This week the pound unfolded as expected towards the downside and the first specified target was reached and exceeded.

We are updating the main count according to the latest price action and as well adding an alternate count which expects upwards corrective movement.

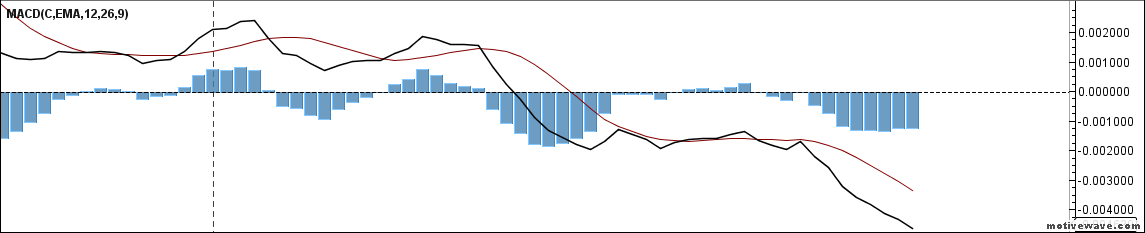

It should be noted that MACD readings on the 8-hours chart does not provide enough data -at the time being- to confirm or refute the main count`s view.

As always we will let price action decide for us which count is the highly probable count.

