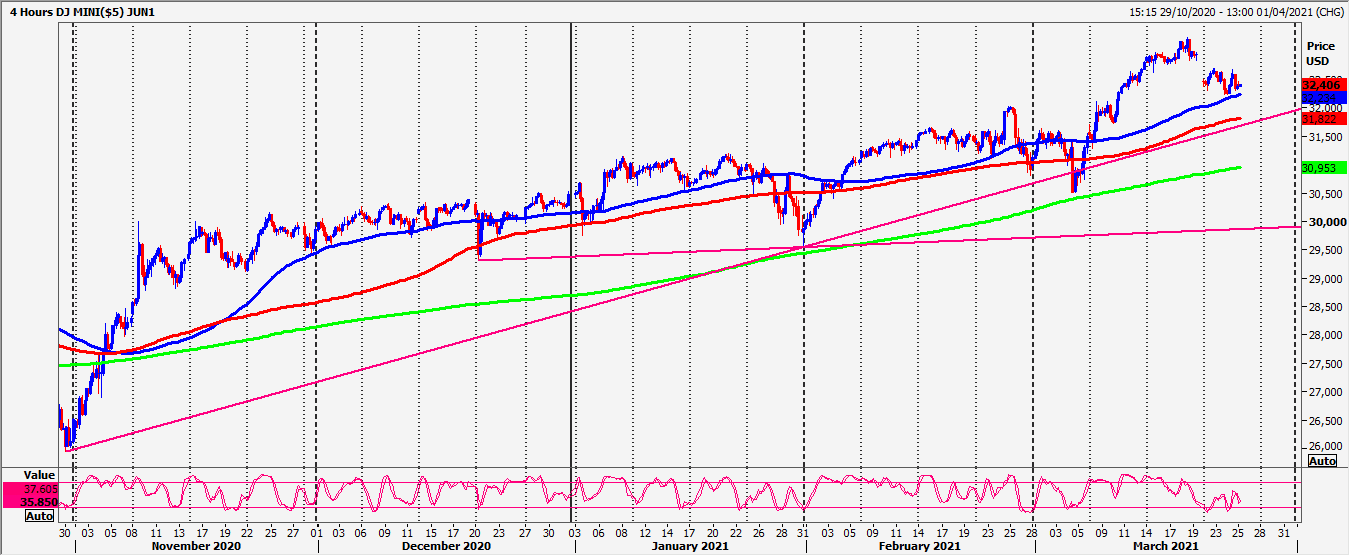

Emini Dow Jones JUNE trades almost exactly the same range as Tuesday

Emini Dow Jones – Nasdaq

Emini Dow Jones JUNE trades almost exactly the same range as Tuesday.

Nasdaq JUNE 2 week trend line support at 12760/730. Longs need stops below12700.

Daily analysis

Emini Dow Jones June has minor support at 32300/250 but below risks a slide to32100/050. Longs need stops below 32000. A break lower targets 31900/850.

First resistance at 23650/700 held perfectly again yesterday. A break above 32750opens the door to 32850/870, perhaps as far as 30000/33050 before a retest of theJune contract high at 33116.

Nasdaq tests the lower end of the range at 12760/730. A break below 12700 targets12600 / 12550. If we continue lower look for 12430 / 12400 before a retest of theMarch low at 12225 / 12200.

Longs at 12760/730 target 12910/950. A break above 13000 tests 6 week trend lineresistance at 13100/130. A break higher tests last week’s high at 13285/300.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk