ETH/USD cautiously rises as cryptocurrencies bounce back

European equities rose on Wednesday as investors assessed the impact of the announced sanctions on Russia. The DAX, CAC 40, and FTSE MIB rose by more than 0.50%. On Tuesday, the United States announced a series of sanctions targeting the Russian state, some banks and individuals. These limitations mean that Russia will not be able to access the global debt market. In Europe, Germany announced sanctions on the Nord Stream 2 gas pipeline project while the UK targeted banks and politicians in the Duma.

Stocks also rose as the market reflected on the latest quarterly results by some of the biggest companies in Europe. Barclays reported strong results as its net income rose to over 1.1 billion pounds. Revenue rose by 4.4%, helped by its investment bank division. Meanwhile, Stellantis, the parent company of Fiat Chrysler and PSA reported that its revenue jumped by 14% from the previous year to 152 billion euros. Its annual profit came in at 13.4 billion euros. The commodities boom helped propel Rio Tinto’s business as its revenue soared. As a result, the company will return $7.7 billion to investors through buybacks.

The New Zealand dollar rose sharply after the RBNZ delivered its interest rate decision. The bank decided to deliver the third consecutive rate hike in its attempt to prevent the economy from overheating. The baseline rate is currently at 1%, which is higher than last year’s low of 25 basis points. The bank also noted that it will start its quantitative tightening process by reducing the amount of bonds it purchased. Other key events today were the relatively modest wage price growth data from Australia and the latest Eurozone inflation data.

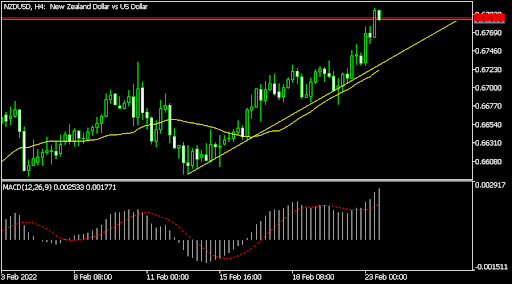

NZD/USD

The NZDUSD pair rose to a high of 0.6798, which was the highest level since January 21. This was a significant level since the price is currently trading at 0.6521. It has also moved above the 25-day moving average. It has also risen above the 61.8% Fibonacci retracement level while the MACD has moved above the neutral level. Therefore, the pair will likely keep rising as bulls target the key resistance at 0.6820.

EUR/USD

The EURUSD pair moved sideways as focus remained on the Ukrainian crisis. It is trading at 1.1345, which is a few points below the intraday high of 1.1360. On the hourly chart, the pair remains slightly below the upper side of the descending trendline. It is also slightly above the 25-day moving average while the DeMarker indicator is slightly below the overbought level. Therefore, the pair will likely remain in this range during the American session.

ETH/USD

The ETHUSD pair tilted higher as investors attempted to buy the dips. The pair is trading at 2,728, which was slightly above this week’s low of 2,500. On the four-hour chart, the pair has moved to the upper side of the Bollinger Bands while the Relative Strength Index (RSI) and MACD have moved upwards. Therefore, the pair will likely keep rising although this rebound seems like a dead cat bounce.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.