EU Markit PMIs Preview: Would a continued recovery actually matter?

- EU manufacturing and services activity is expected to remain in expansion territory in August.

- Speculative interest can’t ignore the sharp increase in coronavirus outbreaks in Europe.

- EUR/USD weighed by a resurgent dollar, but the slump remains corrective.

After growth indicators collapsed to record lows in April as a result of the pandemic-related lockdowns, most indexes returned to expansion levels between June and July. The latest Markit PMIs showed that in the Union, manufacturing activity recovered to 51.8, the first month the index showed expansion since February 2019. The Services PMI printed at 54.7, downwardly revised from its preliminary estimate yet also expanding, as the region lifted restrictions related to the coronavirus pandemic.

Markit will publish this Friday the preliminary estimates of its August indexes. The EU Manufacturing PMI is foreseen at 52.9 from the previous 51.8, while the Services PMI is expected at 54.5 from 54.7. The Composite Index has been forecast at 54.9, unchanged from July final reading.

The expected numbers for the whole of Europe and countries, in particular, are all expected to remain within expansion territory. However, there’s more than just the numbers. As said, the record slumps seen earlier this year are a consequence of the coronavirus pandemic, which is far from over.

Coronavirus overshadowing data

In Europe, most governments are struggling not to impose new restrictions, as the number of new contagions has been on the rise ever since the month started. Selective lockdowns have been reimposed, yet not always respected. If there’s one lesson authorities have learned these months, is that economies can’t stop. Even in those countries that had the shortest lockdowns, the damage made to the economy has been terrible.

With that in mind, fears over what will happen next will likely outweigh encouraging reports. Speculative interest is far more concerned about what’s next, with the possibility of another setback. Whatever happened so far, in a world that can´t control the coronavirus, has become irrelevant. The market needs more than a positive number to be convinced the worst is over.

EUR/USD Technical Outlook

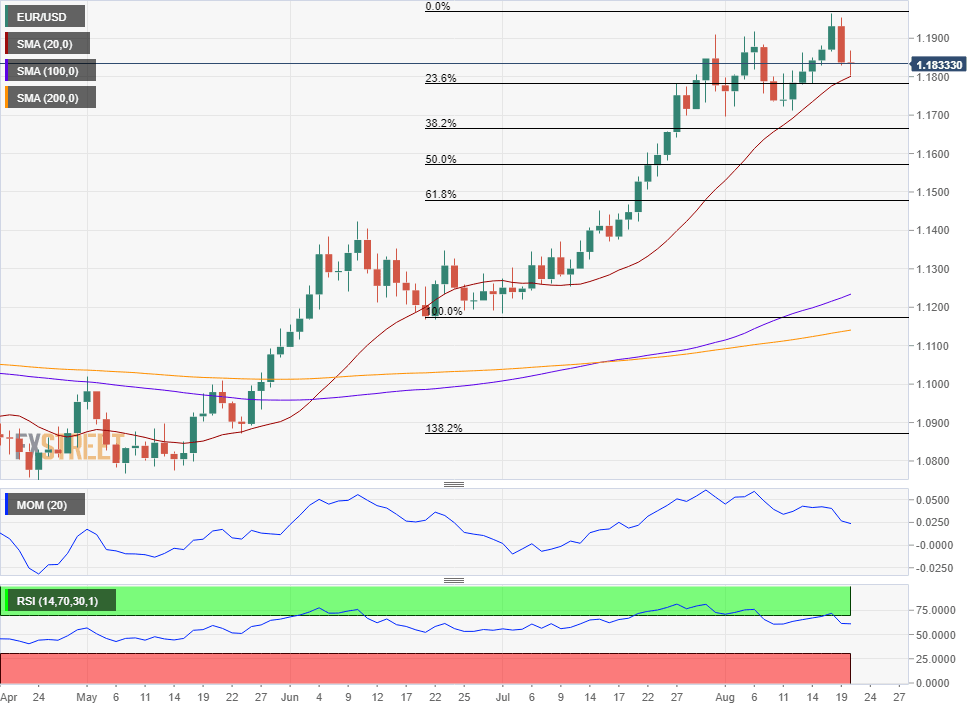

The EUR/USD pair is struggling to retain gains above the 1.1800 level. The pair has been on quite a directional advance since mid-June, which makes of the ongoing slide a corrective one. The pair is above the 23.6% retracement of its 1.1167/1.1965 rally at 1.1776.

Technical readings also suggest that the decline is far from indicating a dollar’s comeback, as the pair met buyers around a bullish 20 DMA, while technical indicators have lost their bearish strength after correcting overbought conditions. Even further, the Momentum indicator is bouncing from its midline, while the RSI stabilized around 61. Upbeat readings could help EUR/USD recover towards the mentioned high, with the downside restricted as long as the pair remains above 1.1770. The corrective decline may extend below this one, mainly exacerbated by additional profit-taking ahead of the weekend. The next relevant support comes at 1.1690, where the pair bottomed this month.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.