Elliott Wave view: Oil impulsive rally in progress [Video]

![Elliott Wave view: Oil impulsive rally in progress [Video]](https://editorial.fxsstatic.com/images/i/Commodities_Oil-1_XtraLarge.jpg)

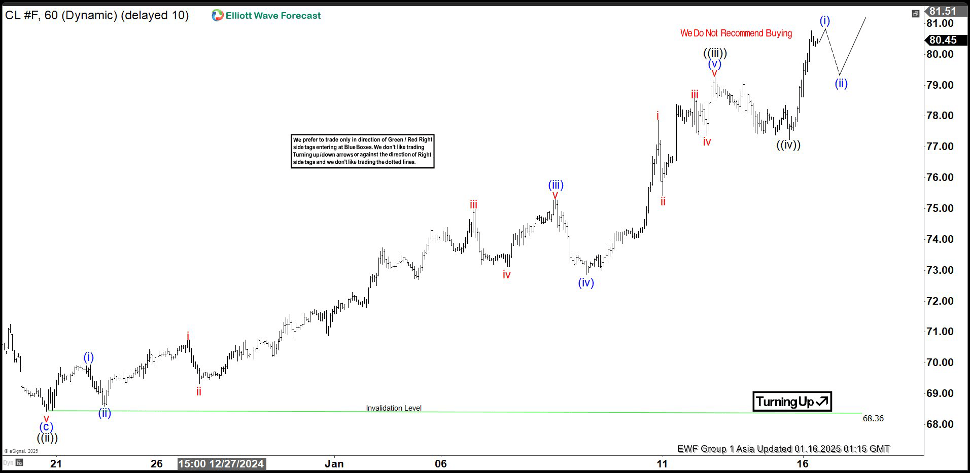

Short term Elliott Wave view in Light Crude Oil (CL_F) suggests cycle from 12.6.2024 low is in progress as an impulse. Up from 12.6.2024 low, wave ((i)) ended at 71.44. Pullback in wave ((ii)) ended at 68.42 as the 1 hour chart below shows. The instrument extends higher in wave ((iii)) with subdivision of an impulse in lesser degree. Up from wave ((ii)), wave (i) ended at 69.94 and wave (ii) ended at 68.59.

Wave (iii) higher ended at 75.29 and pullback in wave (iv) ended at 72.84. Final leg wave (v) ended at 79.27 and this completed wave ((iii)) in higher degree. From there, the instrument pullback in wave ((iv)) which ended at 77.24. Wave ((v)) higher is in progress and wave (i) of ((v)) should end soon. It should then pullback in wave (ii) to correct the rally from 77.24 low before extending higher again. Near term, as far as pivot at 68.36 low stays intact, expect pullback to find support in 3, 7, 11 swing for further upside. Once wave ((v)) is complete, the instrument should correct cycle from 12.6.2024 low in 3, 7, or 11 swing before it turns higher again.

Oil (CL_F) 60 minutes Elliott Wave chart

CL_F Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com