ETH/USD soars to record high as bullish momentum accelerates

The EURUSD rose slightly on Monday even after signs emerged that Europe is going through a fourth wave of the Covid-19 pandemic. In Germany, data by Robert Koch Institute showed that the number of cases per 100,000 people rose to 201.1. This was the highest it has been since the pandemic started. The previous peak was 197.6 and was recorded in December last year. Still, analysts believe that the country’s healthcare system will be able to manage the new upsurge of cases since most people are now vaccinated. Other European countries like France and Spain have also seen more cases.

Global stocks were mixed today as concerns about the rising Covid-19 cases in China and Europe. In Europe, the DAX index declined by about 5 points while the Stoxx 50 index declined by 0.15%. In the United States, futures tied to the Dow Jones rose by more than 100 points while those tied to the Nasdaq 100 index declined by 0.15%. The CBOE volatility index declined by more than 1.4%. The stocks are also reacting to the $1 trillion infrastructure deal that was passed on Friday. This package will see the government spend $1 trillion in the next 10 years on projects like roads, bridges, and broadband.

Cryptocurrency prices continued the bullish momentum that was started on Sunday as demand rose. Ethereum surged to more than $4,700 while Bitcoin rose to more than $66,000. In total, the market capitalization of all cryptocurrencies that are tracked by CoinMarketCap rose to more than $2.8 trillion. There was no major reason why the rally intensified today. Perhaps, investors are waiting for the upcoming earnings release by Coinbase, the second-biggest exchange in the world. Also, it could be because of the infrastructure package that was passed during the weekend. The legislation changed the legislative definition of custodial services to include companies like Coinbase.

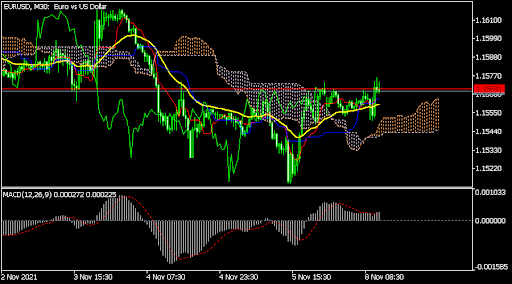

EUR/USD

The EURUSD pair held steady on Monday as investors continued to reflect on the recent Fed decision and NFP data. On the 30-minute chart, the pair has moved a few pips above the neckline of the inverted head and shoulders pattern. In price action analysis, this pattern is usually a bullish sign. It has also moved slightly above the short and longer-term moving averages. The price is slightly above the Ichimoku cloud. Therefore, the pair will likely keep rising in the near term.

ETH/USD

The ETHUSD pair popped to the highest level on record as cryptocurrency prices jumped. The pair rose to a high of 4,725, which was substantially higher than the July low of less than 2,000. The price is still above the short and longer-term moving averages while the Average Directional Index (ADX) has been rising as well. It has also moved above the ascending trendline that is shown in pink. Therefore, the pair will likely keep rising as bulls target the key resistance at 5,000.

BTC/USD

The BTCUSD pair also rose to a high of more than 66,000 as demand for Bitcoin rose. The pair is a few points below its all-time high of 66,930. It seems to be forming a cup and handle pattern. It has also moved above the key support level at 64,200. It is being supported by the 25-day and 50-day moving averages. Therefore, the pair will likely keep rising, with the next key target being at 70,000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.