Elliott Wave live: Risk-on is back [Video]

![Elliott Wave live: Risk-on is back [Video]](https://editorial.fxstreet.com/images/Resources/quot-reward-quot-highlighted-in-red-under-heading-quot-risk-quot-on-printed-document-16232281_XtraLarge.jpg)

Heey traders!

I’m finally back after two weeks of vacation. I had a wonderful time with my family and friends, and now I’m just getting back into the market. It will take me a few days to catch up on everything I missed, but here’s what is clear so far: stocks are back in risk-on mode!

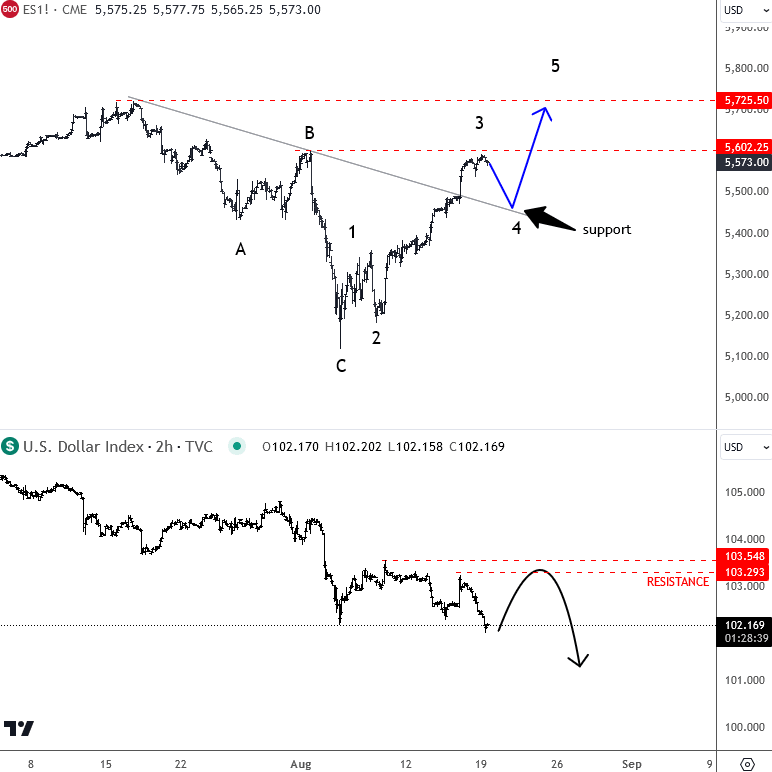

After some initial recession fears spurred by the NFP report showing higher unemployment (4.3%) at the start of the month, stocks have bounced back up as last week’s retail sales data indicates the economy isn’t as bad as feared. CPI figures have also helped stabilize the markets, and with the FED potentially closer to cutting rates in September, the stock market may continue higher.

I will keep an eye on wave 4 on SPX, and that’s also when dollar can be sold across the board, hopefully from higher/better levels. Metals are also looking good, pointing higher. Cryptos made some rebound as well, and possibly there is more to come if stock remains stable.

Grega

For a detailed view and more analysis, you may want to watch below our latest recording of a live webinar streamed today on August 19 2024:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.