In our previous analysis GBPUSD: Is Cable`s Consolidation Complete Yet ?! Cable unfolded exactly as expected and targets were reached and exceeded locking in 156 pips in profit. On the other hand, the alternate count expects that wave (c) green is incomplete and that it is unfolding downwards.

We are updating the main count according to the latest price action which now expects Cable to unfold upwards to complete the final leg within wave 2 of minor degree.

On the other hand, the alternate count expects that wave 2 of minor degree is complete and that Cable has started to unfold downwards within wave 3 of minor degree as an impulse.

As always we will wait for either counts confirmation point to be reached to determine the highly probable count.

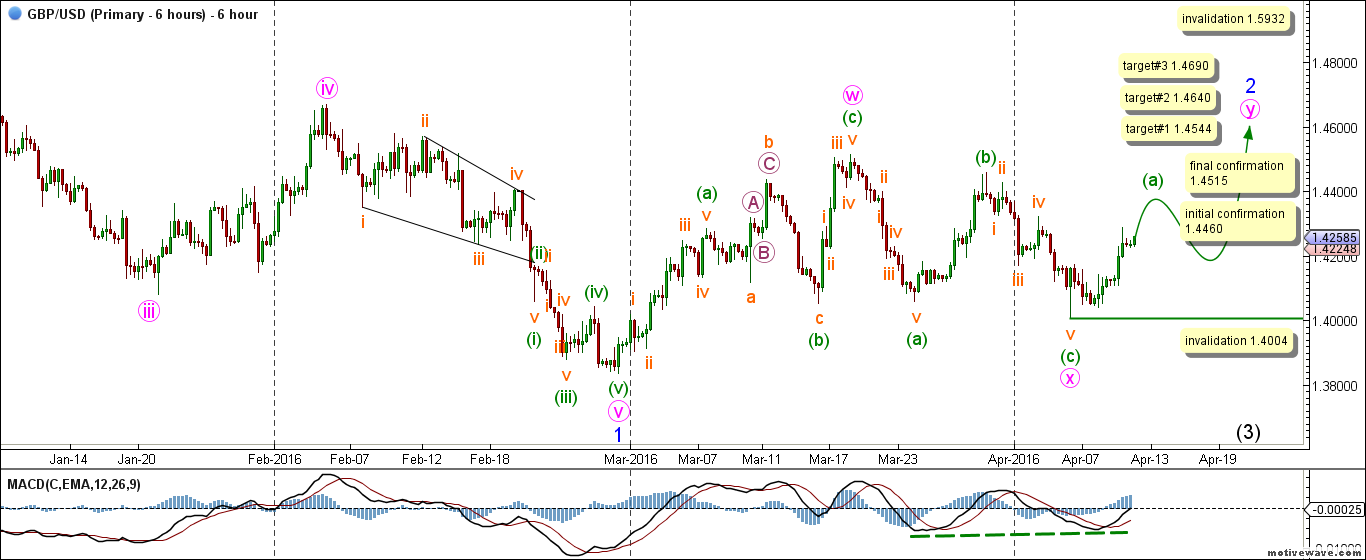

Main Count

– Invalidation Point: 1.5932 — 1.4004

– Confirmation Point: 1.4460 — 1.4515

– Upwards Targets: 1.4544 — 1.4640 — 1.4690

– Wave number: y pink

– Wave structure: Corrective

– Wave pattern: ُDouble Zigzag

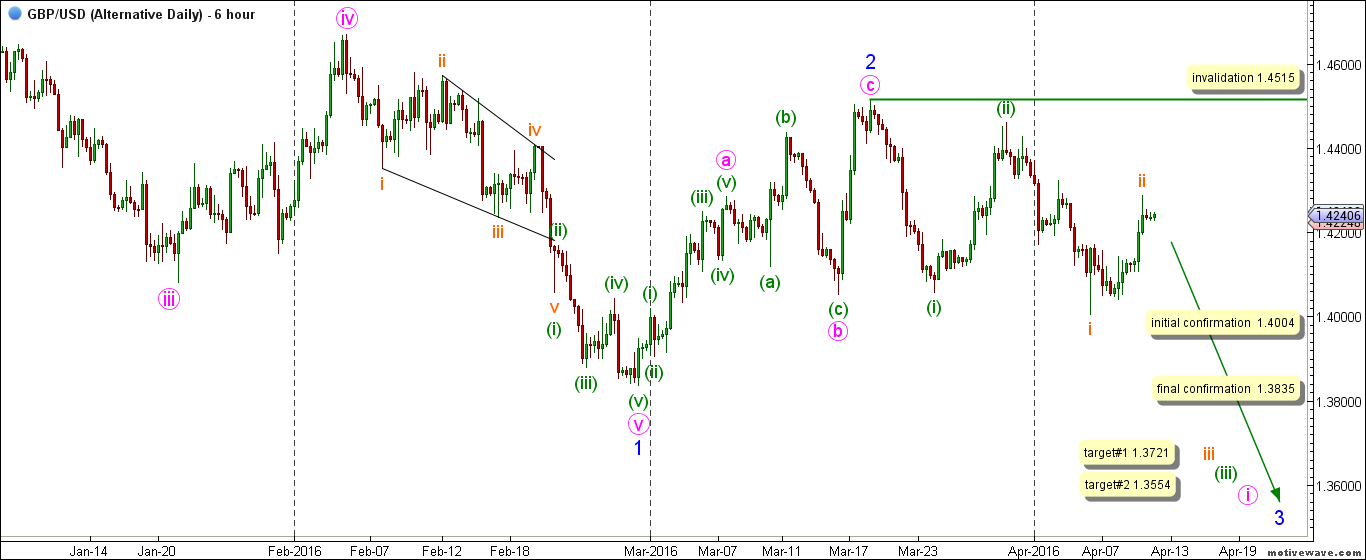

Alternate Count

– Invalidation Point: 1.4515

– Confirmation Point: 1.4004 — 1.3835

– Downwards Targets: 1.3721 — 1.3554

– Wave number: (c) (iii) green

– Wave structure: Motive

– Wave pattern: ُImpulse

Elliott Wave chart analysis for the GBPUSD for 11th April, 2016. Please click on the charts below to enlarge.

Main Wave Count

This count expects that wave 1 blue is complete as an impulse labeled waves i through v pink with wave v pink unfolding as an impulse labeled waves (i) through (v) green.

Within minor wave 2 blue, waves w and x pink are complete and that wave y pink has started unfolding upwards.

Wave w pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave (a) green unfolded as an impulse labeled waves i through v orange.

Wave (b) green unfolded as an expanded flat correction labeled waves a, b and c orange with wave b orange unfolding as a zigzag labeled waves A, B and C purple.

After the completion of wave (b) green, wave (c) green unfolded as an impulse labeled waves i through v orange.

Wave x pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave (a) green unfolded as an impulse labeled waves i through v orange.

Wave (c) green unfolded as an impulse labeled waves i through v orange.

Within wave y pink it is likely that wave (a) green is unfolding upwards as an impulse.

This count would be initially confirmed by movement above 1.4460 and the final confirmation point is at 1.4515.

At 1.4544 wave y pink would reach 0.618 of wave w pink and at 1.4640 wave 2 blue would reach 0.382 of wave 1 blue and finally at 1.4690 wave y pink would reach equality with wave w pink.

