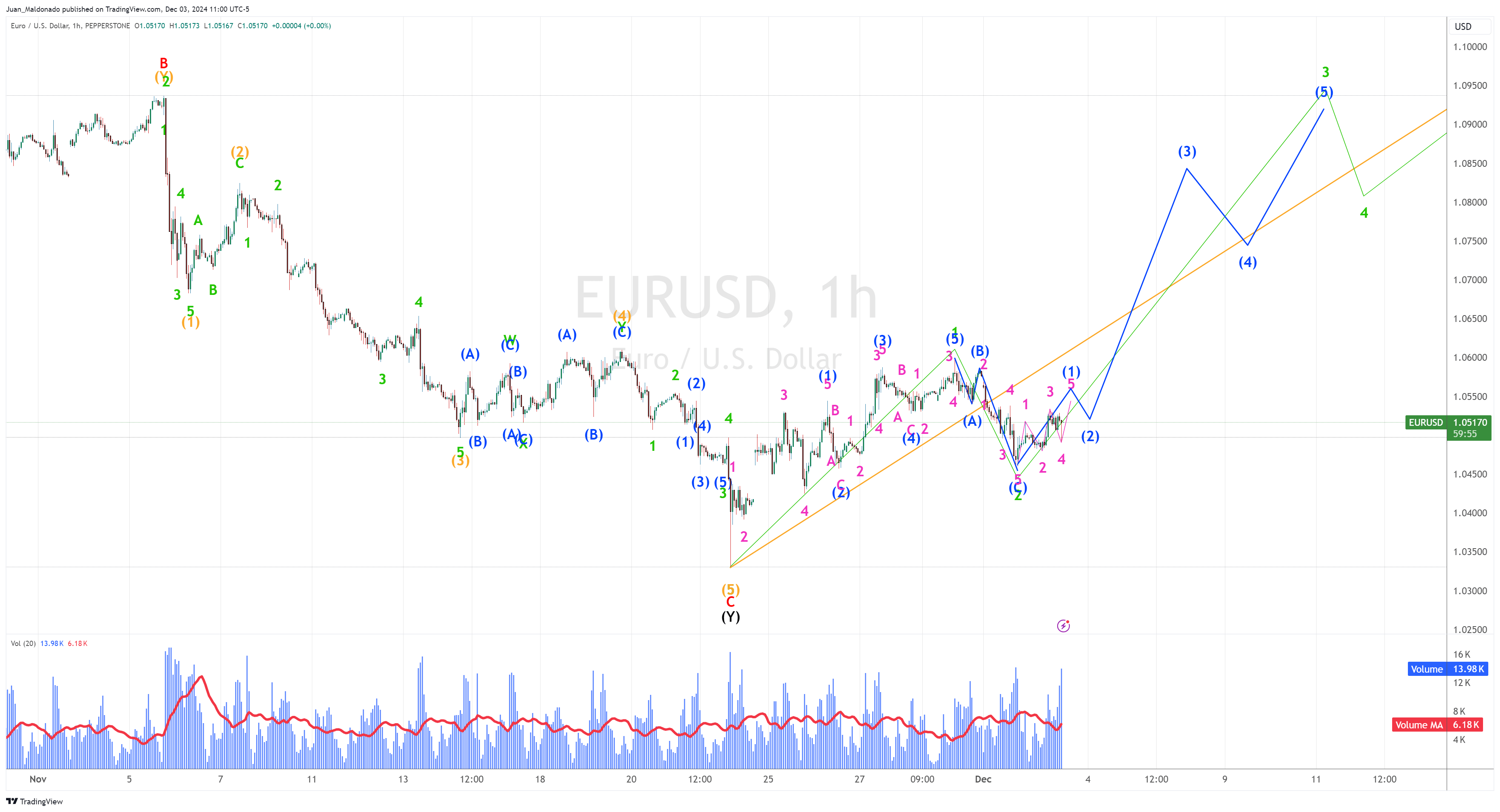

Let’s analyze this chart to understand how price cycles help us predict future movements in EUR/USD. According to the Elliott Wave count, the low recorded in November (1,0332) marks the beginning of a potential bullish impulse. We observe five waves in blue completing the first impulse (Wave 1 of green degree), reaching 1.0580. Next, we see a Zigzag pattern characterizing Wave 2 (green degree). What can we expect from here? Let’s explore the possible scenarios together.

