EUR/CAD: Room for downward mobility - FXStreet Signals

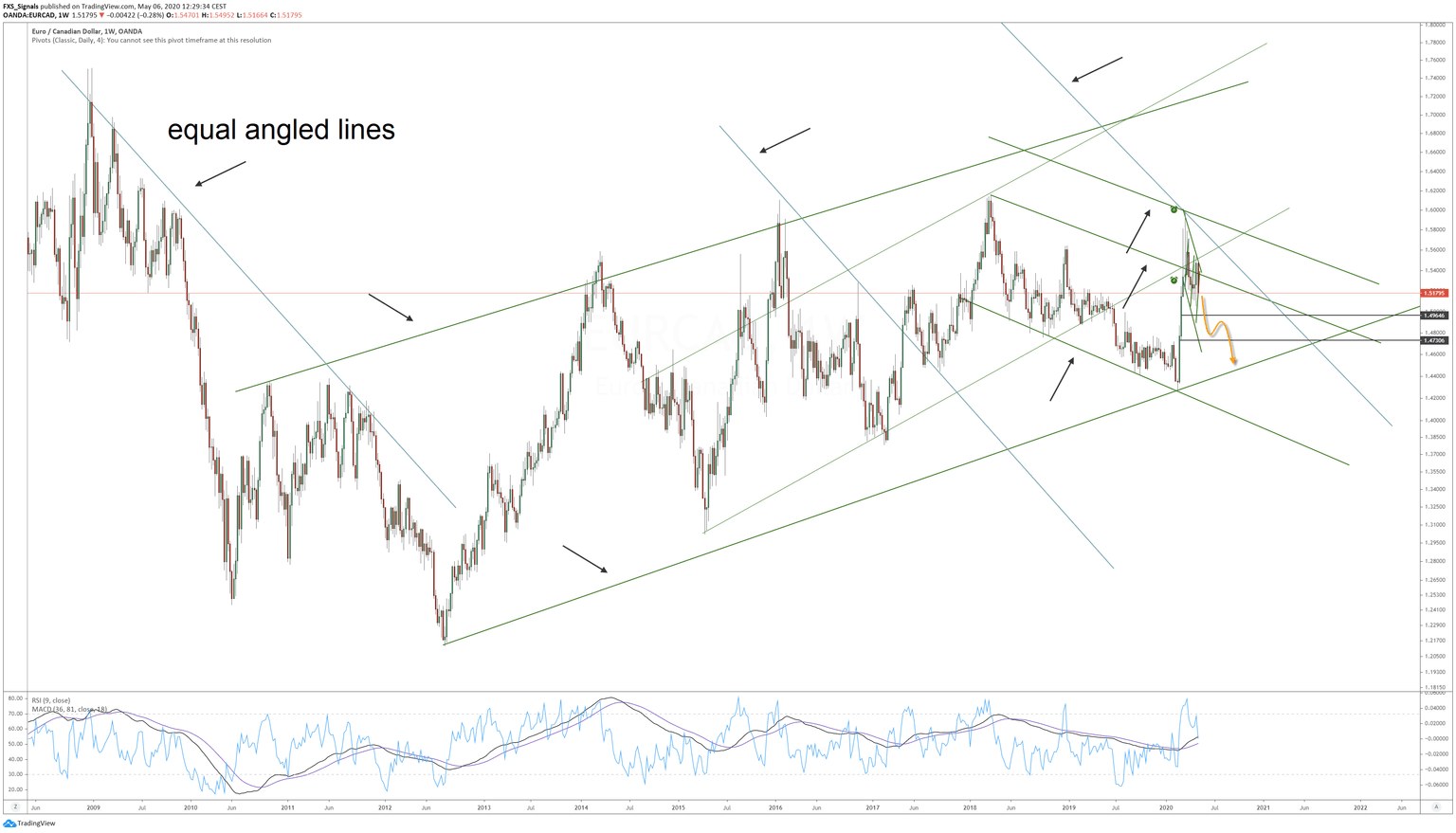

We stick with our EUR/CAD Sell entry from 1.5323 triggered by the "Extreme Volatility 4H" strategy last Friday, when overbought conditions were in a need of alleviation. The cross may not exactly take the route we anticipate, but at present we can be happy with a possible end destination being somewhere in the vicinity of the multi-year ascending channel bottom (currently at 1.4350). Prior to that final target, we will probably see some instability and chop and goofy price action between 1.4970 and 1.4740. We referred to this area as containing a lot of past memory (see the 4-hour chart below).

The EUR/CAD does not react to all risk-on/off scenarios equally: it may explore new highs on the upper part of the aforementioned multi-month channel, or it may erode to deeper levels, breaking its lower boundaries. There will be pullbacks along the way with days (or hours) of "risk-on", but another sell-off wave in equities -as we expect for the 2nd half of May- would weigh on the CAD (lifting EURCAD). This means that we have one more week to reach our dowsinde projection before a cycle-induced reversal takes the pair possibly higher.

For more info on the FXStreet Signals service click here.

Author

Gonçalo Moreira, CMT

Independent Analyst

As a trader in the foreign exchange market since 2005, Gonçalo Moreira honed his analytic and strategic skills through the Chartered Market Technician (CMT) designation.