ECB Preview: Five reasons to expect Lagarde to lift the Euro with a hawkish hike

- Economists expect the ECB to raise rates by 50 bps after two consecutive 75 bps hikes.

- High core inflation, strong growth and high temperatures in October point to a 75 bps hike.

- Hawkish control and lack of commitment to guidance add to the hawkish case.

- The Euro has room to rise, at least in the immediate reaction.

Frankfurt's Weihnachtsmarkt is surely lit up nicely for Christmas – but the European Central Bank (ECB), headquartered in that German city, is unlikely to provide any gifts for markets. Economists expect the ECB to moderate its pace of rate hikes to 50 bps, and they might be wrong-footed due to five reasons. Even if doves force a slowdown, they will likely pay with a hawkish message.

I expect the Euro to rise in response to the bank's decision.

1) Core inflation is high

The Frankfurt-based institution has a "single needle" in its compass – getting inflation to around 2%. While the headline Consumer Price Index (CPI) fell from the peak, it still stands at a chokingly high level of 10% as of November.

According to ECB Chief Economist Phillip Lane, inflation may have peaked. Nevertheless, the road down is still long.

Source: FXStreet

More importantly, the leap in energy prices has spread to other areas. Core CPI, which excludes energy and food, is holding at 5%. That comes before the full impact of collective wage bargaining takes effect.

When workers have more money, they spend more. Rising core inflation is much harder to tame, and requires a longer fight.

Source: FXStreet

That is one reason to continue raising rates at a fast pace.

2) Growth still strong in Q3

Forecasts for the eurozone have been gloomy, but the economies of the old continent have proved resilient. An increase in reopening-related tourism, and excess savings from the pandemic have kept Europe humming between July and September.

Even Germany, whose industry heavily relies on Russian gas, experienced growth, defying skeptics. Moreover, Europe's largest economy is also dependent on exports to China, but the twin COVID and property crises have not prevented Germany from continuing to expand. That means additional inflationary pressures.

