Effects of a politicized Fed on markets during US election year

- Donald Trump has been openly critic about the Fed policy for the recent months.

- Fed expected to keep interest rates on hold for the election year.

- First quarter of 2020 is filled with events channeling lots of uncertainty into the markets.

- Commodities and safe-haven assets could be the most bullish, at the expense of stocks and risk-on currencies.

Markets have just been given the positive news that we have all been waiting for. At the time of writing, December 30th, the South China Morning Post reports that China's top trade negotiator, Liu He, is heading to Washington on Saturday with a trade delegation to sign the phase-one trade deal between the US and China. A historic event that will finally bring some tangibility to the obscurity of what markets have had to trade upon to date with respect to what has actually been agreed between Washington and Beijing.

Once markets have this clarity, investors will be very quick to start placing positions on the periphery of a phase-two deal, the Federal Reserve and US elections 2020. No matter the outcome of the details of the phase-one deal, a counterintuitive reaction in the markets could follow suit.

US/Sino trade deal on the cards

At the most extreme, should the details of the phase-one deal remain precarious, we could see an adverse reaction in markets and a strong correction in global equities coupled by a subsequent flight to safety, propelling safe-haven assets back on their northerly trajectories. On the other hand, if much of the details in the phase-one deal reveal what markets had already been expecting, as investors cash-in on profits, perhaps following an initial knee-jerk to the upside, we could still see some money taken off the table. Such idle capital would likely be destined to the usual safe havens, supporting asset classes such as gold and even the yen should US stocks and yields take a trip to the downside having been elevated for so long on the phase-one sentiment.

While, one way or another, it should be regarded as good news that the US and China have finally broken the deadlock and chains which had tied the two nations up in an 18-month tit for tat trade war, it could still be regarded as only a truce fire. The next phase of a trade deal between the US and China could come in stages and is yet to be determined.

A phase-one deal addresses the easy stuff, which focuses on China's agricultural product purchases, tariff rollbacks and includes some intellectual property pledges. The deal will indeed soothe markets and assuage domestic policy concerns. However, the harder issues are yet to come which will address copyrights, industrial espionage, complying with those issues as well as with security and privacy issues and that is where the greater risks lie and where an underbelly of risk-off sentiment could flare-up – if we take Brexit as an example, we can see just how quickly market sentiment can turn around.

At a drop of a hat – a negative headline – in the case of trade wars, we can be looking at skyrocketing gold towards Sep. highs in the $1550s as well as higher bond & yen prices – in the case example of Brexit, GBP fell around 600 pips or 4.5% on the return of hard Brexit fears.

This then leads us into the Federal Reserve and US elections – for all three are tightly correlated – for signs of a politicised Federal Reserve have been emerging during Donald Trump's presidency.

For this year, Trump's main priority had been to secure a "big" (to coin the Trump vocabulary) phase-one trade deal announcement, locking in "big"-ticket Chinese purchases of US agricultural goods that he could then go on to tout as an important win during his re-election campaign in 2020. Now that he has probably achieved that, its time to go back to the drawing board for us. Markets will now try to determine what is in store with respect to the Federal Reserve and the US elections while trying to predict what cards Trump has up his sleeve when we consider the implications of an ongoing currency war with China. In doing so, we have to consider the implications of a politicized Fed for 2020 and beyond.

A politicized Fed

The topic of a politicized Fed was a hot one in the middle of this year, a theme that had been brewing since President Trump started to call out the Fed as not doing enough and the Chinese as currency manipulators. It's a complicated mix of, politics, monetary policy, global trade, domestic economics and outright nuclear war. For the time being, however, we can probably discount the apocalypse now that a phase-one deal is in the final throes, or perhaps even a done deal by the time this goes to print.

Starting with the Federal Reserve, the central bank governor, Jerome Powell, who was nominated by President Trump on 2017 to serve as the Chair of the Federal Reserve, lifted rates four times in 2018 – and had raised them nine times in total starting from late 2015 as the economy strengthened. On October 30th 2019, the Fed cut for a third time, reversing nearly all of 2018’s rate increases as uncertainty from President Trump’s trade war and slowing global growth continued to pose risks to the United States economy – or was there more to it? After all, the US had been experiencing rock-bottom unemployment and decent overall growth.

