Elliott Wave intraday analysis: USD/JPY correcting larger degree [Video]

![Elliott Wave intraday analysis: USD/JPY correcting larger degree [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen1_XtraLarge.jpg)

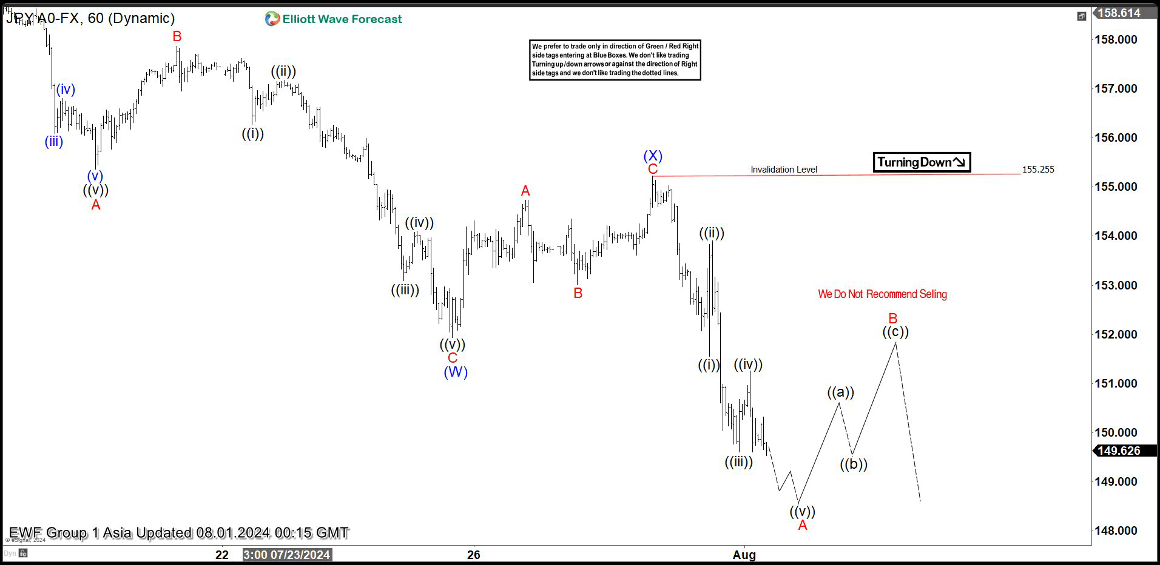

Short term Elliott Wave in USD/JPY suggests that cycle from 7.3.2024 high is in progress as a double three Elliott Wave structure. Down from 7.3.2024 high, wave A ended at 155.37 and rally in wave B ended at 157.86. Wave C lower ended at 151.94 which completed wave (W) in higher degree. Pair then rallied in wave (X) which ended at 155.25 as a zigzag structure. Up from wave (W), wave A ended at 154.73 and wave B ended at 153. Wave C higher ended at 155.25 which also completed wave (X) in higher degree. Pair has turned lower in wave (Y) which subdivides into a zigzag structure.

Down from wave (X), wave ((i)) ended at 151.54 and wave ((ii)) ended at 153.9. Wave ((iii)) lower ended at 149.6 and rally in wave ((iv)) ended at 151.26. Expect pair to extend lower in wave ((v)) which should complete wave A of (Y). Afterwards, it should rally in wave B to correct cycle from 7.30.2024 high before turning lower again. Near term, as far as pivot at 155.25 stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.

USD/JPY 60 minutes Elliott Wave chart

USD/JPY Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com