- The ECB is set to leave its policy unchanged in January but may paint a gloomy picture.

- President Lagarde could express concern about the strong euro and its contribution to low inflation.

- Unless the bank threatens lower rates, EUR/USD may resume its rises, based on dollar weakness.

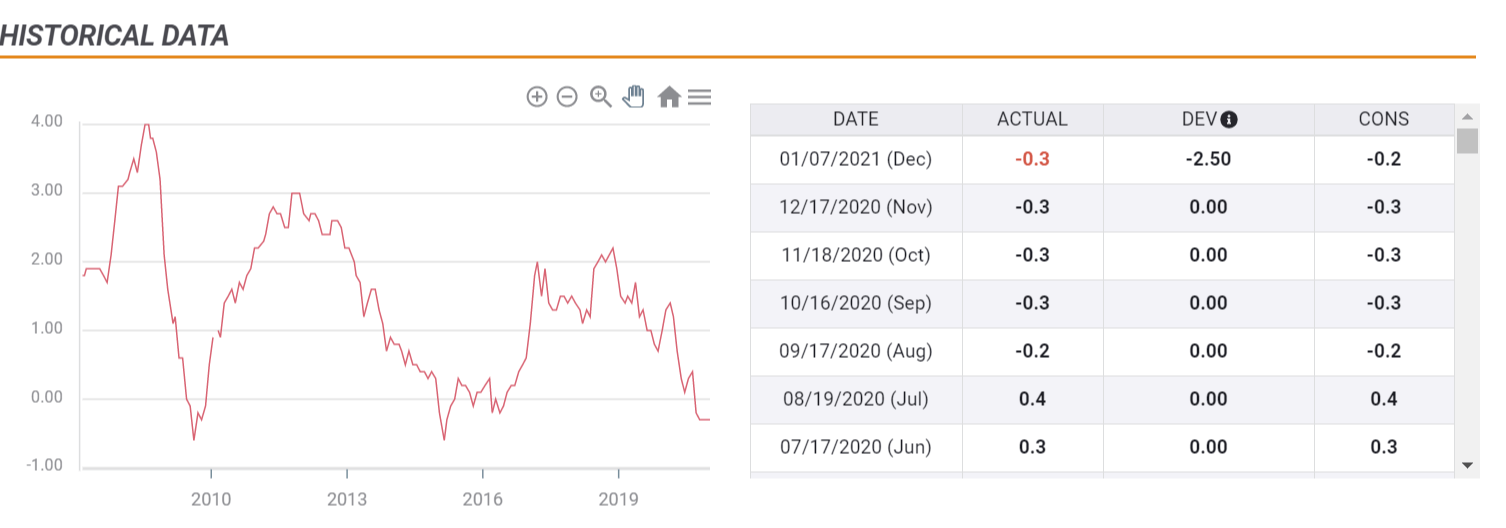

Missing the target for over two years – and moving further away from it– cannot be called a success. The European Central Bank has only one job, keeping inflation "at, or close to 2%" and the current level of -0.3% is undoubtedly an issue.

The COVID-19 pandemic is the main culprit, causing harsh economic pain and lowering demand. A change in German VAT also contributed to pushing the Consumer Price Index lower, but even when that effect fades away – inflation remains depressed. Core CPI, at a positive 0.2% is also dismal.

Source: FXStreet

Another issue is the high exchange rate of the euro, which pushes prices of imported prices lower, and makes European exports less attractive. EUR/USD shot higher amid falling demand for the safe-haven dollar which is the result of the decisive US elections and more importantly, the breakthroughs in coronavirus vaccines. Europe's harsh winter covid wave failed to push the common currency lower.

Christine Lagarde, President of the ECB, expressed some discontent with the high exchange rate of the euro and may take another step in the upcoming meeting. Back in December, the bank announced the expansion of its Pandemic Emergency Purchase Program by around €500 billion.

Contrary to the pre-coronavirus era, printing euros benefit the currency. Instead of seeing the creation of new funds as devaluing existing ones, investors observe lowering borrowing costs for governments, which can boost expenditure and support the economies of the currency bloc.

Rate cut? Not so fast

The only tool that the Frankfurt-based institution can deploy to hit the euro is cutting its deposit rate – which is already at -0.50%, in deep-freeze territory, like the Pfizer/BioNTech vaccine's storage requirements. Further punishing banks for parking money with the bank would be hard. It is also essential to remember that members from Germany and other northern members are not keen on looser monetary policy.

The ECB is unlikely to announce new measures at its first meeting of 2021, in which it does not publish new staff forecasts. However, Lagarde may dedicate more time and use starker language to warn about the damage of the high exchange rate to the economy and to inflation.

Will she succeed? Investors may be taken aback and algorithms may shoot sell orders, pushing EUR/USD lower in response to new language. Nevertheless, without slashing borrowing costs, markets may realize that Lagarde's threats are not credible, and return to trading the currency pair to the tune of moves across the pond.

Timing

The ECB announces its decisions less than 24 hours after Joe Biden is inaugurated as US President. The incoming occupant of the White House is set to push his $1.9 trillion stimulus bill and also sign Executive Orders that may have an economic impact. Will his moves improve the market mood and weigh on the dollar or rather send US Treasury yields higher and boost it? That remains an open question.

Six days after the ECB's decision, her piers across the pond make their announcement. Jerome Powell, Chairman of the Federal Reserve, put an end to speculation about the early tapering of bond buying. Will he take the extra step and expand the Quantitive Easing program? Also here, there is room for speculation.

Conclusion

The ECB is set to leave its policy unchanged but may try to talk down the euro. Without the credible threat of cutting interest rates, any EUR/USD could prove a "buy-the-dip" opportunity.

See EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold gives away some gains, slips back to $2,980

Gold retraced from its earlier all-time highs above the key $3,000 mark on Friday, finding a footing around $2,980 per troy ounce. Profit-taking, rising US yields, and a shift to a risk-on environment seem to be putting the brakes on further gains for the metal.

EUR/USD remains firm and near the 1.0900 barrier

EUR/USD is finding its footing and trading comfortably in positive territory as the week wraps up, shaking off two consecutive daily pullbacks and setting its sights back on the pivotal 1.0900 mark—and beyond.

GBP/USD remains depressed, treads water in the low-1.2900s

GBP/USD is holding steady in consolidation territory after Friday’s opening bell on Wall Street, hovering in the low-1.2900 range. This resilience comes despite disappointing UK data and persistent selling pressure on the USD.

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.