Equities report: Fragile stabilisation of US equity markets

After some intense trading, US stockmarkets seem to be stabilising somewhat, yet the overall situation remains very fragile as the fundamentals causing the intense trading are still present. The uncertainty by Trump’s tariffs is maintained, worries for a recession in the US economy are also present, while NVIDIA seems ot be the latest casualty of US President Trump’s trade wars. To close the report we are to provide a technical analysis of S&P’s 500 daily chart.

Uncertaitny surrounding Trump’s trade war still present

The uncertainty surrounding US President Trump’s trade war is being maintained. In the latest development the US President stated that he will be announcing semiconductor tariffs next week. He also stated that there will be flexibility on some companies in the sector. Please note that the White House on Friday announced an exclusion from tariffs for smartphones, computers and certain other electronics imported largely from China yet Trump stated that the move would be short-lived. Also the US seems to prepare for tariffs on pharmaceuticals. Yet the situation may escalate further, as a release by the White House stated that “now faces up to a 245 percent tariff”, while up to now the tariffs for China were up to 145%. Beijing has now raised tariffs on US products entering Chinese soil to 125% and is “open” to negotiations should the US show respect. Overall the situation remains tense and we may see further escalation before an easing of the tensions in the US-Sino trade relationships. Should tensions actually rise further we may see them having adverse effect on US stockmarkets.

NVIDIA the latest victim of Trump’s trade wars

NVIDIA’s share price is expected to slide at today’s American open as the company is hit by a the effort by the White House to curb exports of semiconductors. The company disclosed that the US will be requiring for the time being indefinitely export licenses for the H20 chips which were specifically designed for the Chinese market as per tech experts. The company is now facing an estimated hit of $5.5 billion. Please note that the company got orders of $18 billion for the specific chip with exports to China being expected to reach $17 billion. On the one hand a $5.5 billion charge is a substantial amount of money, even for a chip giant like NVIDIA, on the other hand though the company may be able to bear it. But the issue drills deeper as Chinese customers may start looking for alternatives and the export license may prove to be only a first step for Trump’s government. In any case the issue may weigh on NVIDIA’s share price today, yet losses for its share price may be moderated, should the no further adverse developments emerge in the coming days.

Fed’s stance and US financial releases

As these lines are written the retail sales growth rate for March was released and accelerated beyond market expectations in a positive macroeconomic signal for the demand side of the US economy, which could prove supportive for US stockmarkets. We also note for the supply side later today the release of the industrial output growth rate for March while on Friday we get the Philly Fed Business index for April. Other than that, the calendar is rather light until our nesxt equities report. Thus we may see fundamentals leading the markets. Besides US President Trump’s trade wars, we also note the Fed’s stance as a fundamental issue for US stockmarkets. Later today we note the planned speech of Fed Chairman Powell on the US economic outlook. Should the Fed Chairman highlight the risk of a recession in the US economy, it could intensify a risk off market sentiment among market participants, thus weighing on US stockmarkets. Similarly should Fed policymakers continue to signal doubts regarding extensive further rate cuts, they could also weigh on US stock markets as they may contradict the market’s extensive dovish expectations, forcing it to reposition itself.

Technical analysis

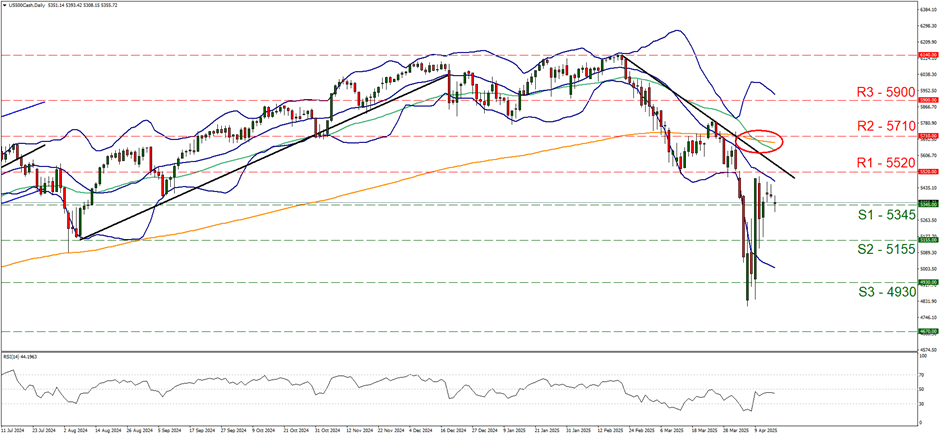

US500 daily chart

-

Support: 5345 (S1), 5155 (S2), 4930 (S3).

-

Resistance: 5520 (R1), 5710 (R2), 5900 (R3).

Since our last report S&P 500 rallied nearing the 5520 (R1) resistance hurdle before correcting lower and after some intense trading, seems to be stabilising, nearing and actually testing today the 5345 (S1) support line today. We note the death cross forming as the 50 MA (green line) has dropped below the 200 MA (orange line) which could signal normally the possibility of an intense drop yet the price action seems to fail to follow for the time being. Let’s not forget that the MAs are followers and not leaders. The RSI indicator has risen, nearing the reading of 50 and implying a substantial easing of the bearish sentiment for the pair. For the time being we expect the index to stabilise somewhat maintaining a wait-and-see position thus a sideways motion bias is adopted at the current stage. For a bullish outlook we would require the index to break the 5520 (R1) resistance line and continue to break the 5710 (R2) resistance level. For a renewal of the bearish outlook we would require S&P 500 to break the 5345 (S1) support line clearly and continue to also break the 5155 (S2) support level.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.