EUR/GBP outlook: Extends steep ascend into fifth straight day

EUR/GBP

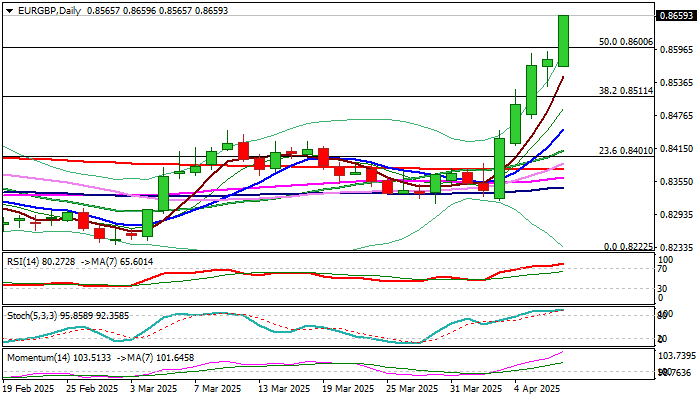

EURGBP holds in steep ascend for the fifth consecutive day, strongly supported by rising risk aversion on the latest escalation of trade war, as Euro turned to safe haven asset (along with yen and Swiss franc) on weakening dollar.

Fresh acceleration higher on Wednesday (the price was up almost 1% until early US trading) hit the highest since early January 2024, while the pair advanced nearly 4% in the latest five-day rally.

Bulls broke through important barriers at 0.8600 (50% retracement of 0.8978/0.8225) and 0.8624/44 (former tops of Aug 9 / Apr 23 last year) generating fresh bullish signals.

Important Fibo barrier at 0.8689 (61.8%) comes in focus, although bulls may take a breather for consolidation as strongly overbought daily studies suggest.

Dips should be shallow (in currently very favorable fundamentals) and offer better levels to re-enter firmly bullish market.

Good supports at 0.8600/0.8550 should ideally contain.

Res: 0.8689; 0.8714; 0.8765; 0.8800.

Sup: 0.8624; 0.8600; 0.8550; 0.8511.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.