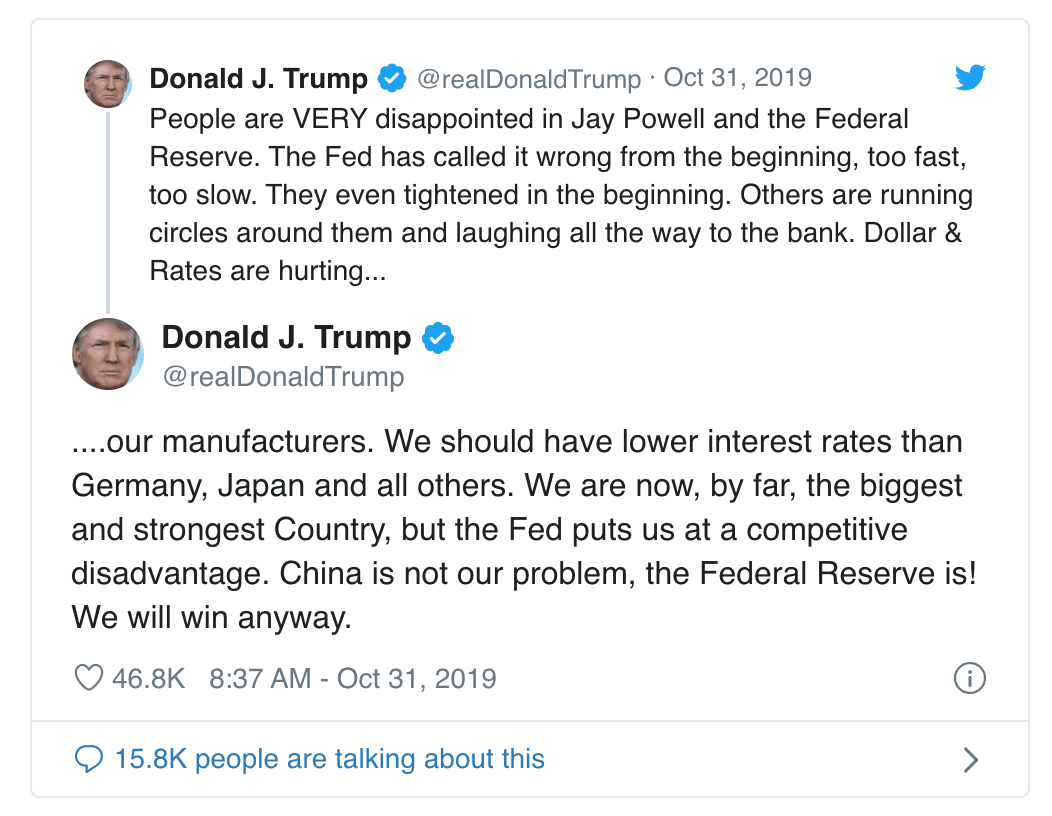

While the central bank was on a steady march to raise rates in 2018, it had spent the entire year in 2019 trying to insulate the American economy and to maintain a record expansion humming. In the background, of course, we had President Trump heavily criticising the Fed and directly attacking Chair Powell, claiming that “people are VERY disappointed in” the central bank leader, sending out such tweets as follows:

(Just one of several direct hits at Chair Powell).

Such provocation towards the Fed raised the suspicion that the central bank was about to bow down to the President. Tweets such as these initially started to impact financial markets, despite the fact that it would take more than just a president to politicize the Fed – its chairman and Congress must also acquiesce. However, over time, the markets started to discount such a possibility and it was back to business as normal.

In the final 25 basis point cut of 2019, in October, stripping rates all the way back to within a range of 1.5 percent to 1.75 percent, Fed chair Powell, said that while “there’s plenty of risk left,” although noting there are signs that some challenges had been subsiding, including the possibility of a trade deal between the US and China and a negotiated exit for Britain from the European Union. Well, it would seem that a hard Brexit is still very much a risk that is on the table and we are far from being out of the woods with regards to a trade deal between the US and China.

The consensus among economists is that the Fed will now pause after having cut rates three times in 2019. So what's in store for 2020 and how can we play it? Well, not so fast. 2020 might not be the vanilla monetary policy from the Fed according to domestic economics, yet there is still the risks of a politicised Fed.

Casting minds back to November, Monday 18th (to be precise), President Trump and Powell got together to discuss "economic issues", in a meeting that Trump said was "good & cordial," adding that the two spoke about rates and 'dollar strength'. What does that sound like to you?

That is code language for, we are at a currency war with China. Trump needs Powell on his side. However, Powell has repeated time and time again, most grandly on a panel at Capital Hill, that Fed policy is not influenced by political considerations.

