EUR Rates: how hawkish can they get?

Rates markets are pricing a much more hawkish path to ECB interest rates than three months ago. Some of it is related to improvement in sentiment, some to changes at the top of the ECB. Going forward, a communication vacuum at the central bank could leave markets to draw their own hakwish conclusion. High-beta fixed income assets valuation would be at risk.

Lagarde inherits more optimistic markets

The first press conference of a new ECB president is always an emotional moment for a rates strategist. It inevitably brings back memories of the previous president's first conference, and the realisation that these memories are now eight years old. Now is not the time to write a summary of all that has changed since Mario Draghi took office in November 2011, we direct our readers to the excellent piece written by our economics team on this subject. Instead, we will limit ourselves to how much has changed in rates markets since the September 2019 meeting, arguably Draghi's last ‘live' meeting, and what it says about how markets view the Draghi-Lagarde transition.

On a combination of encouraging domestic economic developments, global optimism, and shift in the ECB's communication, EUR money markets are pricing a much different path for ECB rates in the coming five years. In short, they foresee no more cuts in 2020-2021, and 30 basis points of tightening in 2022-24.

Lagarde re-pricing? EUR rates have changed their view on ECB rates

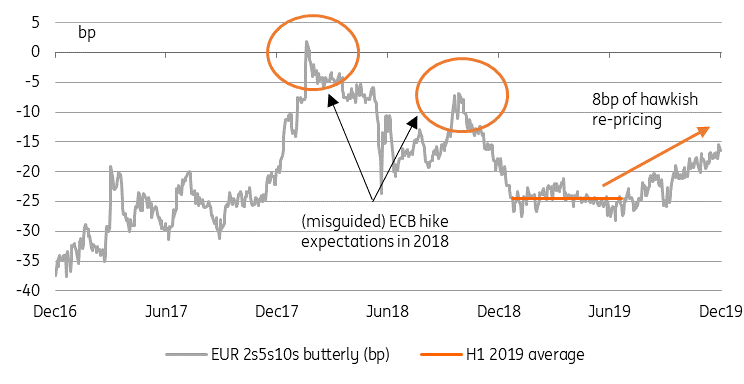

The same is visible in the cheapening of the belly of the curve. ‘Butterflies' such as EUR 2s5s10s (the difference between 5Y interest rates on the one hand, and 2Y and 10Y on the other) is now around 8bp higher than its average in the first half of this year, highlighting investors' expectation of policy tightening in the medium term. A comparison with the spikes in this butterfly in early and mid-2018 is telling. At that time, 2s5s10s rose above 0 compared to -16bp today. This suggests potential for further hawkish re-pricing if markets become excited about the chances of ECB tightening in the coming years. But will they?

Intermediate rates have risen since H1 2019

No definitive answer on the inflation outlook yet...

The ECB has tied the fate of both its main policy instruments - interest rates and asset purchases - to the inflation outlook. We defer to our economics team for an assessment of how likely inflation is to have reached its target by 2022, when the market is pricing a first hike. What we can say is that September ECB projections (to be updated this week) only have HICP ex-good and energy at 1.5% annualised in 2021. Whether this will be deemed sufficient to hike rates is uncertain. We feel more confident in saying that this will not be clear for the best part of 2020.

What then are rates markets getting excited about? For a start, the stabilisation in economic data since the September meeting could be a reason for markets questioning the outlook for inflation. This is possible, but with core HICP having averaged under 1.1% over the past 10 years, this seems unlikely. An alternative explanation is that the barrage of ECB comments stressing the negative side effects of negative rates, has made markets slowly start to re-assess the ECB's reaction function.

The ECB is forecasting only a modest uplift in core inflation

...but rates markets will draw their own conclusion

Enter Christine Lagarde. As our economics team has highlighted in their preview, one of Lagarde's first jobs is to mend fences after recent controversies from opposing hawks and doves, with Draghi in the role of chief dove. Whether this is justified or not, we see a risk that rates markets would consider a non-committal Lagarde as giving ground to the hawks who opposed Draghi so publicly. More practically for this week's press conference, we also see a risk that the absence of comment on the ECB's appropriate policy stance (beyond trotting out the official line), would be construed as an endorsement of hawkish market expectations.

The time between now and when an uplift (if any) in core inflation is confirmed could be considerable but rates markets will not wait to price a hawkish ECB view. We see a risk of this happening in the coming months as Lagarde et al. stay noncommittal ahead of the upcoming policy review and avoid controversial subjects that would reopen divisions among Governing Council members. As has been the case in the past, this would probably prove premature but financial markets are forward-looking in nature and reflect whatever information is available to them at the time. A lack of policy direction at the ECB could reinforce current hawkish market assumptions.

At a time when central bank policy acts as a prop for many assets' valuation, we see a risk of divergence between the perceived ECB stance and a still tepid outlook. We are particularly cautious on the outlook for high-beta fixed income markets as an increase in rates volatility would be detrimental to the risk-reward of owning these assets for their carry.

Read the original analysis: EUR Rates: how hawkish can they get?

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.