EUR struggles for support

EUR/USD breaks lower

The Euro struggled after retail sales across the bloc remained flat in April. The pair has given up most of the gains from its mid-Mach rally and is heading towards the daily support of 1.0540. The latest bounce has met stiff selling pressure at 1.0780 and the subsequent U-turn sent the single currency back to the base of the rebound at 1.0670 with a tentative break suggesting further weakness. Its breach would invalidate the brief bullish momentum and cause a sell-off below 1.0635. 1.0730 has become a fresh resistance.

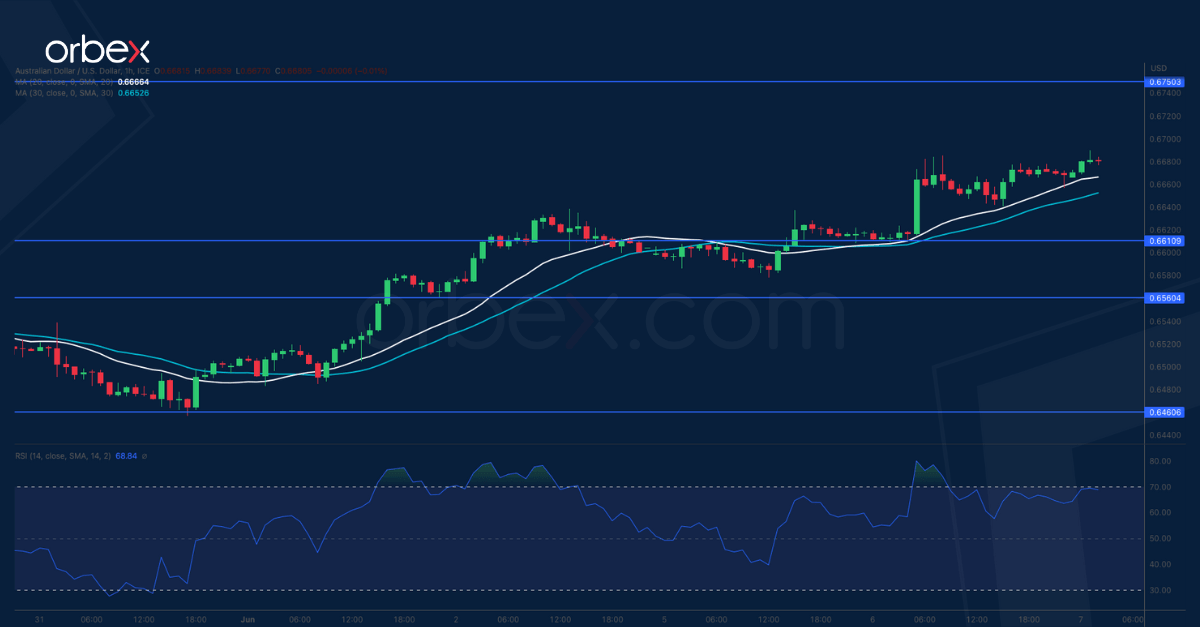

AUD/USD bounces back

The Australian dollar jumped after the RBA surprised the market with another tightening move. The price continues to capitalise on its bounce off the base of last November’s rally at 0.6460. A surge above the key support-turned-resistance of 0.6640 has forced more sellers to cover their bets and eased the bearish pressure, clearing the path for a potential extension towards 0.6750. The RSI’s double top in the overbought zone may temporarily limit the bullish fever and 0.6610 is the closest support in case of a retracement.

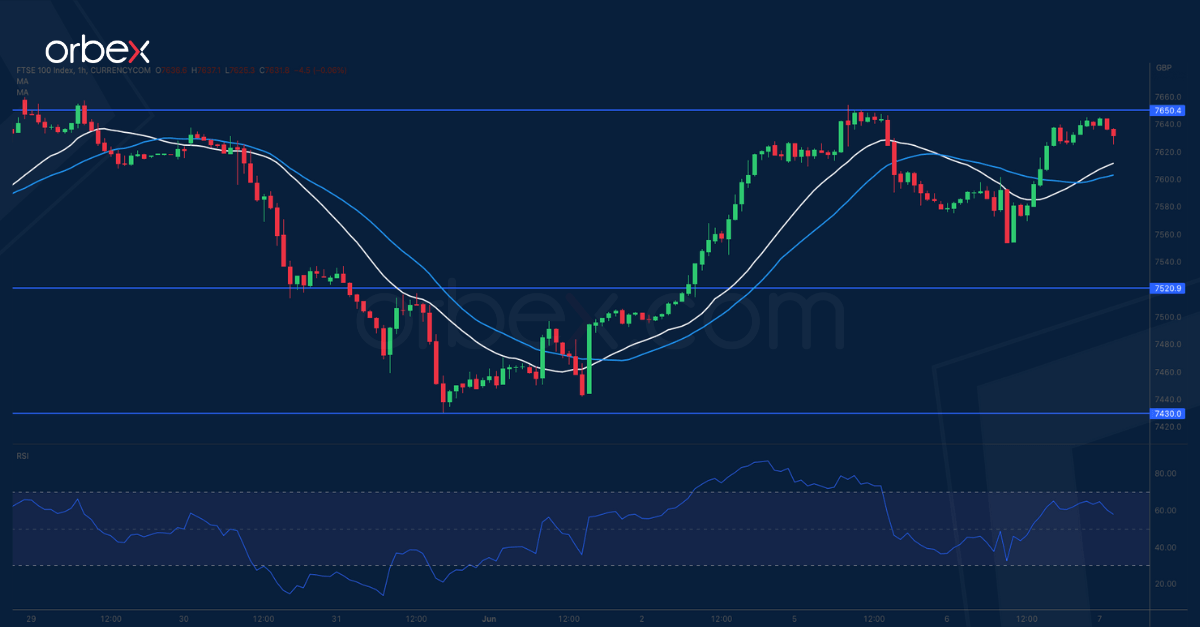

UK 100 tests resistance

The FTSE 100 bounces back supported by a rally in energy stocks. A V-shaped rebound has brought the index to its first key resistance at 7650 which coincides with the 20-day SMA. A bullish breakout would flush selling interests out and pave the way for an extended recovery to the previous consolidation zone around 7800 where a liquidation kicked off later last month. A close above this major ceiling might trigger a bullish continuation above 8000 in the medium-term. 7520 is an important level to maintain the current momentum.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.