Main scenario

We anticipate continuing the bullish trend (Wave 3 of green degree). Wave three corresponds to public participation and is typically the fastest wave. The price has completed the second wave and is now building the foundation for Wave 3.

Alternative scenarios

It’s possible that Wave 2 of Green Degree is still active and needs to drop a bit further. We must extend the corrective wave using a double Zigzag pattern in this case. Detecting the price reversal in time is crucial to avoid losses. The price should exhibit small-bodied bearish candles to maintain the corrective Wave 2 scenario in green degree.

Targets

Let’s now look at the targets for the bullish cycle using liquidity zones. From smallest to largest, these levels will serve as resting points during the trend: 1,06 – 1,0840 – 1,0940. It’s essential to confirm each step through price action and volume to make informed decisions as each new candle forms.

DISCLAIMER: No Earnings Projections, Promises or Representations

Trading currencies, stocks, futures, and options implicate significant risk of loss and is not suitable for every investor. The quotes of financial markets may fluctuate, and, as a result, clients could lose more than their investment. The highly leveraged of futures trading means that modest market movements will have a greater shock on your trading account, and this can go against your trading capital, that can result in considerable losses or can benefit your trading capital, resulting in significant gains.

If the price of any financial instrument moves against you, you may result in more massive loss than the original money deposited into your account. You are entirely responsible for all the risks from your trading decisions and resources you use and for a trading system that you are using. You should not make any trading decisions unless you understand entirely the nature of the trades (transactions) you are entering into and your exposure to loss.

If you do not fully understand these risks, you must find independent advice from your financial advisor.

All the trading reports, videos, webinars, and strategies are used at your own risk.

All the content on elliottwavestreet.com should not be used as advice or recommendation of any type. It is your responsibility to confirm and decide which trades to make based on your analysis. Trade only with risk capital; that you can afford to lose, and that will not negatively impact your lifestyle and your financial obligations needs. Past results are no indication of future performance. The information found on this website should not be interpreted as an implied promise or guarantee.

ElliottWaveStreet.com is not responsible for any losses incurred as a result of using any of our trading reports, courses, webinars, video, strategies and any information posted by us.

There is no assurance that any prior successes or past results as to earnings or income (whether monetary, whether convertible to cash or not) will apply, nor can any prior successes be used, as an indication of your future success or results from any of the information, content, or strategies. Any and all claims or representations as to income or earnings (whether monetary or advertising credits, whether convertible to cash or not) are not to be considered as “average earnings”.

(i) The Economy: The economy, both where you do business, and on a national and even worldwide scale, creates additional uncertainty and economic risk. An economic recession or depression might negatively affect the results produced by our Service.

(ii) Your success or lack of it: Your success in using the information or strategies provided at elliottwavestreet.com depends on a variety of factors. We have no way of knowing how well you will do, as we do not know you, your background, your work ethic, your dedication, your motivation, your desire, or your business skills or practices. Therefore, we do not guarantee or imply that you will trade successfully.

(iii) Forward-Looking Statements: Materials contained on this website or in materials purchased and/or downloaded from this website may contain information that includes or is based upon forward-looking statements within the meaning of the securities litigation reform act of 1995. Forward-looking statements give our expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts, they use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with a description of potential earnings or financial performance.

Any and all forward looking statements here, in other materials contained on this website or in materials purchased and/or downloaded from this website are intended to express our opinion of earnings potential. Many factors will be important in determining your actual results and no guarantees are made that you will achieve results similar to ours or anybody else, in fact no guarantees are made that you will achieve any results from our ideas and techniques in our material.

(iv) Due Diligence: You are advised to do your own due diligence when it comes to making trading decisions and should use caution and seek the advice of qualified professionals. You should check with your accountant, lawyer, or professional advisor, before acting on this or any information. You may not consider any examples, documents, or other content on the website or otherwise provided by us to be the equivalent of professional advice. Nothing contained on the website or in materials available for sale or download on the website provides professional advice in any way.

