In our previous analysis GBPUSD: Cable`s Mighty Downtrend the main count expected Cable to unfold upwards to complete a fourth wave correction before resuming its downtrend.

Cable unfolded upwards in a corrective manner and this week`s main count expects Cable to reverse directions and unfold downwards within a fifth wave.

The alternate count expects that Cable`s upwards correction has more to offer upwards to complete a second wave correction of minute degree.

As always we will wait for either counts confirmation point to be reached to determine the highly probable count.

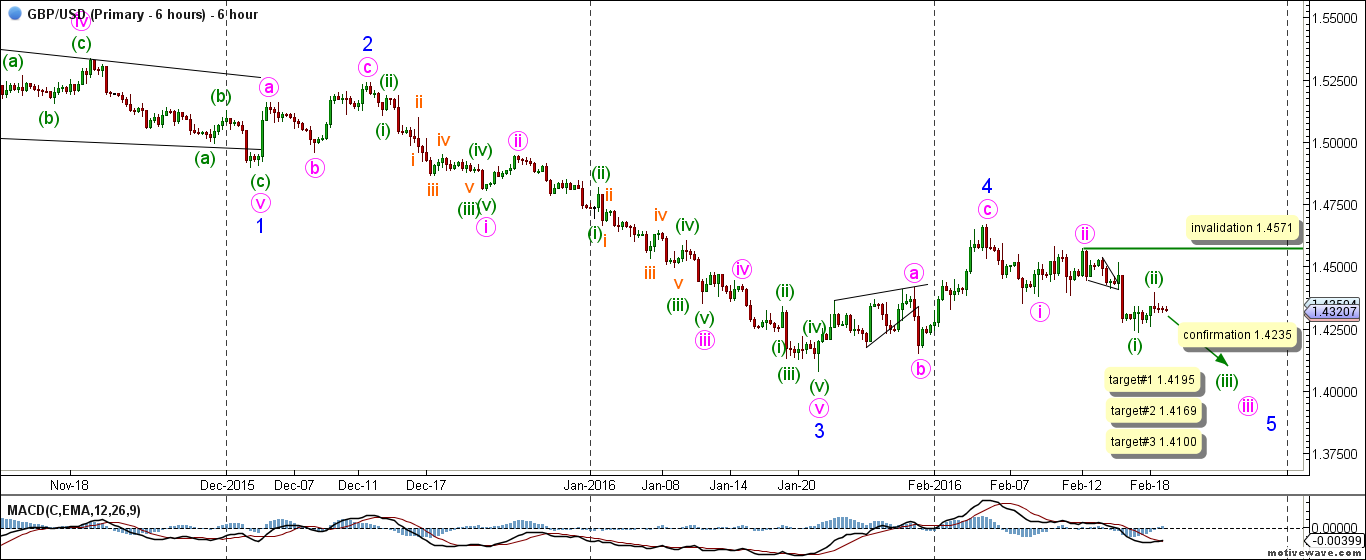

Main Count

- Invalidation Point: 1.4571

- Confirmation Point: 1.4235

- Downwards Target: 1.4195 -- 1.4169 -- 1.4100

- Wave number: (iii) green

- Wave structure: Motive

- Wave pattern: ُImpulse

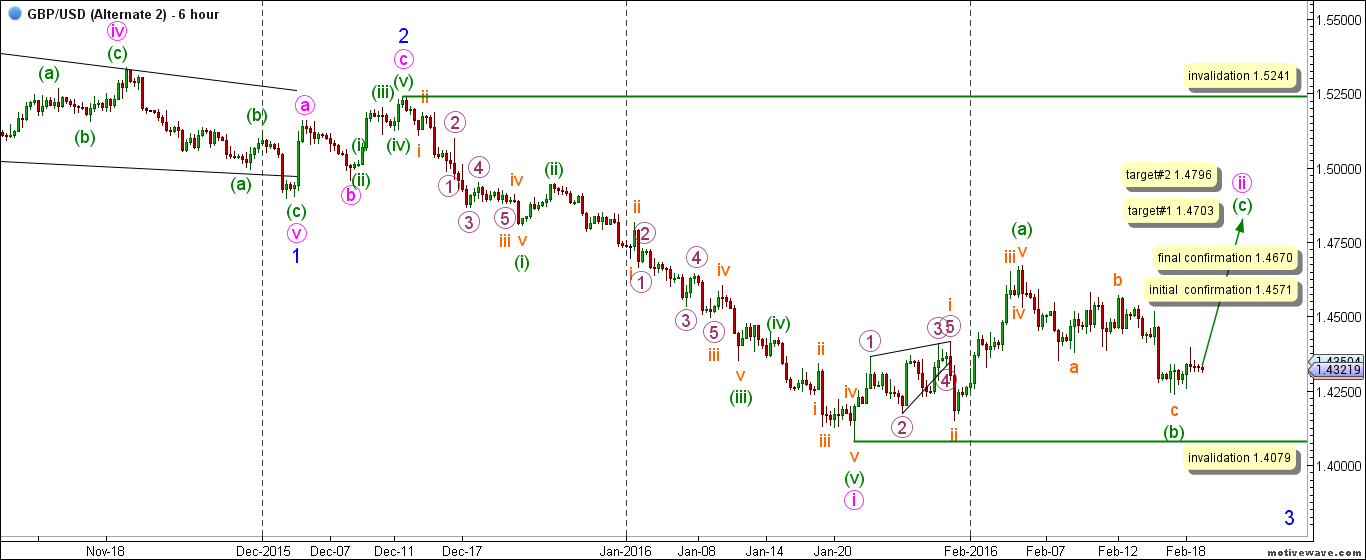

Alternate Count

- Invalidation Point: 1.4079 -- 1.5241

- Confirmation Point: 1.4670

- Upwards Target: 1.4709 -- 1.4796

- Wave number: (c) green

- Wave structure: Motive

- Wave pattern: ُImpulse/Ending diagonal

Main Wave Count

This count expects that primary wave C maroon is unfolding towards the downside.

Within wave C maroon intermediate waves (1) and (2) black are complete and intermediate wave (3) black is unfolding downwards.

Within intermediate wave (3) black it is expected that minor waves 1 through 4 blue are complete and that wave 5 blue is unfolding downwards.

Wave 1 blue unfolded as a leading diagonal labeled waves i through v pink.

Wave iv pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave v pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Minor wave 2 blue unfolded as a zigzag labeled waves a, b and c pink.

Minor wave 3 blue unfolded as an impulse labeled waves i through v pink.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Wave 4 blue is likely complete and wave 4 blue unfolded as a zigzag labeled waves a, b and c pink.