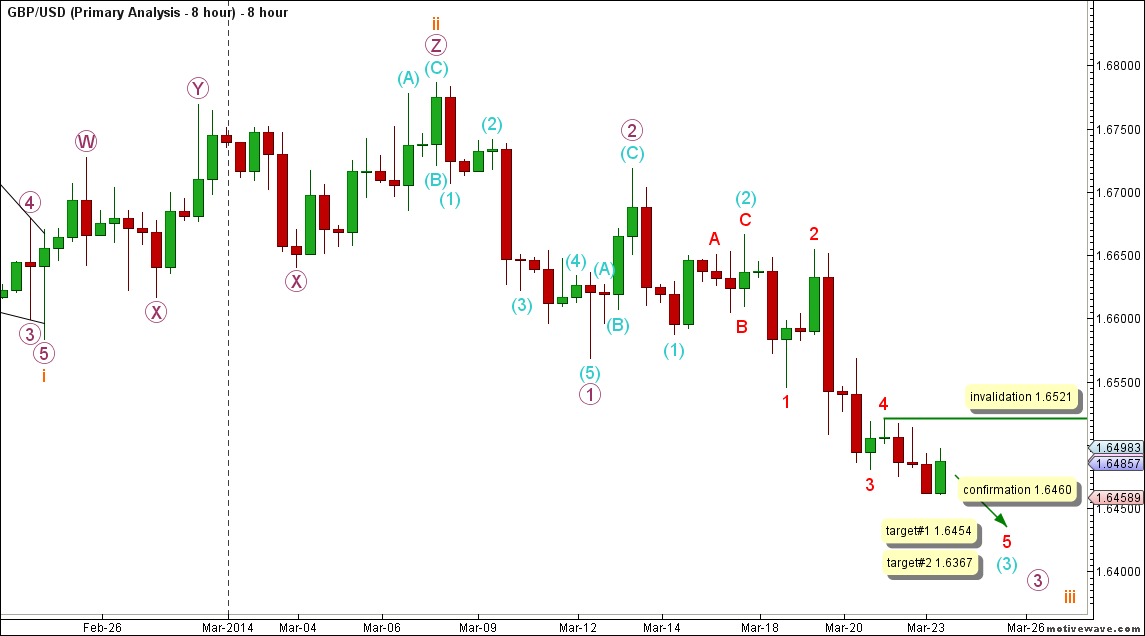

8-Hours Main Count

- Invalidation Point: 1.6521

- Confirmation Point: 1.6460

- Downwards Target: 1.6454 -- 1.6367

- Wave number: 3 purple

- Wave structure: Motive

- Wave pattern: Impulse

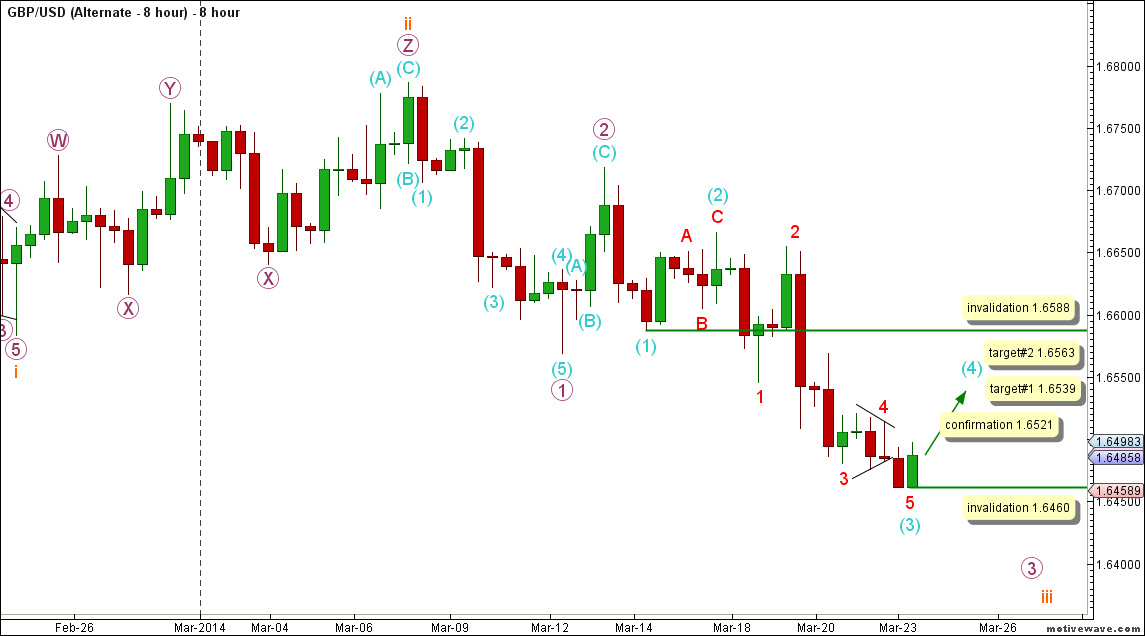

8-Hours Alternate Count

- Invalidation Point: 1.6460 -- 1.6588

- Confirmation Point: 1.6521

- Upwards Targets: 1.6539 -- 1.6563

- Wave number: (4) aqua

- Wave structure: Corrective

- Wave pattern: Zigzag

Main Wave Count

This count expects that wave (C) black is likely complete and that wave (D) black is starting to unfold towards the downside.

Within wave (D) black, waves i and ii orange are highly likely complete and wave iii orange is starting to unfold towards the downside.

Wave i orange unfolded as a leading diagonal labeled waves 1 through 5 purple.

Wave ii orange unfolded as a triple zigzag labeled waves W, X, Y, X and Z purple with wave Z purple unfolding as a zigzag labeled waves (A), (B) and (C) aqua.

Within wave iii orange waves 1 and 2 purple are expected complete with wave 1 purple unfolding as an impulse labeled waves (1) through (5) aqua.

Wave 2 purple unfolded as a zigzag labeled waves (A), (B) and (C).

Within wave 3 purple waves (1) and (2) aqua are expected complete and wave (3) aqua is unfolding towards the downside.

Wave (2) aqua unfolded as a zigzag labeled waves A, B and C red with wave B red unfolding as an expanded flat correction.

Within wave (3) aqua waves 1 through 4 red are expected complete and wave 5 red is underway.

As far as MACD study goes, the lack of a MACD divergence on the 8 hours chart does not confirm or refute the main count`s view.

This count would be confirmed by movement below 1.6460.

At 1.6454 wave (3) aqua will reach 1.618 the length of wave (1) aqua and at 1.6367 wave 3 purple will reach 1.618 the length of wave 1 purple.

This count would be invalidated by movement above 1.6521 as within wave 5 red no second wave may retrace more than 100 % the length of the first wave.

Alternate Wave Count

The difference between both main and alternate counts is within the subdivisions of wave (3) aqua.

This count expects that wave (3) aqua is complete as an impulse labeled waves 1 through 5 red with wave 4 red unfolding as a triangle and therefore this count expects that wave (4) aqua is unfolding towards the upside.

This count would be confirmed by movement above 1.6521.

At 1.6539 wave (4) aqua will reach 0.382 the length of wave (1) aqua and at 1.6563 wave (4) aqua will reach 50 % the length of wave (1) aqua.

This count would be invalidated by movement above 1.6588 as wave (4) aqua may not enter the price territory of wave (1) aqua, as well this count would be invalidated by movement below 1.6460 as within wave A red within wave (4) aqua no second wave may retrace more than 100 % the length of the first wave.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD rebounds on Thursday after midweek pullback

EUR/USD tuned back into the high end on Thursday, getting bolstered by a broad-market selloff in the Greenback. US data that printed better than expected helped to ease concerns of a possible economic slowdown within the US economy looming over the horizon.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.