We assume no responsibility for any losses or damages resulting from your use of any link, information, or opportunity contained within the website or within any information disclosed by the Company in any form whatsoever.

(v) Purchase Price: Although we believe the Subscription price is fair for the value that you receive, you understand and agree that the purchase price for our Service has been arbitrarily set by us. This price bears no relationship to objective standards.Information provided in this website is intended entirely for informational and educational purposes and is gathered from sources considered to be safe. Information found on this website is not guaranteed. No guarantee of any kind is implied or possible when possible future price movements on the financial markets are published on this website.

https://elliottwavestreet.com nor any of its directors, employees, employees, partners, agents or affiliates, collect money from the public or manage third-party accounts, we are not licensed for this purpose. All our services are focused solely for academic purposes that promote research. Reports, comments, opinions and any written or audiovisual expression do not represent a suggestion of trading or investment, past events do not guarantee future events, investments in stock markets, FOREX, derivatives among others are considered high risk and such risk may not be suitable for your investment capital, remember that handling your money is your responsibility, do not invest money that cannot bear to lose, we recommend you to seek advice before making any investment and verify with the authorities of your country the rules and laws on investment in financial markets.

We have created alliances with third party brokers to reduce the cost of some products and services made available through https://elliottwavestreet.com; if you make the decision to deposit your money in one of the brokers that https://elliottwavestreet.com has alliance, remember that you are NOT depositing your money at https://elliottwavestreet.com or World Markets Academy LLC. Before depositing your money check the permits, regulations, disclosure of risk, terms and conditions of these brokers, this verification is your responsibility, do not forget to consult with the authorities of your country of residence all the requirements to make these investments.

Remember that https://elliottwavestreet.com and World Markets Academy LLC do not have access to the management of your money, therefore the decisions that you take based on the technical analysis presented in the products, services, videos, courses and blog of https://elliottwavestreet.com and World Markets Academy LLC are your responsibility, when taking the products or services made available through https://elliottwavestreet.com you accept that the losses and / or profits are your responsibility, remember that https://elliottwavestreet.com is for the sole purpose to teach market analysis techniques, past situations do not guarantee future situations.

Your use of https://elliottwavestreet.com is at your own risk. The products and services made available through https://elliottwavestreet.com are provided “as is” and “as available”, without warranties of any kind, expressed or implicit, including but not limited to, warranties of merchandising, suitability for a particular purpose, non-infringement or course of performance.

World Markets Academy LLC, its affiliates and their licensor providers do not guarantee that a) https://elliottwavestreet.com will operate uninterrupted, secure or available at any time or place; b) errors or defects will be corrected; c) https://elliottwavestreet.com is free of viruses or other harmful components; or d) the results of the use of https://elliottwavestreet.com comply with your requirements or demands.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Recommended Content

Editors’ Picks

EUR/USD drops below 1.0500 amid French political jitters

EUR/USD is back in the red below 1.0500 in the European session on Wednesday. The pair trades with caution amid renewed US Dollar buying and French political uncertainty as the government faces a no-confidence vote in a busy day ahead. US data, Lagarde and Powell eyed.

GBP/USD turns south toward 1.2600 after Bailey's dovish comments

GBP/USD has come under fresh selling pressure, heading toward 1.2600 in European trading on Wednesday. Dovish remarks from BoE Governor Bailey fuel a fresh leg down in the pair ahead of US ADP Jobs data, ISM Services PMI data and Fed Chair Powell's speech.

Gold price slides below $2,640, fresh daily low ahead of Fed Chair Powell's speech

Gold price attracts some sellers following an intraday uptick to the $2,650 supply zone and hits a fresh daily low during the first half of the European session on Wednesday. The precious metal, however, remains confined in a familiar range held over the past week or so as traders seem reluctant to place aggressive directional bets ahead of Fed Chair Jerome Powell's speech.

ADP report expected to show US private sector job growth cooled in November

The ADP Employment Change report is seen showing a deceleration of job creation in the US private sector in November. The ADP report could anticipate the more relevant Nonfarm Payrolls report on Friday.

The fall of Barnier’s government would be bad news for the French economy

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.