Elliott Wave View: Dow Futures (YM) Short Term Support Area [Video]

![Elliott Wave View: Dow Futures (YM) Short Term Support Area [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/dow-jones-industrial-average-17339541_XtraLarge.jpg)

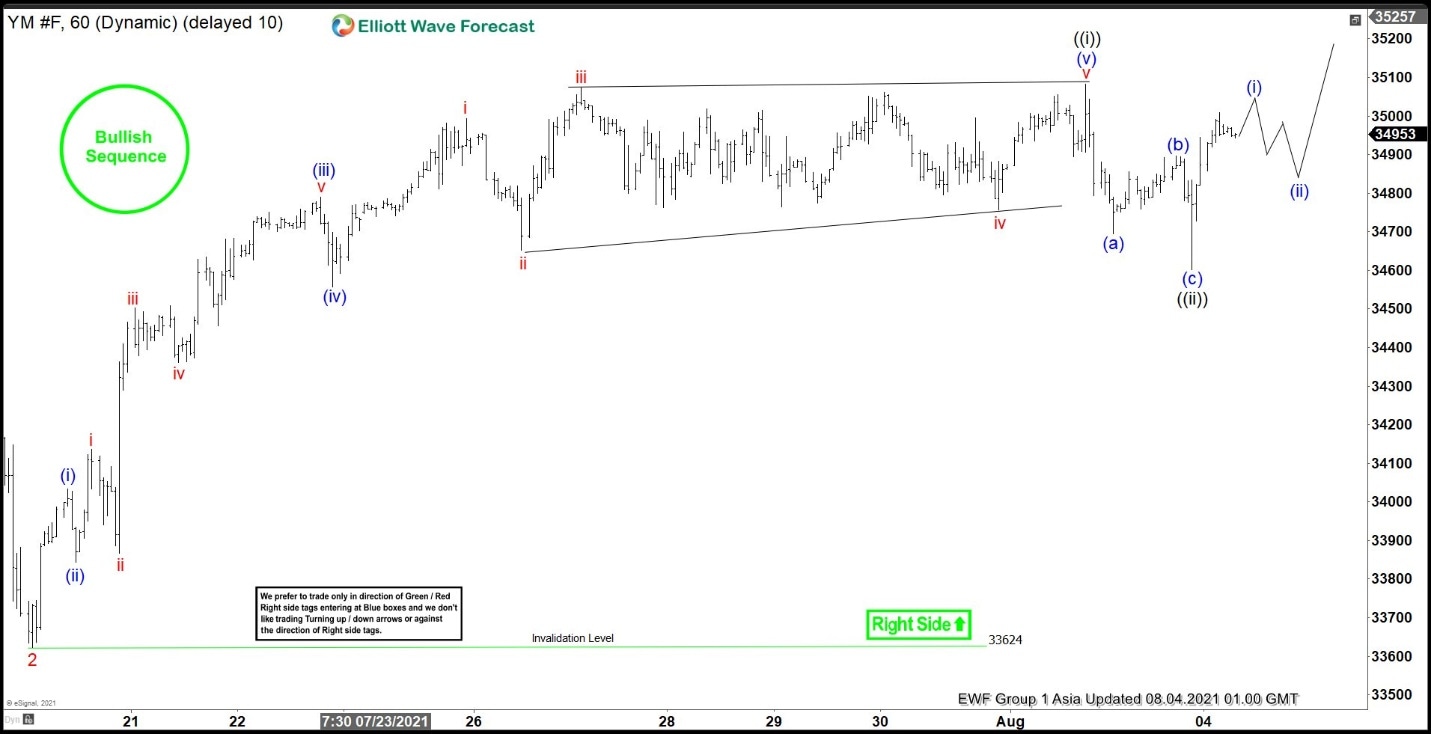

Short Term Elliott Wave view in Dow Futures (YM) suggests the rally from June 21 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from June 21 low, wave 1 ended at 34975 and pullback in wave 2 ended at 33624. Index has resumed higher in wave 3 with internal subdivision as another 5 waves impulse in lesser degree. Up from wave 2, wave (i) ended at 34034 and pullback in wave (ii) ended at 33843. Index resumes higher again in wave (iii) towards 34789 and dips in wave (iv) ended at 34557. Final leg higher wave (v) of ((i)) ended at 35082.

Wave ((ii)) pullback is unfolding as a double three Elliott Wave structure. Down from wave ((i)), wave (w) ended at 34602 and rally in wave (x) ended at 35009. Expect wave (y) to end at 100% – 161.8% Fibonacci extension of wave (w) towards 34217 – 34521 blue box area. Index should then find buyers at the blue box area for further upside or 3 waves rally at least. Near term, as far as wave 2 pivot on July 20 low at 33624 stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.

Dow Futures (YM) 60 Minutes Elliott Wave Chart

YM Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com