Equity market chart book

The dominant narratives are extremely pessimistic right now, so it might not take much for the glass to go from half empty to half full. A credible Covid strategy from China and a pivot from the Fed could meaningfully change the story.

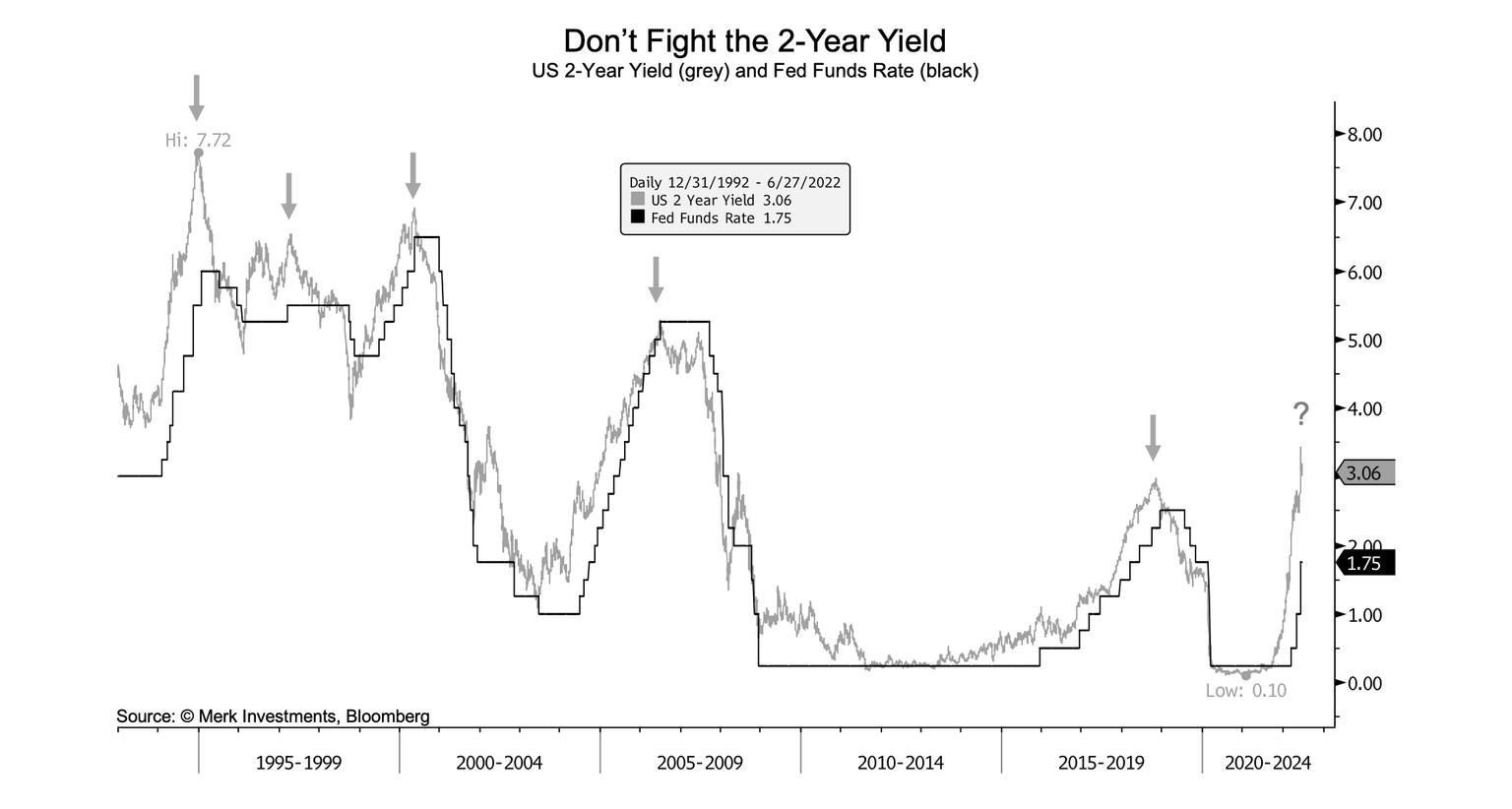

In fact, the Fed dovish pivot may have already started. The 2-year yield spiked up to 3.45% a couple weeks ago and has since fallen back to around 3%.The 2-year yield typically peaks at or before Fed rate hiking cycle peaks and above rate hiking cycle peaks. In other words, hiking cycles don’t last as long or get as far as the market thinks and inflection points in the 2-year yield are a real-time proxy for Fed pivots.

The expected Fed rate hiking cycle peak has shifted higher and sooner over the past month: from an expected peak in mid-2023 at about 3.25% to the end of 2022 at 3.75%. As a historical reference, at the time of the December 2018 Fed meeting (which turned out to be the last hike of that cycle), the market was pricing the cycle to peak about a year later (in Nov 2019). So, I'm starting to think the next hike might actually be the last for this cycle. I realize that's non-consensus but that's always the way it is at the end of the tightening cycle.

Forward guidance has gotten the Fed into trouble, and they may well abandon it. In other words, I wouldn’t be surprised if the Fed changes tune without much warning. Despite being behind the curve (the Fed probably should have started tightening in late 2020, early 2021), they have aggressively moved the rates that matter most: mortgage rates. The Fed’s primary transmission mechanism (to dampen aggregate demand growth) is through mortgage cost. At this point, they have arguably sufficiently punched the mortgage market in the nose, moving the 30yr rate from under 3% to over 6% in less than a year.

More important than the recession vs soft landing outcome is that inflation does indeed come down. Money supply growth has moderated to pre-Covid levels, mostly due to fiscal policy (not monetary policy). Fiscal policy is now tighter than pre-Covid levels. With a return of the supply-side, inflation can and should moderate as well–barring further exogenous negative supply shocks, which are inherently difficult to forecast. If we are through peak inflation, peak inflation expectations, and at or near peak Fed hawkishness, the market very well may be able to start to climb a wall of worry.

On equity market internals, the China CSI 300 Index and the US IPO Index haven't made new lows since April and May, respectively. In other words, they were making higher lows when the S&P 500 was making new lows in June. Those segments of the market were the first to decline and might be the first to bottom and rise again.

As always, everyone needs to put probability and reward-to-risk assessments in the context of their strategy, process, and time horizon.

Author

Alex Edwards

UKForex

Alex Edwards runs the corporate desk at UKForex, where he manages the FX exposures of a broad range of clients. His team offers best execution in spot and forward FX, covering all major currency pairs and many minors.