Elliott Wave intraday analysis on Silver (XAG/USD) looking to find buyers [Video]

![Elliott Wave intraday analysis on Silver (XAG/USD) looking to find buyers [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Silver/silver-miner-with-nugget-18319797_XtraLarge.jpg)

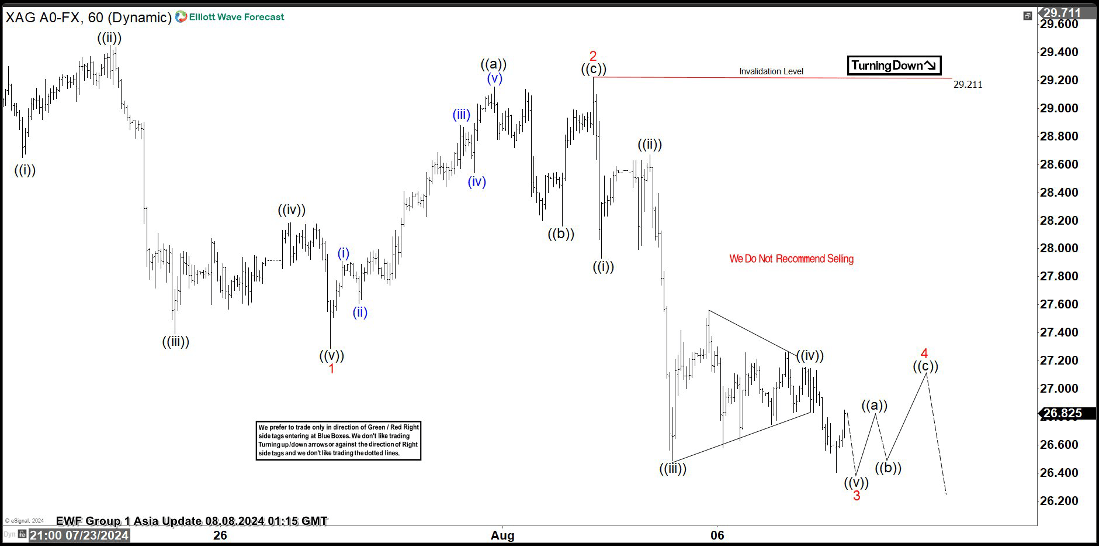

Short term Elliott Wave view in Silver (XAG/USD) suggests that pullback to 28.58 low ended a wave (A). The metal turned higher again in wave (B) ended at 31.75 high. The market resuming lower from wave (B) high breaking below 28.58 low to rule a larger correction. It means, Silver is developing a wave (C) of ((4)) as a zig zag Elliott Wave structure. Down from wave (B), wave ((i)) ended at 28.65 and wave ((ii)) ended at 29.45. Wave ((iii)) lower ended at 27.40, and pullback in wave ((iv)) ended at 28.19. Wave ((v)) ended at 27.29 which completed wave 1. Pullback in wave 2 ended at 29.22 high and the metal resumed lower in wave 3.

Down from wave 2, wave ((i)) ended at 27.93 and wave ((ii)) ended at 28.67. Wave ((iii)) lower ended at 26.49, and pullback in wave ((iv)) built a triangle structure ended at 27.16. Currently, silver is trading in wave ((v)) of 3. We are calling for one more low to end the cycle. The ideal place to end this wave comes in 26.32 – 26.06 area, where buyers should appear to start wave 4 pullback. Near term, as far as pivot at 29.22 high stays intact, expect pullback as wave 4 to fail in 3, 7 or 11 swing for further downside in wave 5 of (C).

Silver (XAG/USD) 60 minutes Elliott Wave chart

XAG/USD Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com