Up for six months in-a-row and at its highest since January 2015, half of EUR/USD's rally has been based on dollar's weakness, but the other half has been the result of speculation that the ECB will trim its QE program this year. Speculation on the matter grew amid an optimistic Draghi and rising inflation, anyway still below the ECB's target of "close to, but below 2.0%." Encouraging growth figures, with manufacturing and services indexes steady at six year highs since the end of the first quarter, backed the case of less monetary facilities needed in Euro-land.

Confidence in a brighter future for the region coupled with a gloomy one for the US, as data began to soften, particularly inflation, erasing chances of a fourth rate hike in the US and reducing substantially chances of the third one promised last year. Not to mention, Trump's administration is doing little progress, or better said, none, when it comes to growth measures.

ECB's head Draghi has sounded optimistic meeting after meeting, but warned about the risk of retrieving QE and cheered the positive effects it has in the economy. The market, however, ignored the cautious side of its speech, and rushed to price in upcoming tapering since last March, and even forced Draghi to set a date in the July meeting, when the press persistently asked and got his word that policymakers will discuss the issue "during the fall."

Delaying tapering is not a matter of not trusting in the economic recovery, it is a matter of "a too-strong EUR". As it expensive its gets, the slowest will be the achievement of the central bank's target. Draghi doesn’t want a stronger EUR and there's little he could do about it, as his attempts to down talk the currency have been worthless. A good example of this is what happened by the end of last week, when the pair hit 1.2070, and big news' agencies rushed to report that the ECB will likely discuss tapering in December, "according to people familiar with the matter."

Headlines had a partial effect, as the pair is anyway retaining its bullish long-term trend. Clearly, no change is expected to be implemented in this September meeting, but the market will be looking for hints on the ECB's strategy for eventually winding down its asset purchase program. As said above, Draghi & Co. don't want a strengthening EUR, so chances of big announcements this Thursday are limited. Anyway, the common currency may take just the mildest positive comment to hold on to hopes of upcoming tightening, and send it higher.

EUR/USD levels to watch

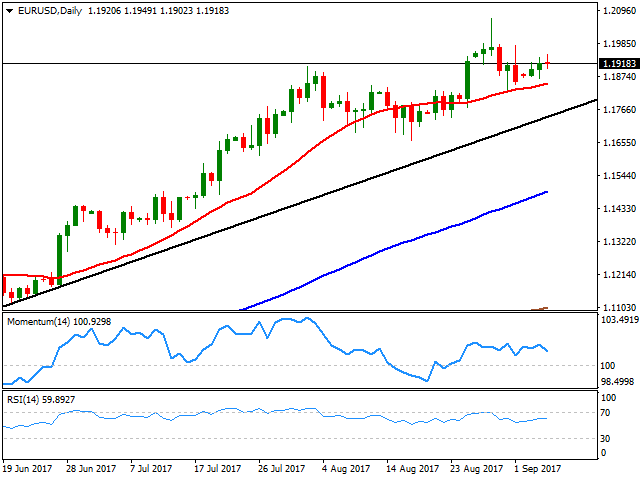

The EUR/USD pair trades with a modest positive tone this week, up by some 80 pips from Friday's close, neutral according to the daily chart, but positive, amid the price holding above all of its moving averages and with the shortest providing support since mid August, currently around 1.1850, while last week's low stands at 1.1822, this last the key support in the case of EUR's weakness, as, as long as the price remains above it, chances of a trend change are pretty much null. In fact, as long as it holds above that daily ascendant trend line coming from early April's low at 1.0603, now around 1.1750, bears will have little saying on the pair. Below the mentioned low of 1.1822, 1.1780 and 1.1740 are the next level to watch on persistent EUR's weakness over the following sessions. To the upside, an intermediate resistance comes at 1.1960, with an upward acceleration through the level exposing the 1.2000/20 region, en route for a retest of this year high of 1.2070.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold clings to gains around $3,430

Gold fell from its previous record high of $3,500 per troy ounce, as overbought indications and a comeback in the US dollar appear to have led purchasers to take a break. Meanwhile, all eyes are on the Trump-Powell frenzy and impending Fed officials' statements.

EUR/USD trims losses, retargets 1.1500 and beyond

EUR/USD now bounces off daily troughs near 1.1460 and refocuses back on the 1.1500 barrier amid some humble knee-jerk in the US Dollar. In the meantime, markets remain cautious in light of President Trump’s criticism of Fed Chair Jerome Powell and its potential implications for the US markets.

GBP/USD treads water below 1.3400

GBP/USD is trading in a narrow zone below the 1.3400 level as the Greenback's solid comeback gains traction on Tuesday. However, continuing concerns about a US economic downturn and misgivings about the Fed's independence are anticipated to limit Cable's downside risk.

3% of Bitcoin supply in control of firms with BTC on balance sheets: The good, bad and ugly

Bitcoin disappointed traders with lackluster performance in 2025, hitting the $100,000 milestone and consolidating under the milestone thereafter. Bitcoin rallied past $88,000 early on Monday, the dominant token eyes the $90,000 level.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.