Source: FXStreet

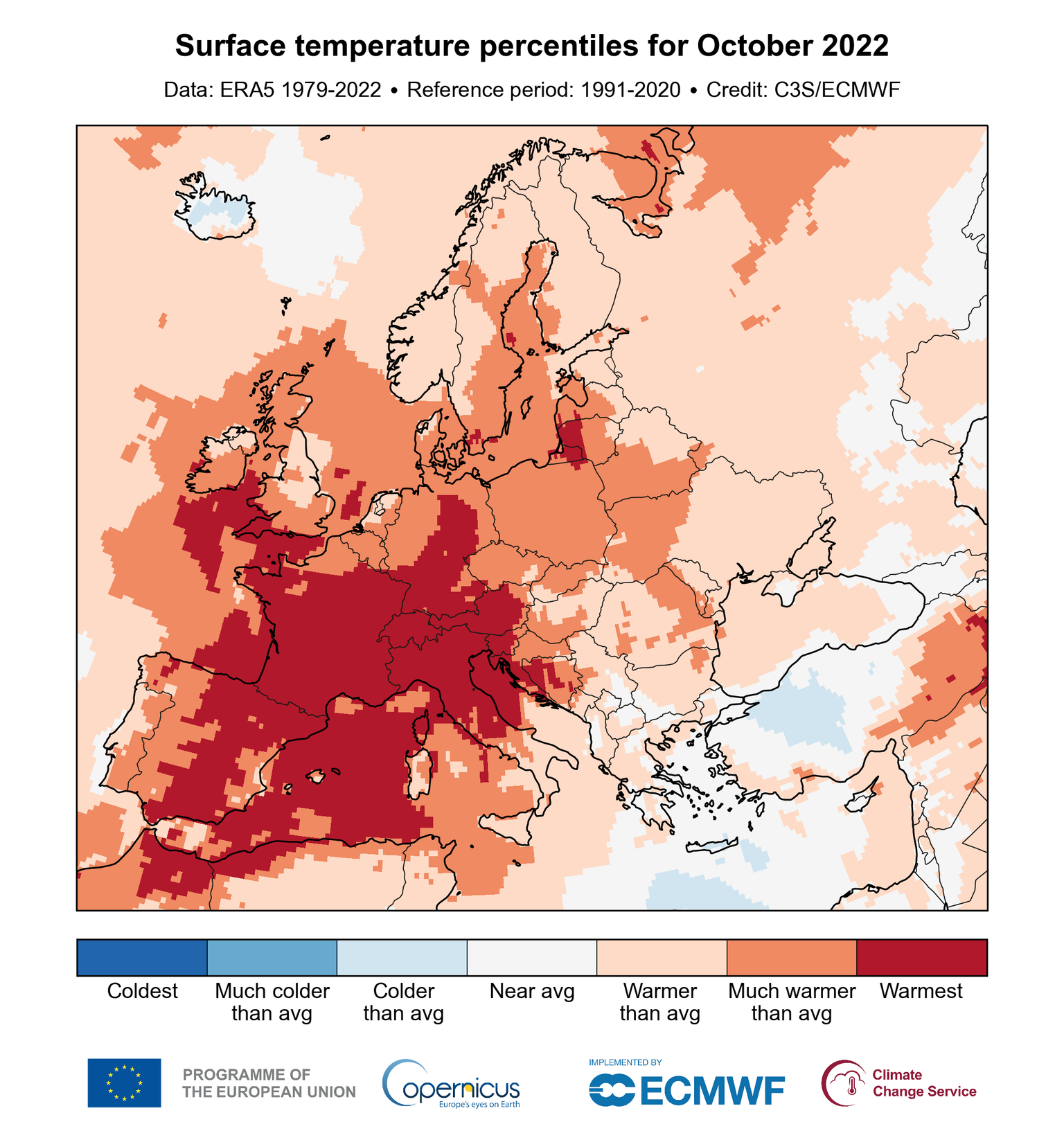

3) Hot October

While snow has been falling recently across the continent, the first full month of autumn was unusually warm, with consequences for consumption and inflation expectations. Europe was able to fill its gas storages and prevent any fears of shortages or blackouts during this season.

While the continent may face a worse crisis in the next wintery season, that warm month contributed to growing confidence among consumers and the industry. Faith in the ability to adapt, with some backwind from luck in the form of hot weather, may encourage more spending. The "siege mentality" is over, at least for now.

Source: EU's Copernicus

4) Hawks are in control

Moving from the economic to the political, it is essential to note that hawks are in control at the ECB. Since the Jackson Hole gathering in late August and even before, Isabel Schnabel has had a powerful voice in shaping the bank's policy. The German member is leading a group of hawks who feel vindicated by the rising price.

While ECB President Christine Lagarde may sound moderate, her influence is weakening after several gaffes and ongoing criticism from within and without. She was forced to abandon any clear signals toward future moves, saying, "we turn our back on forward guidance."

At the same time, hawks such as Schnabel have been vocal in supporting a big rate hike – and they have been vindicated by the data. Therefore, there is a higher chance of a 75 bps hike rather than a 50 bps one.

5) Price for a 50 bps may prove hawkish

Even if doves win the argument for a moderation of rate rises in acknowledgment of a peak in headline inflation, they will have to pay the price for that. Europe is forged in crisis and in compromise. To create a euro-fudge that includes a slowdown in raising borrowing costs, the bank would have to lay down a plan to squeeze its balance sheet.

The ECB continues holding nearly $9 trillion in eurozone bonds, reinvesting proceeds of maturing debt. The Fed is allowing its balance sheet to squeeze by refraining from a full repurchasing of maturing bonds, while the Bank of England is actively selling debt in markets.

Officials have been mulling their desire to follow suit but have yet to present a plan. The elephant in the room is Italy, which has a high 150% debt-to-GDP ratio, and a new right-wing government is picking fights with Brussels. While Italian PM Giorgia Meloni intends to stick to reforms agreed upon by her predecessor Mario Draghi – who was Lagarde's predecessor at the ECB – markets are jittery.

Lagarde and her colleagues are wary of letting Italian debt mature without repurchases, a move that could trigger further selling by bond vigilantes and wrack havoc in markets. I believe doves will prefer swallowing a 75 bps hike over signaling any imminent squeeze to the ECB's balance sheet.

If hawks cede ground on borrowing costs, they will likely demand a plan to rid themselves of holding debt – withdrawing euros from markets. That would be positive for the euro.

Hawks may also demand new forward guidance, promising vigilance on inflation and raising rates as much as necessary. As mentioned above, hawks are in control.

Market reaction and context

As described above, I expect the ECB to opt for another 75 bps rate hike and for this to boost the Euro. The common currency could later retreat if Lagarde's tone is more cautious and as long as the balance sheet reduction remains distant. Such a leap in the Euro and a partial retreat is my baseline scenario.

Another scenario would be a 50 bps hike but a hawkish message, triggering a drop in the currency's value before a recovery later on. This scenario has a lower probability. In any case, an all-out hawkish outcome or an outright dovish one are both less likely, given the compromises needed within the ECB.

The ECB announces its decision 75 minutes after the Bank of England and some 18 hours after the US Federal Reserve. Both are projected to slow the pace of hikes from 75 to 50 bps. Seeing Europe lead with another big move would add oomph to the Euro's advance, at least in the initial phase.

A busy 24 hours of rate decisions:

Source: FXStreet

Final thoughts

As with the Fed decision, it is essential to note that the ECB announcement is a multi-faceted event, including the rate decision, comments on the balance sheet and also new forecasts. These staff projections have proved prone to massive change – or totally unreliable – so I have not focused on them.

What I do want to reiterate is that the first reaction to the decision is unlikely to be followed by a movement in the same direction but rather by a reversal. Nevertheless, the euro has more chances than not to emerge as a winner from the ECB decision.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.