ECB lowers rates, Euro edges lower

The euro is showing little movement on Friday. In the European session, EUR/USD is trading at 1.1369, up 0.09% on the day.

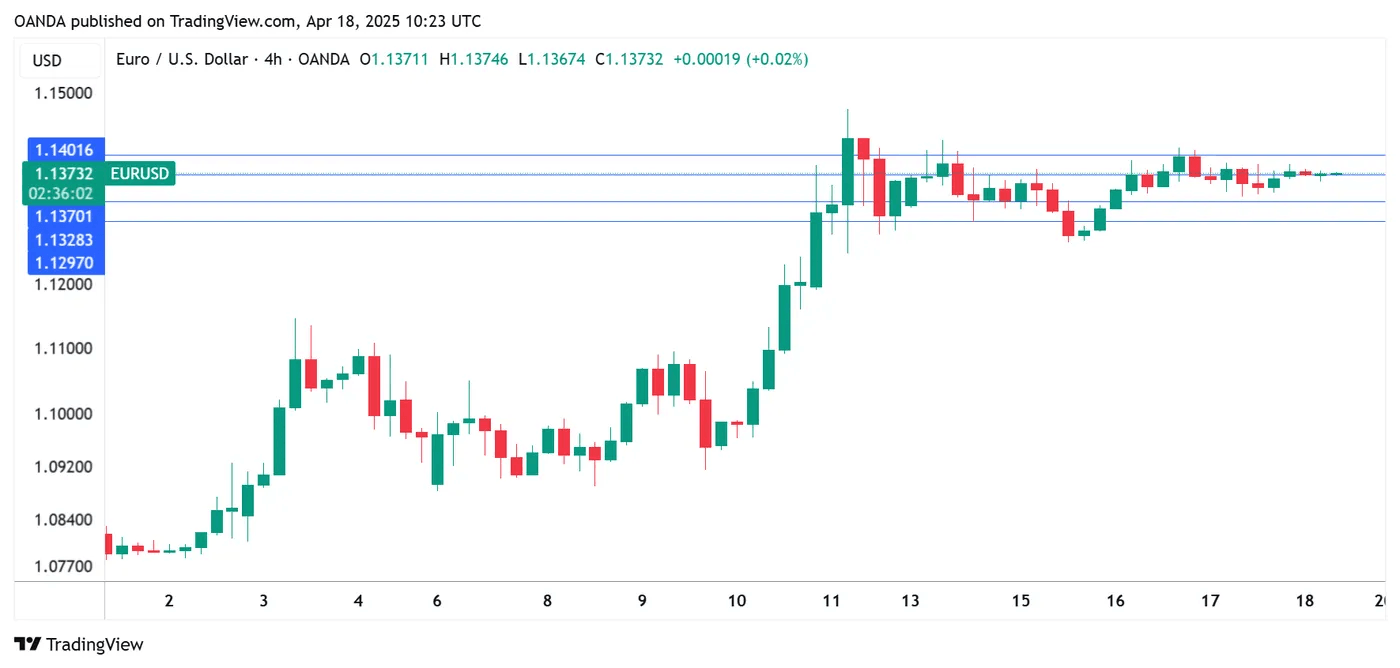

EUR/USD technical

EUR/USD 4-hour Chart, April 18, 2025

ECB cuts rates by a quarter-point

The ECB lowered its deposit facility rate on Thursday by a quarter-point, bring the rate to 2.25%. This marked the seventh rate cut since the ECB started its easing cycle in June 2024 and interest rates are now at their lowest since December 2022. The markets had expected the rate cut and the euro showed limited movement in response to the move.

The ECB's rate cut was largely a response to the chaos around US tariff policy. US President Donald Trump has sharply attacked the EU over its trade policy and slapped 25% tariffs on steel and aluminum imports into the US. The EU retaliated with counter-tariffs but suspended those measures for 90 days after Trump suspended a second round of tariffs on EU goods. The sides are negoatiating but the US has threatened new tariffs on pharmaceutical products and the EU-US trade war could escalate in the coming weeks.

The euro has benefited so far from the escalating trade tensions, as hit 1.1476 last week, its highest level since February 2022. The US dollar has sustained sharp losses against the major currencies as investors look for safer shores in the midst of the turmoil in the financial markets.

ECB warns of downside risk to growth

The ECB statement said that the inflation continues to ease but expressed concern over worsening trade tensions which have muddied the economic outlook. ECB President Lagarde said in her follow-up press conference that "downside risks to economic growth have increased" whcih would likely impact on exports, investment and consumption.

The Federal Reserve is prepared to lower rates if necesary but the markets have priced in a hold at 90% the May 7 meeting according to CME Fedwatch. A cut in June is much more likely, with a 60% probability.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.