EUR/USD: The price could keep dropping to 1.1550

US stocks rose on Thursday as investors reflected on strong initial jobless claims numbers and corporate earnings. The Dow Jones added more than 515 points while the S&P 500 and Nasdaq 100 rose by 71 and 245 points, respectively. Data published by the Bureau of Labor Statistics (BLS) showed that the number of Americans filing for initial jobless claims declined to a post-pandemic low of 293k while the continuing claims dropped to 2.5 million. Meanwhile, companies like Morgan Stanley, UnitedHealth Group, Walgreens Boots Alliance, and Bank of America reported strong results.

The price of crude oil and other commodities jumped in the evening session as investors continue pricing in a supercycle. Brent crude jumped to a multi-year high of $84 while West Texas Intermediate (WTI) rose to $82. Other commodities like natural gas, copper, nickel, and zinc also rallied. Oil gained even as data by the Energy Information Agency (EIA) showed that inventories rose from more than 2.34 million barrels to more than 6.08 million barrels. The price also reacted to a report by OPEC which downgraded demand slightly in its October monthly report.

The economic calendar will be relatively muted today. The only key data to watch will be the US retail sales numbers. Economists expect that these numbers will show that sales continued rising in September. The core retail sales are expected to have risen by about 0.5%. The US will also publish the latest export and import price data. The earnings season will continue today, with the key companies to watch being Goldman Sachs, Charles Schwab, PNC Financial, and JB Hunt.

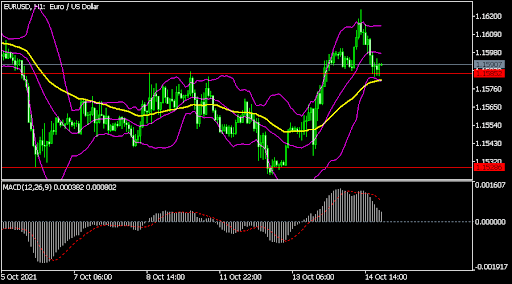

EUR/USD

The EURUSD pair declined sharply in the overnight session as the US dollar made a comeback. The pair declined from a high of 1.1625, which was lower than yesterday’s high of 1.1625. On the hourly chart, it has tested the key support, which it struggled to move above earlier this week. It has also moved between the lower and middle lines of the Bollinger Bands while the MACD has formed a bearish crossover. Therefore, a break below the current support will send a signal that there are more sellers left. As such, the price could keep dropping to 1.1550.

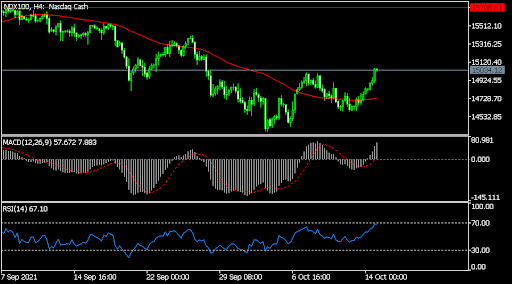

NDX 100

The Nasdaq 100 index jumped sharply as the market reacted to the ongoing earnings season. The index rose to a high of $15,050, which was the highest level on September 28. While rising, it moved above the key resistance level at $15,000. It also rose above the 25-day moving average. The Relative Strength Index (RSI) and the MACD have continued to rise. Therefore, the index will likely keep rising as investors buy the dips.

ETH/USD

The ETHUSD pair made a bullish breakout in the overnight session. It rose to a monthly high of 3,790, which was substantially higher than this month’s low of 3,200. The pair moved above the bullish flag pattern. It also rose above the 25-day and 50-day moving averages. Therefore, the pair will likely keep rising as bulls target the next key resistance at 4,000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.