This count would be invalidated by movement below 1.4004 as within wave y pink no B wave may retrace more than 100 % of its A wave. As well this count would be invalidated by movement above 1.5932 as wave 2 blue may not retrace more than 100 % of wave 1 blue.

Alternate Wave Count

The difference between both main and alternate counts is within the subdivisions of wave 2 blue.

This count expects that wave 2 blue is complete and that wave 3 blue has started unfolding downwards.

Wave 2 blue unfolded as a zigzag labeled waves a, b and c pink.

Wave a pink unfolded as an impulse labeled waves (i) through (v)_green.

Wave b pink unfolded as an expanded flat correction labeled waves (a), (b) and (c) green.

Within wave 3 blue, it is likely that wave i pink is underway with waves (i) and (ii) green complete and wave (iii) green is unfolding downwards.

Within wave (iii) green waves i and ii orange are complete and wave iii orange has started unfolding downwards.

This count would be initially confirmed by movement below 1.4004 and the final confirmation point is at 1.3835.

At 1.3721 wave (iii) green would reach 1.618 of wave (i) green and at 1.3554 wave iii orange would reach 1.618 of wave i orange.

This count would be invalidated by movement above 1.4515 as wave (ii) green may not retrace more than 100 % of wave (i) green and it should be noted that the invalidation point would be moved to the end of wave (ii) green once we have confirmation on the daily chart that wave (iii) green is underway.

We may also wish to keep an eye on the daily update GBP USD Forecast.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD weighed down by China, tariffs

AUD/USD remained on the back foot, slipping back to the area of multi-year lows around 0.5950 on the back of mounting fears surrounding tariffs and their impact on the Chinese economy.

EUR/USD refocuses on 1.1000 amid tariffs jitters

EUR/USD reversed two daily pullbacks in a row an d managed to advance to the boundaries of the 1.1000 barrier on the back of fresh weakness hurting the US Dollar and persistent tariff fears.

Gold erases gains, back to the $2,980 zone

Gold prices now lose extra ground and slip back to the area of daily troughs near $2,980 mark per troy ounce following an unsuccesful attempt to maintain the trade above the critical $3,000 level earlier in the day.

RBNZ set for another interest rate cut amid trade tariff uncertainty

The Reserve Bank of New Zealand is on track to deliver a 25 basis point cut to the Official Cash Rate, bringing down the key policy rate from 3.75% to 3.50% following its April monetary policy meeting on Wednesday.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.