The full statement from the Fed:

Pushing back against political encroachment is a priority for the Fed. Throw in politics and all of a sudden Powell is roped into Trump's political campaign to have him re-elected again as the president seeks to not only goose the economy to improve his chances but given how egotistical he is, to see through what has likely become a personal vendetta for the President with China.

We have not heard much from Trump over this matter since the meeting, but it is likely to rear its head again as he prepares for the 2020 election campaigns. If he doesn't get what he wants from Powell down the line, it would not be surprising to see him to start nominating pro-Trump policy heads to policy seats on the Federal Reserve’s board, such as former presidential candidate Herman Cain and conservative pundit Stephen Moore. Not that these two could not swing interest rates alone, but such appointments could erode non-partisan standards that make the Fed one of the most important economic institutions in the world as it takes on the Chinese yuan.

Fed on hold for 2020

However, for now, we can expect the Fed to stay on hold for the foreseeable future while Powell is at the helm – future traders certainly don't see any moves. Federal Reserve projections show no interest-rate changes in 2020 but the annual rotation among voters could still influence policy as incoming members include an outspoken dove while two hawks depart.

We have a clear dove in Minneapolis Fed chief Neel Kashkari joining the team and we also have Robert Kaplan from Dallas, Philadelphia’s Patrick Harker and Loretta Mester from Cleveland. According to the summary of economic projections updated on Dec. 11, interest-rate forecasts by Fed officials next year showed 13 expected no change and four pencilled in a quarter-percentage-point hike as the country heads into a US presidential election year. That's pretty well unified.

As for the incoming members, these will replace dove James Bullard from St. Louis, who wanted a half-point rather than quarter-point cut in September, and Chicago’s Charles Evans, who also supported easier monetary policy. Kansas City Fed President Esther George and Boston’s Eric Rosengren, hawks who both dissented against all three rate cuts this year, will also be departing.

Looking at the members directly

Mester (hawk): The Cleveland Fed president is the most hawkish but has not shown any immediate intentions to pressure for changes, although she said she hadn’t favoured cutting rates three times in 2019. So, with unemployment at a 50-year low, we should watch inflation and see how she reacts to commodity prices, (recently) on the rise and upside pressures in inflation.

Kashkari (dove): Minneapolis Fed chief, Neel Kashkari, was advocating rate cuts as inflation was subdued. He will likely pipe down if commodity prices indeed head higher. Oil is now above $61bbls and that is something to monitor in 2020 considering the Chinese trade deal and OPEC+ accord. He argues, however, that the Fed should commit to not raising rates again until core inflation rises back to 2% on a sustained basis.

Kaplan (centrist): The Dallas Fed chief is no bullish on the economy but is watching the yield curve. Should we see rats on the long end tick higher, he will likely be on the air of caution and want to see a dovish committee taking heed.

Harker (centrist/ hawkish): Philadelphia’s Harker was not a fan of the Fed's rate cuts throughout 2019 and was outspoken about it. With the phase-one deal sewn-up, he could be more hawkish in 2020 and will be one to watch.

All in all, two hawks and a dove are stepping down from voting and being replaced by an uber dove and three middle-of-the-road people. However, for now, we seem quite balanced at the Fed, so it will be now all eyes on the US elections but it will be worth keeping an eye on commodity prices on the rise and the possibility of an inflation scare and how Trump politicises such circumstances.

Commodity prices on the rise

In the same vein as trade agreements and headline inflation, agricultural commodities could continue to increase on new demand from China which could add to upside pressures to what has been a low inflation period in 2019. Any sudden jerk to the upside could make inflation look relatively larger and likely send yields and the US dollar higher as the market overreacts. Markets will keep an eye on both the Consumer Price Index and Core Personal Consumption Expenditures, the Fed's preferred measure which is well below 2% currently.

CRB Index on the rise – (represents a basket of commodities ranging from Coffee and Cotton to Silver and Natural Gas. This is an important one guys. For over 50 years, this index has served as the most widely recognized measure of the global commodity markets).

2020's considerations – What if?

If history is anything to go by, we know that election outcomes need to be traded with caution and a trader has to have all angles covered. 'What if?' should be applied to our trading strategy.

After being impeached by the House of Representatives earlier this month, US President Trump's odds of winning the 2020 US presidential elections have actually improved above the 40% odds at which he was expected to win just a couple of months back. Trump supporters and the Republican grand machinery have been rallying around him and that is a theme which is likely to continue throughout his campaign. Moreover, the economy has seen the lowest unemployment since 1969 and should past analyses be of use, a US president tends to get another crack at the whip if the incumbent manages to avoid an economic recession.

