Oil (CL) has ended wave ((4)) pullback on June 7 at 65.24. Since then, it has rallied and surpassed 50% of the drop that began on June 6. We saw the highest point at the price of 76.98 and it had a strong bearish reaction in clear 3 waves (A), (B) and (C) forming a zigzag Elliott Wave structure. Wave (A) was an impulse that fell to 70.76. The rally from there was corrective in 7 swings reaching 76.4% Fibonacci retracement to terminate wave (B) at 75.52. Afterwards, Oil continues dropping forming another impulse that concluded wave (C) of ((4)) at 65.24. Down from wave (B), wave 1 ended at 71.68 and rally in wave 2 ended at 72.93. Oil then resumes lower in wave 3 towards 65.63, rally in wave 4 ended at 67.40, and final leg wave 5 ended at 65.24.

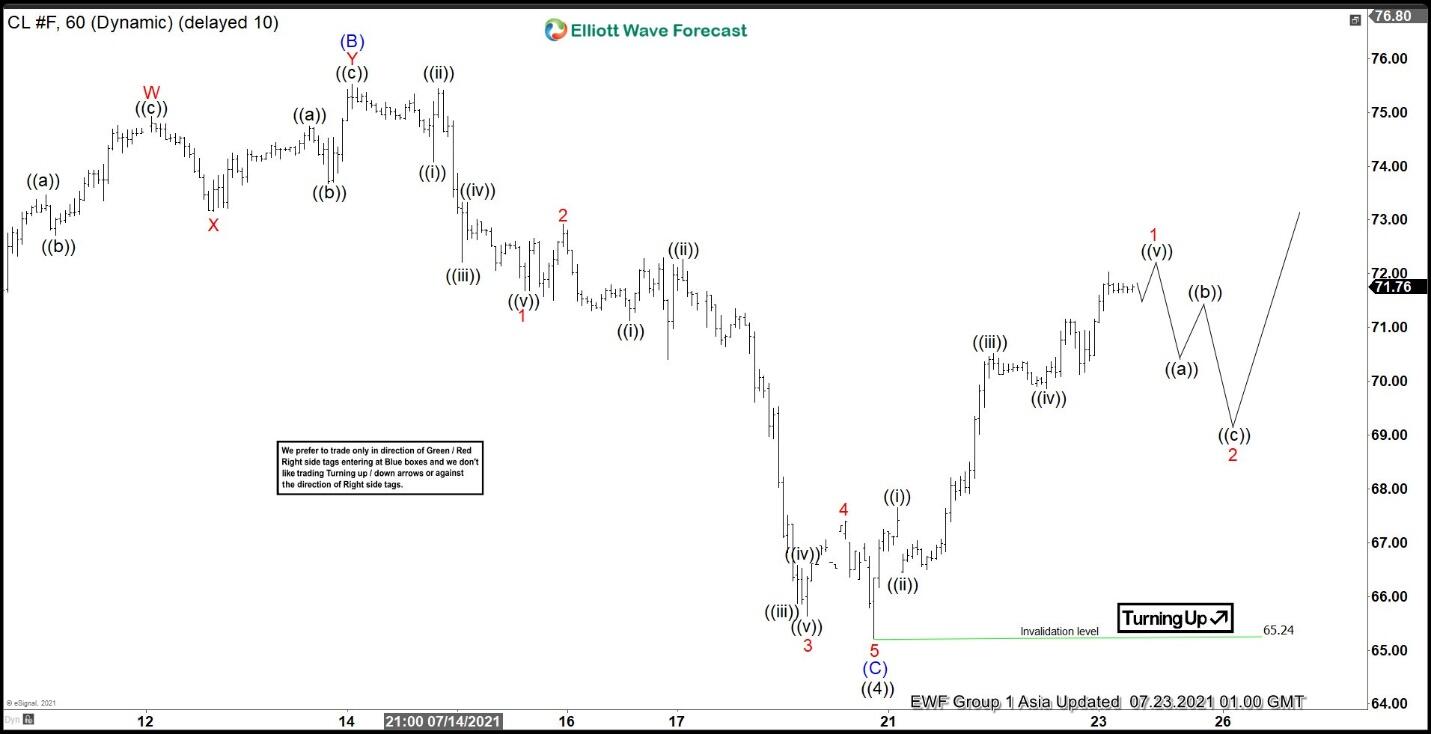

Oil has started to rally in wave ((5)). The bounce from wave ((4)) low at 65.24 looks impulsive. Wave ((i)) ended at 67.65 and the correction as wave ((ii)) ended 66.45. The rally continues and wave ((iii)) completed at 70.51. Wave ((iv)) pullback dropped toward 69.87 and from there, oil extends higher again. Near term, we expect a marginal high to complete wave ((v)). This should complete wave 1 in larger degree and see a pullback in 3 swings at least before the rally resumes. As far as July 20 pivot low at 65.24 remains intact, expect dips to find support in 3, 7, or 11 swing for more upside.

Oil 60 Minutes Elliott Wave Chart

CL #F Elliott Wave Video

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

AUD/USD: Not out of the woods yet

The continuation of the selling pressure around the US Dollar lent extra wings to AUD/USD and propelled it back above the 0.6500 barrier ahead of the publication of the RBA Minutes of its November 5 event.

EUR/USD: The extension and duration of the rebound remain to be seen

EUR/USD regained further balance and trespassed the key 1.0600 hurdle to clock three-day highs following extra weakness in the Greenback and some loss of momentum around the Trump rally.

Gold gives signs of life and reclaims $2,600/oz

After suffering large losses in the previous week, Gold gathers recovery momentum and trades in positive territory above $2,600 on Monday. In the absence of high-tier data releases, escalating geopolitical tensions help XAU/USD hold its ground.

Ethereum Price Forecast: ETH risks decline to $2,258 as exchange reserves continue uptrend

Ethereum (ETH) is up 1% on Monday after ETH ETFs hit a record $515.5 million inflows last week. However, rising exchange reserves and realized losses could trigger bearish pressure for the top altcoin.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.