EU considers Russian Aluminium ban in new sanctions push

The European Union is reportedly considering more import restrictions on Russian aluminium as part of a new package of sanctions targeting Moscow for its invasion of Ukraine. But any impact is likely to be limited while Russian metal is likely to continue to find new sanction-neutral buyers.

Aluminium gets a short boost

LME aluminium prices touched their highest in nearly a month this Wednesday, topping $2,600/t following the news that the European Union is considering more sanctions on Russian aluminium products. Prices later gave up the gains.

The draft measures would be part of the EU’s 16th package of sanctions, marking the third anniversary of the war. Restrictions on aluminium would be gradual, with a timeframe and scope still to be determined, according to reports. The draft proposals are still being discussed between member states and could change before they are formally presented. The EU is expected to adopt the new measures next month.

The US and the UK banned the import of metals produced in Russia in 2024. The EU has so far banned aluminium products, including wire, tube, pipe and foil, which account for less than 15% of EU imports.

Russia is the world’s largest aluminium producer outside China, accounting for about 5% of global aluminium production.

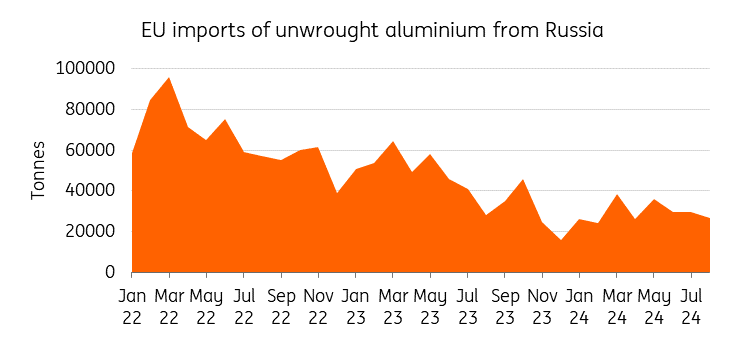

EU’s imports of Russian Aluminium have fallen over the past two years

Source: UN Comtrade, ING Research

EU's imports of Russian Metal have fallen

Although the EU continues to import Russian aluminium, volumes have fallen over the past two years, with European buyers self-sanctioning since the invasion of Ukraine. Russia now accounts for around 6% of European imports of primary aluminium, halving from the 2022 levels.

The gap left by Russian supplies has mostly been filled by imports from the Middle East, India, and Southeast Asia, and this trend is likely to continue.

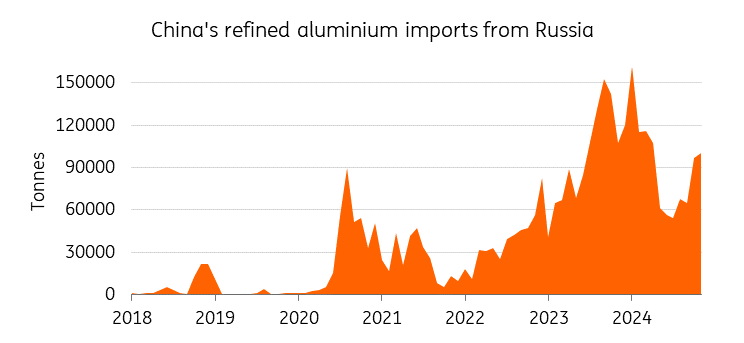

More Russian metal has been shipped to China, the world's biggest aluminium consumer. China imported 263,000 tonnes of primary aluminium from Russia in the first three quarters of 2024, accounting for 33% of the total imports from Russia last year. We expect this trend to continue in 2025.

China’s imports of Russian Aluminium hit record highs in 2023

Source: China Customs, ING Research

China is nearing capacity cap

In China, aluminium output is hitting record highs. The production rate is closing in on Beijing’s 45 million tonnes annual capacity cap (currently running at around 43 million tonnes) following ample rainfall last year, which has enabled full capacity operations in the hydro-powered Yunnan province after a few consecutive years of output cuts. This leaves limited further growth potential for Chinese production. China’s capacity cap also means that the country remains a net importer of aluminium.

Read the original analysis: EU considers Russian Aluminum ban in new sanctions push

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.