Elliott Wave View: Gold has turned bullish [Video]

![Elliott Wave View: Gold has turned bullish [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/safe-investment-gm147322399-17568598_XtraLarge.jpg)

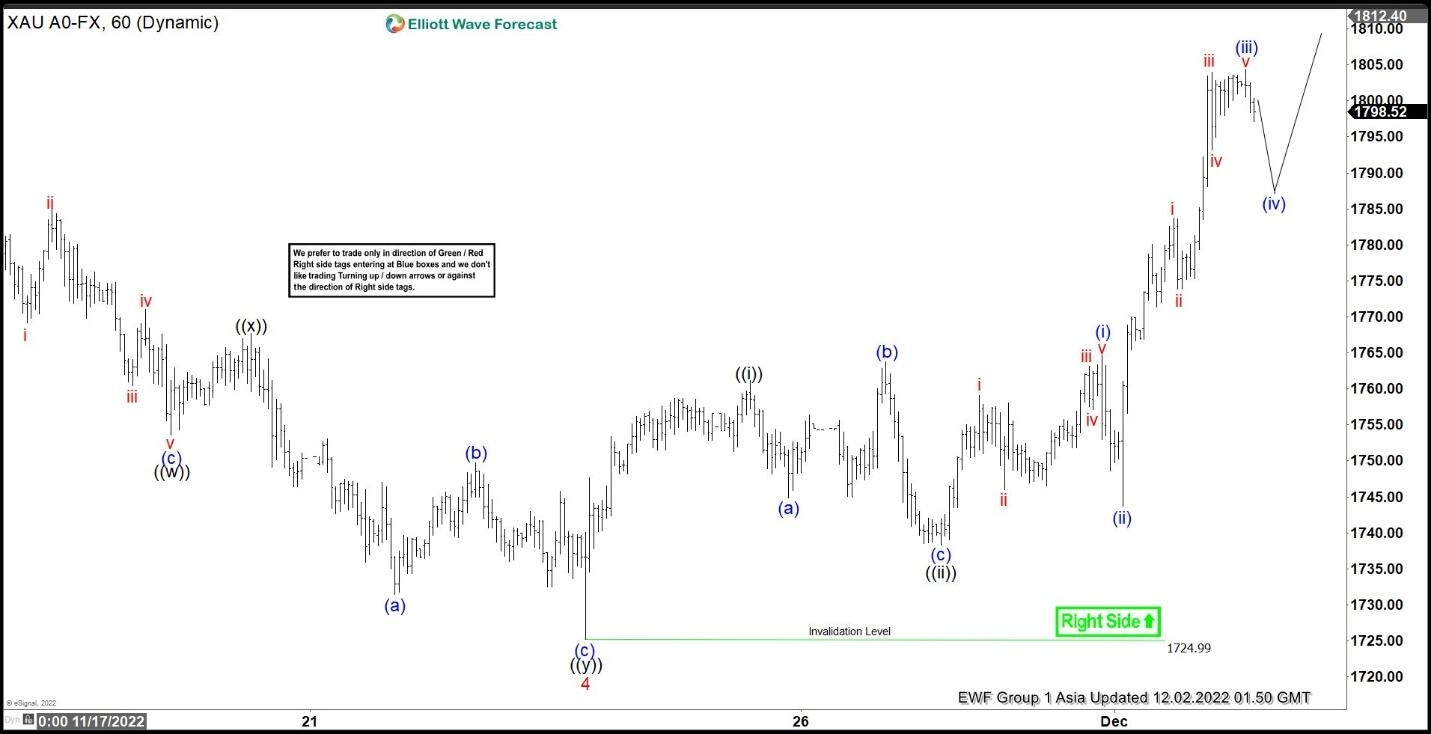

Short term Elliott Wave View in Gold (XAUUSD) suggests the rally from 9.28.2022 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from 9.28.2022 low, wave 1 ended at 1729.46 and pullback in wave 2 ended at 1616.71. The metal then resumed higher in wave 3. Up from wave 2, wave ((i)) ended at 1682.37 and dips in wave ((ii)) ended at 1663.80. The metal resumes higher in wave ((iii)) towards 1772.78 and pullback in wave ((iv)) ended at 1752.30. Final leg higher wave ((v)) ended at 1786.53 which completed wave 3. From there, the metal pullback in wave 4 which ended at 1725.23.

Wave 5 higher is in progress with internal subdivision as an impulse in lesser degree. Up from wave 4 low, wave ((i)) ended at 1761.18 and pullback in wave ((ii)) ended at 1738.30. The metal forms a nest in wave ((iii)). Up from wave ((ii)), wave (i) ended at 1764.66 and pullback in wave (ii) ended at 1743.70. The precious metal then resumes higher in wave (iii) towards 1804.45. Expect wave (iv) to find support for more upside in wave (v) to end wave ((iii)). Near term, as far as pivot at 1725 low stays intact, expect pullback to find support in 3, 7, 11 swing for more upside.

Gold 60 minutes Elliott Wave chart

XAU/USD Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com