This count would be confirmed by movement below 1.4235.

At 1.4195 wave (iii) green would reach 0.618 of wave (i) green and this target is a conservative target. At 1.4169 wave iii pink would reach 1.382 of wave i pink and the final target which is at 1.4100 as at that level wave iii pink would reach 1.618 of wave i pink.

This count would be invalidated by movement above 1.4571 as wave (ii) green may not retrace more than 100 % of wave (i) green. It is worth mentioning that the invalidation point would be moved to the end of wave (ii) green once we have confirmation on the hourly chart that wave (iii) green has started unfolding downwards.

Alternate Wave Count

This count is a very bearish count as it expects that wave 3 blue is extending downwards as an impulse with wave i pink complete and wave ii pink is unfolding upwards in a corrective manner.

Wave ii pink is unfolding as a zigzag correction labeled waves (a), (b) and (c) green with waves (a) and (b) green complete and wave (c) green is unfolding upwards.

Wave (a) green unfolded as an impulse labeled waves i through v orange with wave i orange unfolding as a leading diagonal labeled waves 1 through 5 purple.

Wave (b) green unfolded as a zigzag labeled waves a, b and c orange.

This count would be initially confirmed by movement above 1.4571 and the final confirmation point is at 1.4670.

At 1.4703 wave (c) green would reach 0.786 of wave (a) green and at 1.4796 wave ii pink would reach 0.618 of wave i pink.

This count would be invalidated by movement below 1.4079 as wave (b) green may not retrace more than 100 % of wave (a) green. As well this count would be invalidated by movement above 1.5241 as wave ii pink may not retrace more than 100 % of wave i pink.

We may also wish to keep an eye on the daily update GBP USD Forecast.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.