EUR/JPY

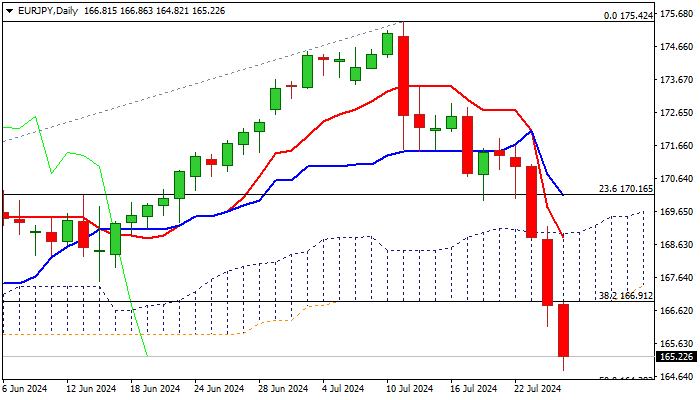

EURJPY extends steep fall into fifth straight day and hit 11-week low in early Thursday (down 1% in Asian session).

Recent interventions by Japan’s authorities boosted yen across the board and fresh strength gained strong momentum, suggesting that the currency could rise further.

Wednesday’s close below pivotal support at 166.91 (daily cloud base / Fibo 38.2% of 153.14/175.42 rally) generated strong bearish signal, which showed immediate result in fresh acceleration lower on Thursday.

Bears eye targets at 164.28 (50% retracement) and 163.91 (200 DMA) violation of which to unmask 161.65 (61.8% retracement) and psychological 160 in extension.

Meanwhile, bears may take a breather for consolidation, as daily studies are strongly oversold.

Upticks should be capped under broken pivot at 166.91, now acting as solid resistance, to keep bears in play and mark positioning for fresh push lower.

Markets shift focus towards next week’s BoJ monetary policy meeting (Wednesday) especially on the latest talks encouraging further rate hikes, which would provide fresh support to rising yen.

Res: 166.91; 167.78; 168.87; 169.01.

Sup: 164.28; 163.91; 163.01; 161.65.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds higher ground above 1.0850 ahead of US PCE inflation

EUR/USD is gaining recovery momentum above 1.0850 in the early European session on Friday. The pair stays underpinned by the renewed US Dollar weakness, as risk sentiment rebounds ahead of the key US PCE inflation data.

GBP/USD stays firm above 1.2850, US PCE data awaited

GBP/USD is holding mild gains above 1.2850 in early Europe on Friday, helped by a broadly weaker US Dollar amid a risk reset. The Fed-BoE divergent policy outlooks continue to favor the Pound Sterling. Traders look to the US PCE inflation data for fresh directives.

Gold focuses on US PCE Inflation and daily close below $2,360

Gold price has managed to defend the key support near $2,360, consolidating weekly losses in Friday’s Asian session. Traders now shift their focus toward the monthly release of the US PCE Price Index after Thursday’s second-quarter GDP.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

US core PCE annual inflation seen lower in June, reinforcing the case of a Federal Reserve's cut

The United States will release June Personal Consumption Expenditures Price Index figures on Friday. The Federal Reserve’s favourite inflation gauge will be released by the US Bureau of Economic Analysis (BEA) at 12:30 GMT.