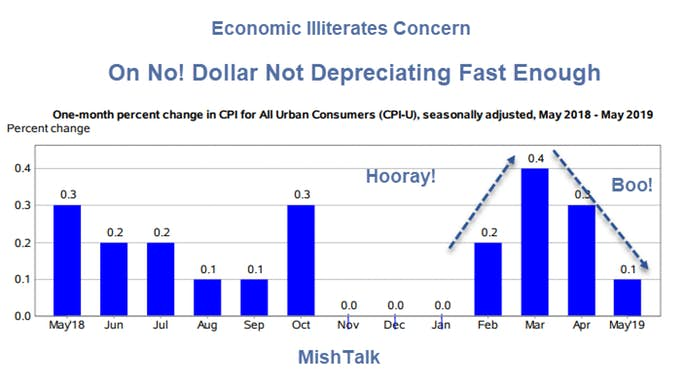

The CPI rose 0.1% month-over-month. Econoday was disappointed. But it did find "bright spots" in food and air travel.

Economists and others are investigating the Consumer Price Index (CPI) for signs of wanted inflation.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in May on a seasonally adjusted basis after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment.

The food index rose 0.3 percent in May after declining in April, with the food index accounting for nearly half of the May seasonally adjusted all items monthly increase. The energy index fell 0.6 percent in May, with the gasoline index falling 0.5 percent and the indexes for electricity and natural gas also declining in May.

The index for all items less food and energy increased 0.1 percent for the fourth consecutive month. The indexes for shelter, medical care, airline fares, education, household furnishings and operations, and new vehicles all rose in May. The indexes for used cars and trucks, recreation, and motor vehicle insurance were among those that declined over the month.

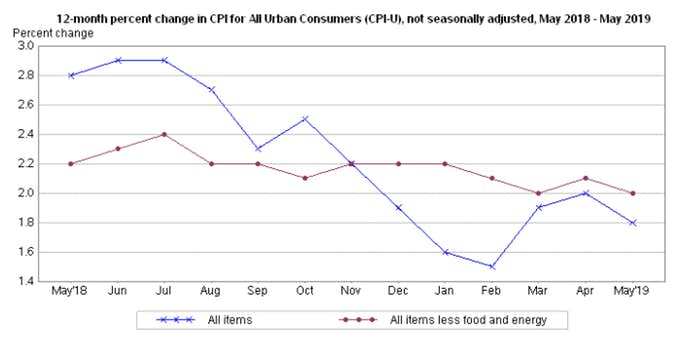

Year-Over-Year CPI

The all items index increased 1.8 percent for the 12 months ending May. The index for all items less food and energy rose 2.0 percent over the last 12 months, and the food index also rose 2.0 percent. The energy index decreased 0.5 percent over the past year.

Econoday Lowlights

Price pressures at the consumer level are losing pace, as the ex-food ex-energy core rate missed expectations with only a 0.1 percent gain in May. The year-on-year rate edged 1 tenth lower to 2.0 percent which also misses expectations. Overall prices rose an as-expected 0.1 percent though the annual rate fell 2 tenths and at 1.8 percent is moving away from the Federal Reserve's target.

Energy fell a monthly 0.6 percent in May with gasoline down 0.5 percent. But food is showing some pressure, up 0.3 percent for a 2.0 percent annual rate. Medical care is also showing a little lift, also up 0.3 percent in the month for a 2.1 percent pace and a 2 tenths gain. Housing, which makes up nearly 1/2 of the index, continues to be the central area of price support though strength is weakening, up only 0.1 percent on the month and 2.8 percent on the year vs 2.9 percent in April.

Other readings include no change for apparel, an area that Jerome Powell was expecting to see some traction appearing. Year-on-year, apparel prices are down 3.1 percent. But airfares, another area Powell expects to see strength, did jump 2.0 percent in the month though this yearly rate is still soft at 0.9 percent. New vehicle prices rose a monthly 0.1 percent with used vehicles down 1.4 percent.

At the last FOMC in late April and early May, policy makers were putting a positive spin on a slumping core inflation rate, in this case the Fed's preferred gauge which is the PCE core which was at 1.6 percent in April. This rate runs several tenths below the CPI core and today's report is not pointing to acceleration for the PCE core back to the 2.0 percent target. The spin Powell puts on the latest inflation data could well be the most important part of next week's FOMC results.

Hooray! Food and Airfares Cost More

The economic stupidity of this line of thought is consistently stunning.

There is no economic benefit to pay more to get less. But that's what economic illiterates say.

Yesterday, Trump complained the US is at a "big disadvantage" because of Euro devaluation.

I commented Clueless Trump Demands You Pay More For Less: He Says So Himself.

Europe vs the US

Europe is hardly a hotbed of economic activity.

France went through months of riots of "yellow vests" protesting the rising taxes and inability to make ends meet.

Because of asinine work rules and regulations, it is difficult to start a business in much of Europe.

Corporations like Google, Apple, Amazon, and Microsoft cannot exist in Europe because the EU would demand they be broken up to save the family farm and bookstore.

The US is clearly not at a big disadvantage to Europe.

And if the Eurozone splinters over Italy, it is difficult to say what the heck a euro would be worth. For discussion, please see Italy's Mini-BOT Trojan Horse Could Blow Up the Eurozone.

No Economic Benefit to Inflation

There is no economic benefit to inflation.

The average second-grader understands it's better to get 10 gumballs for a dollar than 1. The average economic doesn't.

Economic foolishness doesn't come easily. You have to be taught to be stupid. It takes years of brainwashing.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

AUD/USD: Next stop emerges at 0.6580

The downward bias around AUD/USD remained unabated for yet another day, motivating spot to flirt with the area of four-week lows well south of the key 0.6700 region.

EUR/USD looks cautious near 1.0900 ahead of key data

The humble advance in EUR/USD was enough to partially leave behind two consecutive sessions of marked losses, although a convincing surpass of the 1.0900 barrier was still elusive.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

SEC gives final approval for Ethereum ETFs to begin trading

The Securities and Exchange Commission approved the S-1 registration statements of spot Ethereum ETF issuers on Monday, making it the second digital asset ETF to go live in the US, according to the latest filings on its website.

Commodity FX gets no help from higher US equities

Markets were all over the place on Monday. US equities put in a decent recovery, though this did nothing to help beaten down commodity FX, with the Australian Dollar, New Zealand Dollar and Canadian Dollar all getting hammered.