- The ECB is likely to leave its monetary policy settings unchanged in September.

- The bank’s take on the euro surge amid negative inflation in focus.

- The ECB forecasts (leak) show more confidence in the economic outlook.

The European Central Bank (ECB) monetary policy decision is much-awaited on Thursday, as the bank remains concerned about the appreciation in the euro, increasing deflationary pressures and uncertainty around the coronavirus situation in Europe.

Despite the recent negative developments, the ECB is set to announce no changes to its monetary policy settings for the second straight month in September, having expanded its Pandemic Emergency Purchase Program (PEPP) with EUR600 billion in June.

The interest rates on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will likely remain unchanged at 0.00%, 0.25% and -0.50%, respectively while the PEPP will be maintained at EUR1,350 billion.

President Christine Lagarde will address the post-policy press conference at 1230 GMT after the release of the policy statement at 1145 GMT.

More stimulus on the cards?

The closely-watched Eurozone inflation turned negative in August, as the annualized consumer price index fell 0.2% versus July's 0.4% rise. A sub-zero reading cast a shadow over the effectiveness of the June stimulus expansion, raising expectations to do more.

Note that the ECB has already expanded its balance sheet from EUR4,500 billion to EUR6,424 billion since March to combat the economic impact of the coronavirus.

Eurozone’s long-term inflation expectations showed further deterioration, with a key gauge falling to a fresh monthly low of 1.17% on hopes of a supportive stance by the ECB.

Verbal intervention amid euro strength

Lagarde’s take on the appreciation in the euro will be closely eyed. The bank’s policymakers voiced their concerns over the euro surge, which is seen undermining the nascent economic recovery and could exert additional downward pressure on inflation.

Chief Economist Philip Lane said last week, “The EUR/USD rate does matter. If there are forces moving the euro-dollar rate around, that feeds into our global and European forecasts and that in turn does feed into our monetary policy setting."

With the rates likely on hold, the least the ECB could do is continue with the verbal intervention to contain the rapid rise in the shared currency and ease the concerns. EUR/USD reached the highest levels in two-years at 1.2011 last week, having gained 7% in the past six months.

ECB’s forecasts to show economic optimism

The central bank’s outlook on the economy will also hog the limelight, as the second-wave of the virus tightens its grip across Europe, which could slow down the economic recovery.

However, the leak of the bank’s forecasts, as reported by Bloomberg, points to more optimism on the outlook. The ECB is said to revise its 2020 GDP estimates higher amid stronger private consumption. Given the strong Retail Sales, the mild upward revision to the forecasts could have a temporary positive impact on the euro.

The news of the forecasts leak saved the day for the EUR bulls, as EUR/USD jumped from 1.1760 to 1.1830 region. The main currency pair trades at 1.1825, adding 0.45% on a daily basis.

The cause for concern for the market still remains the ECB’s inflation forecasts, which could be revised down amid stuttering recovery.

EUR/USD: Key technical levels to watch

Daily chart

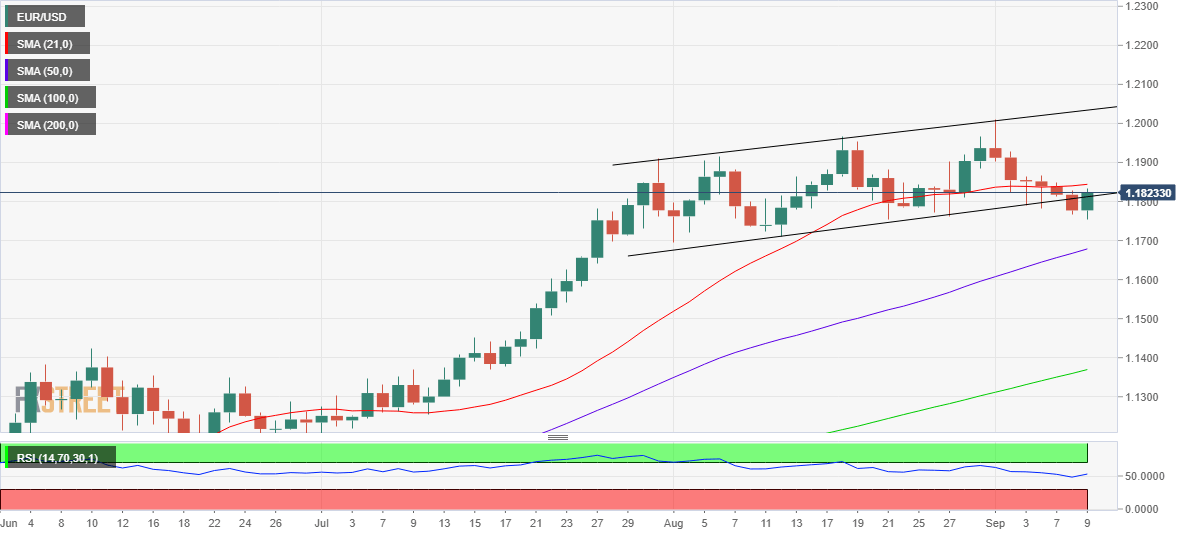

On Tuesday, the spot confirmed a rising channel breakdown on the daily chart after delivering a close below the pattern support at 1.1807. Despite the bearish break, the bulls held onto the critical support near 1.1760.

On Tuesday, the spot confirmed a rising channel breakdown on the daily chart after delivering a close below the pattern support at 1.1807. Despite the bearish break, the bulls held onto the critical support near 1.1760.

Holding onto the said support prompted a solid bounce in EUR/USD on Wednesday, although a daily close above the horizontal 21-day Simple Moving Average (DMA) at 1.1844 is critical to negate the bearish momentum in the near-term.

The daily Relative Strength Index (RSI) saw an upturn above the midline, currently at 53.15, which could allow an additional upside.

A further jawboning of the exchange rate and/or downbeat inflation forecasts could recall the sellers, with the robust support at 1.1757 likely to be retested. A sell-off towards the upward-sloping 50-DMA at 1.1678 cannot be ruled on a break below that strong support.

To the topside, the 1.1900 mark will be back in sight if the ECB comes out less dovish, with the bulls set to challenge the 2020 highs once again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds losses below 1.1400 amid US Dollar recovery

EUR/USD remains pressured below 1.1400 in the European trading hours on Tuesday. The Euro weakens amid rising expectations of further ECB interest rate cuts while the US Dollar draws support from some progress on US trade deals with its major global trading partners. US jobs data awaited.

GBP/USD retreats below 1.3400 ahead of US data

GBP/USD reverses its direction and trades below 1.3400 after setting a multi-year high near 1.3450 earlier in the day. The US Dollar (USD) stays resilient against its rivals as markets remain optimistic about a de-escalation in the US-China trade conflict. Focus shifts to key macroeconomic data releases from the US.

Gold declines toward $3,300 on improving risk mood

Gold price remains heavily offered through the early European session, though it manages to hold above the $3,300 mark amid mixed fundamental cues. Signs of easing US-China trade tensions continue to drive flows away from traditional safe-haven assets and undermine demand for the precious metal.

JOLTS job openings expected to dip slightly in March as markets eye April employment data

The Job Openings and Labor Turnover Survey (JOLTS) will be released on Tuesday by the United States Bureau of Labor Statistics. Markets expect job openings to retreat to 7.5 million on the last business day of March with the growing uncertainty surrounding the impact of Trump’s trade policy.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.