ETH/USD soars as Ethereum demand rises

US stocks continued the bullish momentum as investors waited for the upcoming Federal Reserve interest rate decision. The Dow Jones rose by more than 160 points while the S&P 500 and Nasdaq 100 indices rallied by more than 0.25%. The Fed is expected to turn relatively hawkish as the US economy is doing relatively well while inflation has risen. The stocks also rallied after strong quarterly earnings and deal-making. In a report, Pfizer announced that it will make more money this year than expected. The firm expects its sales will rise to $36 billion this year, helped by the Covid vaccine.

Other top movers were Tesla, whose shares declined after Elon Musk cast doubt on the Hertz deal. Private equity companies like Apollo and KKR also recorded strong sales. Meanwhile, Ferrari shares rallied in New York after the company boosted its forward guidance. Avis Budget shares rallied by more than 100% after the company announced strong results. Other firms that reported strong sales were Under Armour and BP.

Cryptocurrency prices rebounded as demand for the coins jumped ahead of the Fed decision. Bitcoin soared to more than $64,000 while Ethereum prices jumped to more than $4,500. In total, the market capitalization of all coins tracked by CoinMarketCap surged to more than $2.7 trillion. There were no specific reasons as to why the prices bounced back.

Elsewhere, key events to watch today are the UK composite and services PMI data. These numbers are expected to show that the economy did well in October. In the US, ADP will publish its forecast for private payrolls. While important, the data tends to be relatively different from the official data. In Europe, Christine Lagarde will deliver a speech that could have some impact on the euro. The earnings season will continue, with the key companies to watch being New York Times, Emerson Electric, Discovery, and Virtu Finance among others.

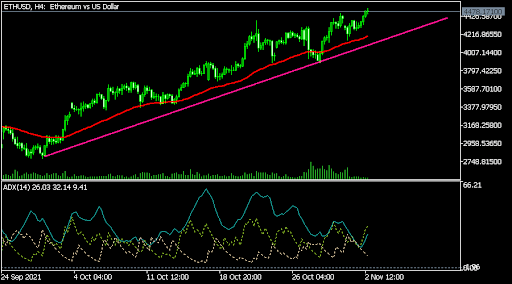

ETH/USD

The ETHUSD pair continued its bullish trend in the overnight session. The pair rose to a high of 4,500, which was substantially higher than the July low of 1,800. On the four-hour chart, the pair remains above the 25-day and 50-day moving averages. It has also moved above the pink ascending trendline. Notably, the Average Directional Index (ADX) rebounded, which is a sign that the trend is strong. Therefore, the pair will likely keep rising as bulls target the next key level at 4,600.

EUR/USD

The strong EURUSD rebound that happened on Monday and Tuesday faded as traders braced for a hawkish Federal Reserve. The pair declined to 1.1577, which was lower than this week’s high of 1.1615. On the four-hour chart, the pair managed to move below the middle line of the Bollinger Bands. It also declined below the 25-day MA while oscillators like the MACD and the RSI also moved lower. Therefore, the pair will likely keep falling in the near term.

AUD/USD

The AUDUSD declined sharply even as the RBA turned hawkish. The pair declined to a low of 0.7425, which was the lowest level since October 19th. It also moved below the 23.6% Fibonacci retracement level and below the 25-day and 50-day moving averages. The Relative Strength Index (RSI) also declined. Therefore, the pair will likely keep falling as bears target the 50% retracement level at 0.7327.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.