Economic resilience on display in Q3 GDP

Summary

US economic growth accelerated in the third quarter to a 4.9% annualized pace, signaling the economy remains resilient in the face of higher rates and still-elevated prices. While persistent strength in demand could put the inflation descent in jeopardy, we do not anticipate this report changes much for policymakers, and we expect the FOMC to leave rates unchanged at next week's meeting.

Economic growth was strong in the third quarter

U.S. economic output accelerated in the third quarter as real GDP rose at a 4.9% annualized rate (chart). At the start of 2023, a number of forecasters, including many at the Federal Reserve, thought the U.S. economy would be either slowing or perhaps even entering a recession by the second half of the year. Instead, it is accelerating. Third quarter growth is more than double the pace of the prior period's growth (+2.1%) and well-above what many observers estimate to be the potential growth rate in the U.S. economy today (~1.8%).

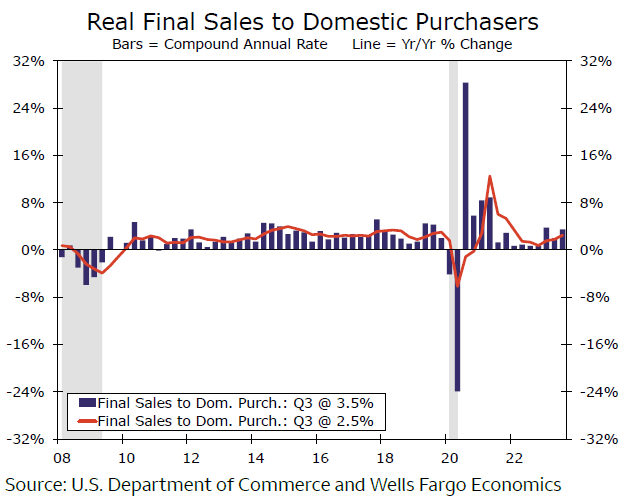

There's no denying this is a strong outturn, but an $80.6 billion build in inventories was responsible for 1.3 percentage points of headline growth. Net exports were the largest surprise to us. We had anticipated a boost from trade, but net exports subtracted 0.1 percentage points from growth on stronger import activity, which does not immediately square with the advance monthly data. Real imports rose at a 5.7% annualized clip in Q3, or by the most in six quarters. Still, growth is tempered a bit when we strip through some of these volatile components and look at the core parts of the economy. Real final sales to domestic purchasers were still robust but expanded at a more moderate 3.5% clip last quarter. As seen in the nearby chart, that's still a pace well ahead of the roughly 2.3% quarterly annualized growth rate averaged over the previous expansion.

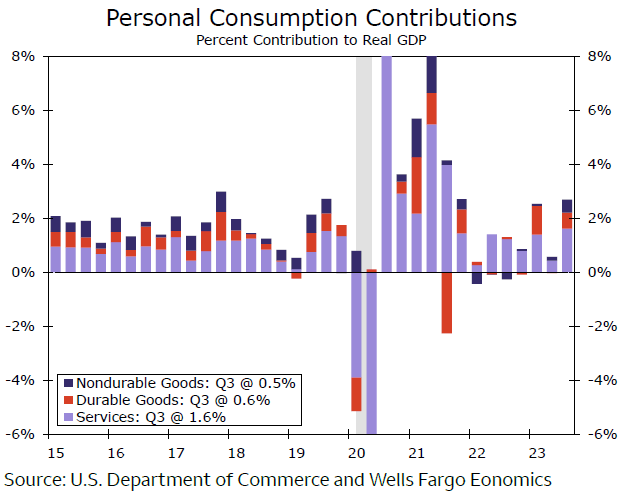

Economic growth was lifted by a robust pace of consumer spending throughout the period, as evidenced by fairly strong monthly retail sales data. Real personal consumption expenditures expanded at a 4.0% annualized pace, or the fastest rate of expansion since mid-2021 when the economy was bouncing back amid reopening. Growth was fairly broad based among major spending categories as well, though services continue to account for a majority of consumption (chart). Services spending rose at the fastest pace in over two years, and goods purchases bounced after a weak second quarter. We will get the full release for September Personal Income & Spending tomorrow, which will include the monthly spending details, but we expect consumption ended the quarter quite strong, setting the fourth quarter up for a decent pace of growth as well.

Beyond consumer spending, residential investment was also pretty strong, seeing its first positive pace of growth in ten quarters (+3.9%). Nonresidential investment was weaker, but most of that weakness is attributed to slower equipment outlays during the period, which fell at an annualized rate of 3.8%. Structures investment (+1.6%) and intellectual property products (+2.6%) both expanded.

Author

Wells Fargo Research Team

Wells Fargo