Should Trump manage another term, it is probably too easy to presume that we will see a rehash of his past tenure as far as markets and the US dollar goes, although as tempting as that might be considering the US administration's policies have sought to bolster the economy and stock markets. However, this was achieved in a period of low inflation and following Obama's presidency, so Trump was essentially given a repaired economy following the GFC on a plate, benefitting from Obama's economic stewardship. President Trump took up the helm as it underwent a decade-long expansion, the longest in American history, and that recovery has continued for Trump up until this point.

In the chart below, we can see just how steady Trump's growth rate has been compared to his most recent predecessors – consistently been between two to three percent.

Source: Business Insider.

What we haven't seen yet is the full picture for 2019 and how the prolonged trade war has taken its toll on the US economy.

As far as job growth, its been steadily adding around 200k jobs per month since Obama's second term which has continued throughout Trump's spell in office, fulled by a strong economy. However, wages have been huge had turner since Trump took up his sat at the Oval. Wages have climbed exponentially and are growing at more than 3% for the first time in a decade.

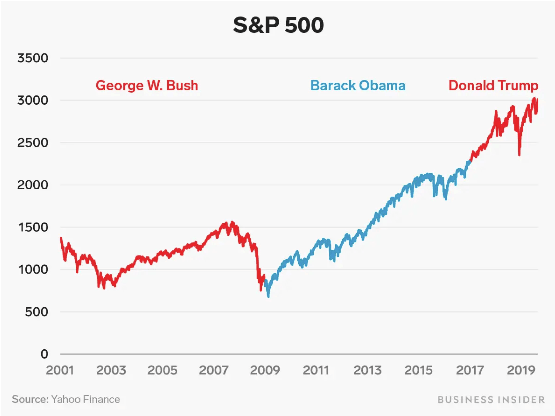

However, one of the most concerning of charts, courtesy of Business Insider and Yahoo Finance, is the performance of the US stock market and using the S&P 500 as a benchmark.

See the volatility in Trump-trade? The market was spooked about the prospects of a recession and a trade war with China. Could this be the technical consolidation period that could lead to a reversal in 2020/21?

Possible catalysts for such could start in 2020 for there is not only likely to be the risks of a fall out between Trump and China over the thornier aspects of a deal. An even bigger elephant in the room is inflation and the federal deficit which is heading back towards the 2012 peaks and soon to reach the peaks of the 2009 crisis, if Trump doesn't throw in the towel on running massive deficits. The major concern is the total federal debt, the amount of money at which the government owes. Coupled with rising inflation, that puts a huge strain on the nation's ability to pay back debt. The effect on markets would be plummeting T-bills and skyrocketing yields from which the Fed would have no choice but to move back to QE = Major US recession – one of which is well overdue according to historic cycles.

So how to play these themes?

For the first quarter of the year, we can expect markets to be on high alert with an ear to the ground for how the US and China get along. A smooth transition over to a phase-two deal will be highly positive for global trade and equities and the global economy as a whole. However, that is unlikely to unfold and gold and the yen (one of, if not the, weakest G10 currencies in Q4), may well be a safe way to play the uncertainty. AUD/JPY should also be in the playbook considering its relationship to the trade wars. Doctor copper is also a must focus, but perhaps one to look at again later in the year should the US and China be seen to moving along in the right direction for the global economy.

For the US dollar, it will be too soon for there to be a radical shift in the markets and it will likely behave better-bid for a while longer as inflation heats up over time, so long as commodities continue to recover and the Fed remains watchful. It really all boils down to the US and China for the first half of the year and speculating further out than the first quarter is not particularly warranted in spot FX. Swing traders applying economic and political fundamental analysis will typically keep an eye on longer-term prospects, but usually, only trade the price action up to days or potentially weeks ahead on daily chart technical analysis. Further out, the US elections will become a theme but market positioning will not come into play until the second half of 2020 where a steady Trump hand at the helm will likely make for continued increases in US benchmarks, albeit in an air of caution.

Q1 trading tips

Too much uncertainty around US/China. Fed on hold, risk-off, a wobble in stocks – buy corrections should Trump's odds of winning increase – buy yen on dips and hold gold, sell rallies in AUD/JPY back to trendline support. US dollar to consolidate, buy deep corrections.

Technical analysis in AUD/JPY

Gold Price Forecast 2020: XAU/USD bulls likely to remain in control

This article belongs to the 20 trading ideas for 2020 series. Check the full list of 2020 pieces.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637139258370876936.png&w=1536&q=95)

-637139258854479053.png&w=1536&q=95)

-637139260572160893.png&w=1536&q=95)