Elliott Wave view on Gold impulsive structure to resume [Video]

![Elliott Wave view on Gold impulsive structure to resume [Video]](https://editorial.fxsstatic.com/images/i/Commodities_Gold-2_XtraLarge.jpg)

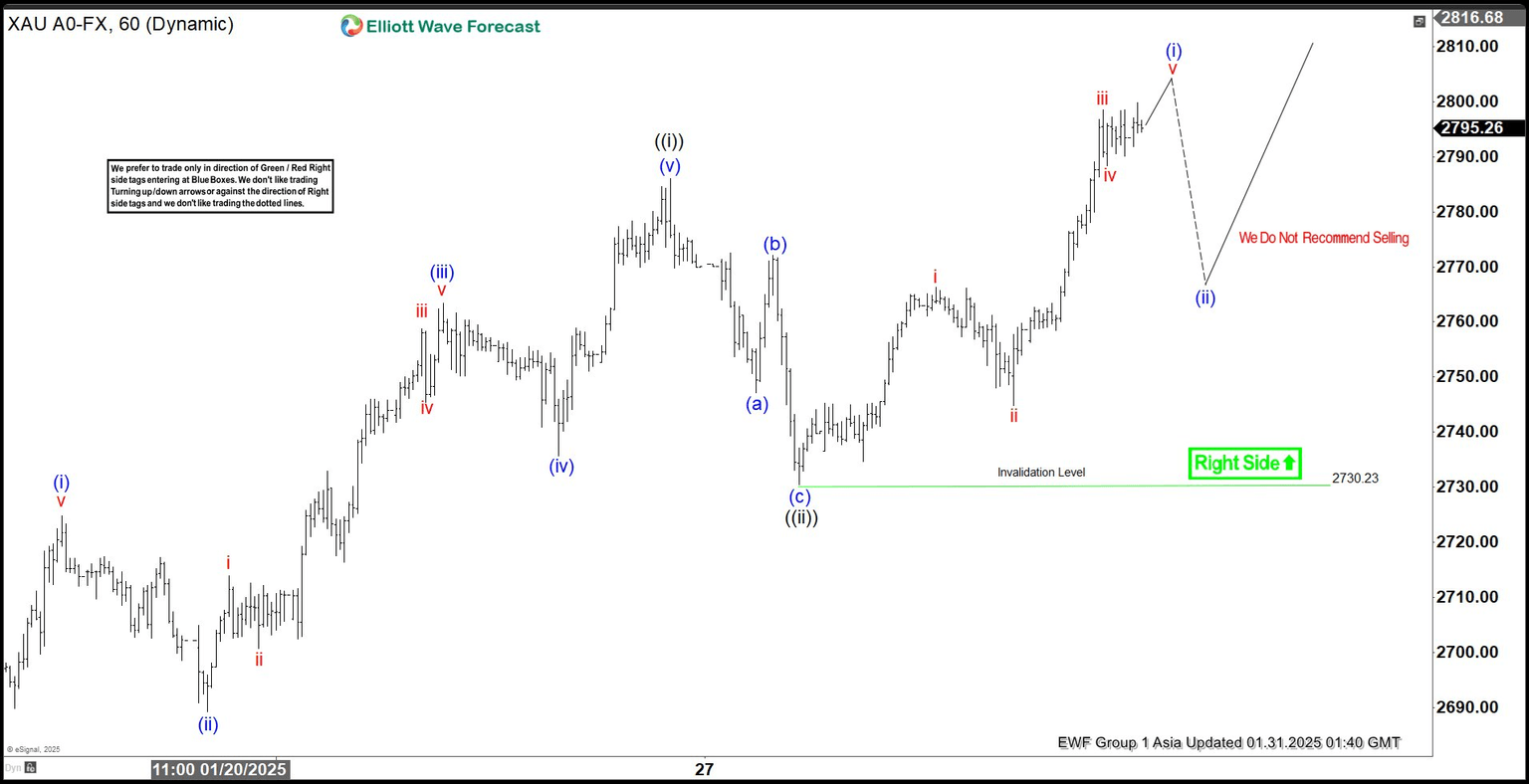

Short Term Elliott Wave View in Gold (XAUUSD) suggests that rally from 1.14.2025 low is in progress as an impulse. Up from 1.14.2025 low, wave (i) ended at 2724.74 and wave (ii) ended at 2689.28. Wave (iii) higher ended at 2763.39 and wave (iv) ended at 2735.67. Final leg wave (v) ended at 2785.87 which completed wave ((i)) in higher degree. Pullback in wave ((ii)) unfolded as a zigzag Elliott Wave structure. Down from wave ((i)), wave (a) ended at 2747.07 and wave (b) ended at 2772.04. Wave (c) lower ended at 2730.23 which completed wave ((ii)).

The metal resumes higher in wave ((iii)). Up from wave ((ii)), wave i ended at 2766.3 and wave ii ended at 2744.78. Wave iii higher ended at 2798.55 and wave iv pullback ended at 2788.43. Expect wave v higher to end soon which completes wave (i) in higher degree. Then the metal should pullback in wave (ii) in 3, 7, or 11 swing to correct cycle from 1.28.2025 low before it resumes higher again. Near term, as far as pivot at 2730.23 low stays intact, expect dips to find support in 3, 7, 11 swing for more upside.

Gold one-hour Elliott Wave chart from 1.31.2025

Gold (XAU/USD) [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com