Ethereum surges to record high over the weekend

Ether price surged to a record high over the weekend as interest in the Ethereum ecosystem increased. The currency crossed the important $3,000 milestone, bringing the total year-to-date gains to more than 300%. This is mostly because of the recent growth of the Decentralized Finance (DeFi) industry whose total value locked has grown to more than $60 billion. The ongoing trend of non-fungible tokens (NFT) has also contributed. Recently, an NFT piece by Beeple, an artist, was sold for almost $60 million by Christie’s. Other leading sports and entertainment professionals have also launched their NFTs. Other cryptocurrencies like Bitcoin, Bitcoin Cash, and Dash also soared.

The Australian dollar declined during the Asian session even after strong manufacturing PMI data from Japan. According to Markit, the country’s PMI increased from 56.8 in March to 59.7 in April. This was the highest it has been in years. Further data by the Australian Industry Group (AIG) showed that the index rose from 59.9 to 61.7. This is a sign that the manufacturing sector is doing well as demand rises. Further data revealed that the ANZ job advertisements increased by 4.7% while the MI inflation gauge rose by 0.4%. The currency also reacted to rising commodity prices, with the Bloomberg Commodity Index (BCOM) rising by 0.50%. Tomorrow, the currency will react to the latest RBA decision and trade numbers.

The economic calendar will be relatively busy today as the market reacts to the latest PMI numbers by Markit. The company and its partners will release data from countries like Germany and the United States. Most analysts expect the PMI data to show that the manufacturing sector continued to improve. The Institute of Supply Management (ISM) will also publish the US manufacturing data. Other important numbers to watch today will be the Turkish inflation and German March retail sales.

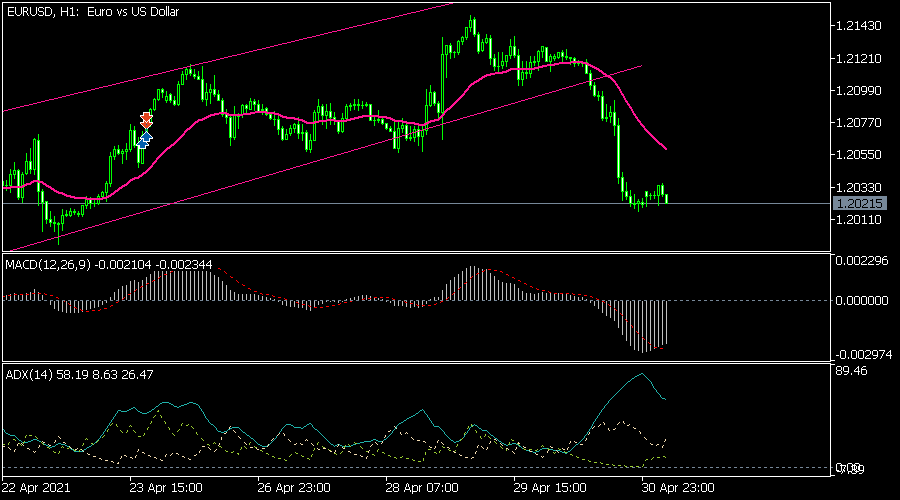

EUR/USD

On Friday, the EUR/USD dropped sharply and left the ascending channel. Today, the pair is little changed and is trading at 1.2023, which is lower than last month’s high of 1.2150. On the hourly chart, the pair is below the 25-day exponential moving averages (EMA) while the Average Directional Index (ADX) has risen. Also, the signal and main lines of the MACD have moved below the neutral line. It also seems to be forming a bearish flag pattern. Therefore, the pair may keep falling as bears attempt to move below 1.200.

GBP/USD

The GBP/USD pair declined to a low of 1.3820, which was the lowest level since April 16. On the three-hour chart, the pair moved below the symmetrical triangle pattern. It has also moved below the 25-day moving average while the relative strength index (RSI) has moved below the oversold level. The pair has also formed a bearish consolidation pattern. Therefore, there is a possibility that it will break out lower as bears target the next support at 1.3730.

ETH/USD

The ETH/USD pair rose to an all-time high of more than 3,000 over the weekend. On the four-hour chart, the pair is above all short and long-term moving averages while the MACD and other oscillators like the Relative Strength Index (RSI) have surged to the highest level in months. While the pair will likely keep rising, a short pullback cannot be ruled out as some bulls take profit.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.