Elliott Wave analysis: USD/JPY making an intraday impulsive decline [Video]

![Elliott Wave analysis: USD/JPY making an intraday impulsive decline [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen-62890274_XtraLarge.jpg)

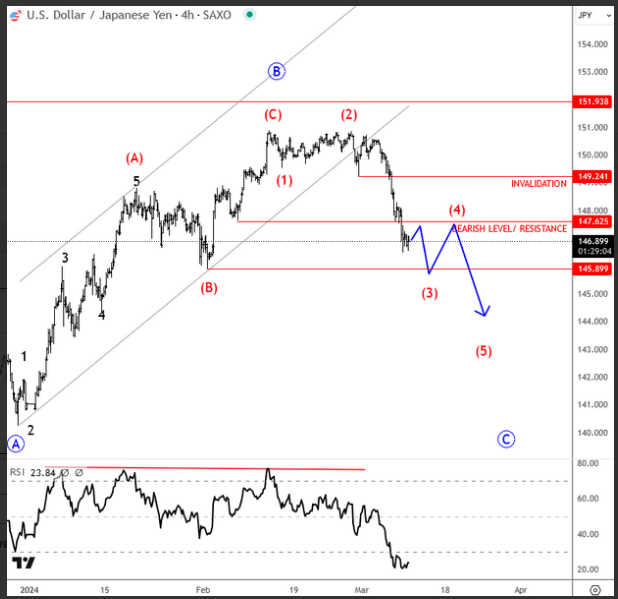

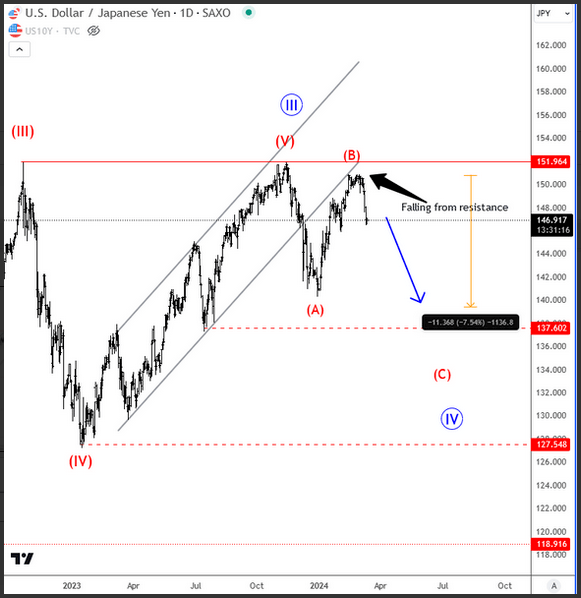

USDJPY came sharply to the downside at the end of 2023 on hawkish BoJ; they are now even saying that normalization can happen in 2024. Also Ueda said that policy change could involve an element of surprise which means that jpy pairs can be very volatile going into 2024. From an Elliott wave perspective, we expect a reversal as well, as pair stoped at a powerful 150-153 resistance area. In fact, we can see nice turn down in the last few trading days on 4h time frame, with price breaking below the channel support line so it appears that weakness is here as recovery from start of the year unfolded in three legs. Ideally, that was wave B corrective rise so there is plenty for room for more weakness into C wave. As such, be aware of more downside, especially after subwave four rally.

Another very important factor for bearish USDJPY are lower US yeilds, which are falling for the last two weeks, but dont forget on US CPI data today. This one can cause a new volatile moves.

I talked about this and more in my latest video.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.