Morgan Stanley is out with its 2016 FX outlook and top 10 trades. The following are the key points in MS' outlook along with the list of its top 10 trades and their related rationales.

FX outlook: The Framework:

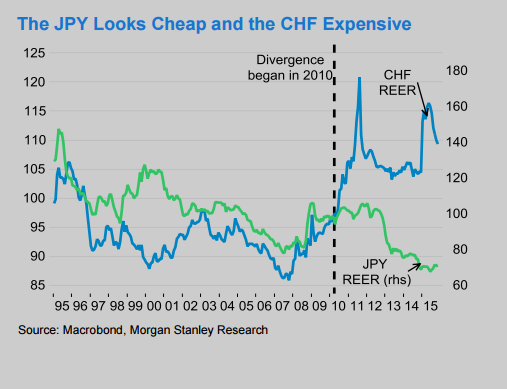

"The JPY should join the USD in outperforming relative to its G10 peers and most of EM, in our view.

Repatriation flows have pushed USD higher, as EM portfolio outflows have led to EM weakness.

Going forward, deleveraging-related EM outflows should allow a bigger degree of differentiation.

Unlike the Fed tightening cycle that began in 2004, higher US rates will likely weaken EM currencies.

Low local investment returns and rising funding costs create balance sheet pressures.

Increasing DM-EM divergence should push real EM funding costs higher, encouraging some EM central banks to run accommodative monetary conditions.

We sell most AXJ currencies (except INR and PHP).

"EUR and CHF are preferred funding currencies, while we think JPY is likely to rally," MS projects.

For latest trades & forecasts from major banks, sign-up to eFXplus

Top Trades for 2016:

1- Short GBP/JPY: Performs best in a risk-off and Brexit scenario.

2- Short CHF/JPY: Relative FX valuation and diverging monetary policies favour the JPY.

3- Long USD vs AUD, CAD, NZD and NOK Basket: Terms of trade weakness and commodity dis-investment should keep commodity FX offered.

4- Long USD vs SGD, TWD and THB Basket: Deleveraging Asian balance sheets create USD demand.

5- Long JPY vs KRW and CNH Basket: A trade benefiting from valuation differentials and Asian balance sheet deleveraging.

6- Short EUR/INR: A carry trade benefiting from high INR rates and a dovish ECB weakening the EUR.

7- Short EUR/MXN: The MXN should benefit from relatively unleveraged balance sheets and strong US trade.

8- Long USD/BRL: We expect a downgrade to non-investment grade, which should drive capital outflows.

9- Long USD/PLN: Upcoming changes to the NBP may bring about new risks for PLN, and widen the USD supportive yield spread.

10- Short CAD/RUB: RUB should benefit from fairer valuations and high yield support. Funding via CAD partially reduces oil sensitivity.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.